Long-time readers of Interconnected know I write a lot about the cloud computing industry. I like to dig deep into the cloud, not just because of my own existing expertise and experience in the industry, but also of its fascinating territorial and geopolitical implications. Even though the cloud powers everything digital, its elements are very physical.

The cloud is effectively the Internet. Where the cloud goes is where the Internet goes (or perhaps vice-versa). To illustrate this phenomenon, I’ve written many posts about the cloud regions and data center locations of all the major public cloud providers, i.e. Alibaba Cloud, AWS, Azure, GCP, IBM Cloud, Oracle Cloud, Tencent Cloud, and two tech companies that do not have a public cloud business (but probably should), i.e. Facebook and Dropbox.

With Hong Kong’s new national security law now in effect, the cloud is shifting underneath our feet -- further away from China and closer to Southeast Asia. The shift is both symbolized and realized by Google and Facebook’s consideration to reconfigure the end point of the Pacific Light Cable Network (PLCN) from Hong Kong to Singapore, as reported by the Financial Times.

TL;DR on PLCN

For context, here’s the topline summary of the PLCN in plain terms:

- It’s jointly developed by Google, Facebook, and a company called Pacific Light Data Communication;

- The network is an advanced set of fiber optic cables, thus very fast;

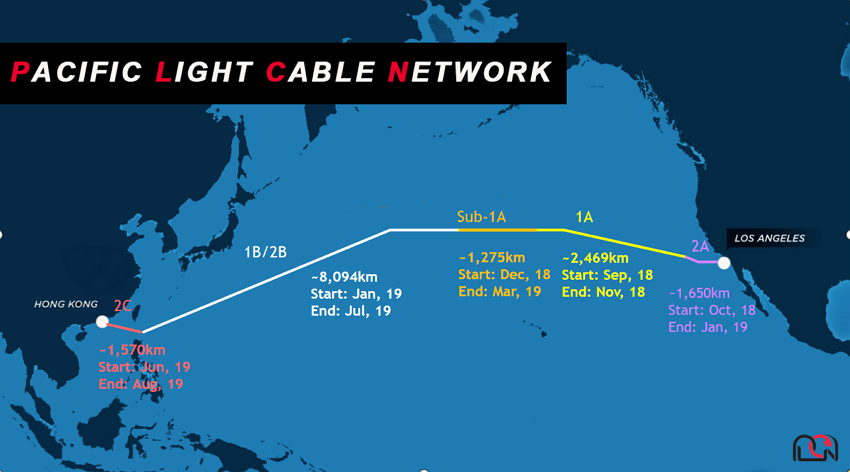

- The cable’s original plan goes from Hong Kong, through Taiwan and the Phillipines to the U.S. It would be the first submarine cable directly connecting Hong Kong and Los Angeles;

- There are six fiber cables in total (imagine a six-lane highway); one is owned and operated by Google, one is owned and operated by Facebook, the other four are owned and operated by Pacific Light Data Communication, presumably to be shared by other cloud or data center vendors who want to access this network capacity;

- Part of the U.S. Department of Justice’s concern with the PLCN has to do with the ownership of Pacific Light Data Communication, which is a subsidiary of the Dr. Peng Telecom & Media Group Co. Ltd, the fourth largest provider of telecommunications services in China;

- In April 2020, the Federal Communications Commission granted Google a temporary, six-month authorization to commercially operate the part of the PLCN connecting Taiwan and the U.S.; this is the only authorization granted to any PLCN operator so far to my knowledge.

Hong Kong -> Singapore

This potential shift of the PLCN from Hong Kong to Singapore actually represents a continuity of, not a departure from, how cloud data centers are currently architected in the APAC region. Of the major public cloud vendors that I’ve written about, these are the ones that already have their own data centers in both Hong Kong and Singapore:

- Alibaba Cloud

- AWS

- Azure

- GCP

- IBM Cloud

- Tencent Cloud

Oracle Cloud, the notable exception, has plans to build data centers in Singapore though not in Hong Kong. Furthermore, Facebook’s lone data center presence in APAC is also in Singapore, not Hong Kong. Thus, Singapore is no stranger to cloud data centers; it is already a prime location, digitally connecting Southeast Asia with the rest of the world.

Sometimes, the Singapore data center is used as the primary location to serve users in Asia with better performance. Other times, it is used as the secondary location to backup user data, which is what TikTok is apparently doing with its American users’ data.

This cross-region backup setup to support disaster recovery is not without technical merit. Whether you are a bank, where losing your users’ data means losing their business, or a social media, where your users’ data is your business, having an extra copy of all the data in a location far away from where your core users are is a good idea. While the key tradeoff is latency (or speed, in plain terms), due to the physical distance between the locations, high-speed fiber cable networks like the PLCN can alleviate that problem.

The key issue that regulators are trying to address is preventing data spying by governments they deem unfriendly. But interestingly, all the public cloud vendors I listed above have cables connecting their Hong Kong and Singapore data centers. And that makes sense from a business perspective, because if you are going to pour billions of dollars building data centers around the world, you want them all interconnected to maximize their usage. So you can’t regulate away the interconnectivity; you can only regulate who and how this interconnectivity will be operated.

A Fast-Growing Southeast Asia

Shifting the PLCN’s Asia endpoint from Hong Kong to Singapore will no doubt benefit Southeast Asia’s Internet economy, which is already growing fast. The leading companies are all big customers of the major cloud providers too; “cloud-native”, if you will. The four that I’ll highlight in this vein are Gojek, Grab, Shopee, and Tokopedia.

Gojek: One of the two Super Apps in Southeast Asia that has over 20 services, from ride-hailing and food delivery, to payment and ticket purchasing. It started in Indonesia in 2009, but didn’t launch its native mobile app until 2015, which also coincided with the start of its use of GCP. To satisfy the hypergrowth of Gojek, GCP’s anchor customer in Southeast Asia, it’s no surprise that Google is prioritizing its data center expansion plan in Indonesia. It launched a new Jarkata region in June. The Gojek team has an active engineering blog and stays on the bleed edge of new cloud technologies, like Kubernetes and various cloud-native databases.

Grab: The other Super App of Southeast Asia that also started as a ride-hailing service, much like Gojek, and now does everything from food delivery, to payment, to consumer financial services. Its cloud usage began on AWS, but in 2018 switched its preferred cloud vendor to Azure after taking a strategic investment from Microsoft. To be clear, this move does not necessarily mean Grab is all-in on Azure; what's more likely is that Grab now has a multi-cloud setup with both AWS and Azure. “Preferred” doesn’t mean “exclusive”.

Shopee: A large e-commerce platform that started in Singapore in 2015. It has since expanded to five other Southeast Asian countries and also has a beachhead in Brazil. Shopee’s parent company, SEA Group, IPO’ed on the New York Stock Exchange in 2017. Tencent made a major $1.4 billion USD strategic investment in SEA Group in March 2019. Shopee uses Tencent Cloud as its cloud infrastructure provider, though its adoption happened before Tencent’s strategic investment in SEA Group.

Tokopedia: Another large e-commerce platform. It was born in Indonesia and its service is only available in Indonesia for now. Interestingly, its infrastructure is already on two different cloud platforms -- first on Alibaba Cloud, then on GCP. Alibaba is the first major public cloud vendor to have active data centers in Jakarta, until Google’s came online in June as noted above. AWS has also announced its plan to build a Jakarta region, which may come online next year. (Alibaba is also an early investor of Tokopedia, so its early adoption of Alibaba Cloud isn’t surprising.)

Decoupling or Entanglement?

The simplistic reaction to the PLCN reconfiguration issue would be just another sign of more decoupling between China and the rest of the world. But as I’ve laid out in the post, there is more entanglement than meets the eye between the major cloud vendors, the tech companies who use them, and the cables themselves that connect all the data centers together.

Assuming the PLCN is reconfigured, which appears likely given the reality that trust between the U.S. and China continues to find a new rock bottom almost everyday, the various business and technology entanglements between American, Chinese, and Southeast Asian companies and investors will not simply decouple and disappear. Singapore, specifically, and Southeast Asia, generally, may end up being winners from the PLCN issue. But that won’t stop Alibaba and Tencent from expanding their cloud platforms into the region as they’ve planned. Same goes for AWS, GCP, and Oracle.

This jockeying for business opportunities between American and Chinese tech giants may make Southeast Asia look like a proxy battleground for influence between the U.S. and China. However, with a population of roughly 750 million people, Southeast Asia is dynamic, young, and can grow into an economic and technological force of its own without needing to pick sides.

The bigger concern that the PLCN issue illuminates is the extreme lack of trust between governments when it comes to data access, governance, and sovereignty. The Justice Department can probably block this one particular fiber cable network from being constructed in Hong Kong. But many cables already exist that connect Hong Kong to other data centers in the region that connect to the U.S., just not directly but in a roundabout way. How far can these restrictions really go? Are they real technical solutions or more political posturing?

There’s no common international framework to evaluate which company or operator is trustworthy and why. This evaluation is currently left to domestic regulators of national governments, who have less knowledge, less perspective, and are subjected to domestic political pressure. That’s a much bigger problem than what reconfiguring a few fiber optic cables can solve.

If you like what you've read, please SUBSCRIBE to the Interconnected email list. New posts will be delivered to your inbox (twice per week). Follow and interact with me on: Twitter, LinkedIn.

东南亚与太平洋光缆网

Interconnected的长期读者知道我写过很多关于云计算行业的文章。我喜欢深挖云这个东西,不仅仅因为我在行业里有些专业知识和经验,也因为云计算有许多与领土和地缘政治关系有关的特征,虽然云支持的所有体验都是数字化的。

云实际上就是互联网。云去哪里,互联网就会去哪里(或者也可以反着说)。为了好好地形容这一现象,我写过一些文章关于大型公有云Regions和数据中心的位置,比如阿里云、AWS、Azure、GCP、IBM云、Oracle云、腾讯云,以及两家没有公有云业务(但也许应该有)的科技公司:Facebook和Dropbox。

随着最近新的国家安全法在香港开始实施,云的布局正在我们脚下移动——更远离中国,更靠近东南亚。这一转变既是由英国《金融时报》所报道的,谷歌和Facebook把太平洋光缆网络(Pacific Light Cable Network,PLCN)的亚太终点从香港移到新加坡的这一考虑。

PLCN小总结

为了给大家足够的背景信息,以下是我个人总结的PLCN概要:

- 它是由谷歌、Facebook和一家名为Pacific Light Data Communication的公司联合开发的;

- 这是一套先进的光缆网络,因此速度非常快;

- 该电缆的原计划是从香港,通过台湾和菲律宾到美国。它会是第一个直接连接香港和洛杉矶的海底电缆;

- 总共有六条光缆(好比是一条六车道的高速公路);一条由谷歌拥有并运营,一条由Facebook拥有和运营,另外四条由Pacific Light Data Communication拥有和运营,应该是共享于其他需要该网络带宽的云厂商或数据中心;

- 美国司法部对PLCN担忧的终点是Pacific Light Data Communication的所有权。该公司是中国第四大电信服务提供商鹏博士电信媒体集团有限公司的子公司;

- 2020年4月,美国联邦通信委员会(FCC)授予谷歌一项为期仅6个月的临时授权,可以商业化运营连接台湾和美国的那段PLCN;据我所知,这是迄今为止授予任何PLCN运营商的唯一授权。

从香港到新加坡

PLCN从香港到新加坡的转移实际上并没有什么特别的,也就是现有云数据中心在亚太地区的当前架构。全球最大的几个公有云厂商中,在香港和新加坡都已经有自己的数据中心,如:

- 阿里云

- AWS

- Azure

- GCP

- IBM云

- 腾讯云

唯一没有被列出的Oracle云已经有计划在新加坡建立数据中心,但不在香港。此外,Facebook在亚太地区唯一的数据中心也在新加坡,而不在香港。因此,新加坡对云数据中心并不陌生;它已经是个宝地了,是把东南亚与世界其他地区链接起来的主要枢纽。

有时候,位于新加坡的数据中心是构架的重点,用于为亚洲用户提供更好的服务。其他时候,它被用作存储用户数据的备份。字节跳动的TikTok显然就是这么用的:美国用户的数据都存在美国,但备份在新加坡。

从技术层面来看,这种支持灾难恢复的跨区备份构架是有必要的。无论你是一家银行(丢用户数据就意味丢生意),还是一个社交媒体(用户数据就是你的业务),在一个远离核心用户的地区备份所有数据是个合理也必要的做法。当然可能会因为地域之间的距离增加产品的延迟(俗话说就是速度),但像PLCN这样的高速光缆网络是应该可以缓解这个问题的。

监管机构想解决的问题是避免不友好的他国政府能得到本国国民的数据的可能性。但有意思的是,上面提到的所有公有云平台都有连接香港和新加坡数据中心的电缆。从商业角度来看,这都是合理的:如果你要砸钱在世界各个角落建设数据中心,你当然希望它们都连接在一起,才能最大程度的让它们被用户使用。因此,监管机构限制不了这种“互相链接”;只能控制谁可以运营这些链接和具体如何运营的做法。

发展迅速的东南亚

把PLCN的亚洲终端从香港移到新加坡,无疑有利于东南亚的互联网经济。当地的互联网经济已经在迅速发展。领先的几家公司也都是各个公有云平台的大客户;甚至可以称为“云原生”。在此篇文章中,我简短的介绍四家公司:Gojek、Grab、Shopee,Tokopedia。

Gojek:东南亚两大超级app之一,拥有超过20项服务,从叫车、外卖到付款和购票。它于2009年在印尼起步,但直到2015年才推出第一款手机app,也是同一年开始用GCP。为了满足想Gojek这种重量级客户的快速发展,谷歌也提高了在印尼的数据中心扩张计划的优先级,这也不足为奇。GCP今年六月宣布雅加达地区的数据中心正式上线。Gojek团队有自己活跃的工程师博客,并一直关注新的云技术,比如Kubernetes和各种云原生数据库。

Grab:东南亚的另一款超级app,起初也是一种叫车服务,很像Gojek。现在做从外卖到支付,再到金融服务的各种业务。它的云基础设施先在AWS上,自2018年,在接受了微软的战略投资后,将首选云供应商转到了Azure。需要说明的是,这一举动并不一定意味着Grab的后台完全都在Azure上;更有可能的是一个AWS和Azure都有的多云设置。“首选”并不意味着“独家”。

Shopee:2015年在新加坡成立的一家大型电商平台,已经扩展到其他五个东南亚国家,并在巴西也有业务。母公司“SEA集团”于2017年在纽约证券交易所上市。腾讯在2019年3月对SEA集团进行了14亿美元的重量级战略投资。Shopee使用腾讯云作为其云基础设施,但采用的时间应该发生在腾讯对SEA集团进行战略投资之前。

Tokopedia:另一家大型电商平台,从印尼起家,目前也只在印尼提供服务。有意思的是,它的基础设施已经在两个不同的云平台上了:首先是阿里云,然后是GCP。阿里云是第一家在雅加达上线数据中心的大型公有云,谷歌的数据中心今年6月才上线。AWS也宣布了其在雅加达地区扩大的计划,可能明年会上线。(阿里巴巴也是Tokopedia的早期投资者之一,因此它很早就采用阿里云也并不奇怪。)

脱钩还是继续“纠缠”?

对PLCN改建这个问题的最简单的反应就是,这是中国与世界其他地区的继续脱钩的体现。但正如文章中所述,最大的云供应商们、使用云的科技公司们以及连接所有数据中心的电缆本身其实都“纠缠”在一起。

虽然PLCN从香港移到新加坡是很有可能发生的,鉴于中美关系似乎每天都能碰到“新低点”,但美国、中国和东南亚的公司和投资机构之间的各种商业和技术纠葛不会简简单单的就脱钩和消失。新加坡和整个东南亚可能会是PLCN问题解决后的赢家,但这并不意味着阿里云和腾讯云会停止去东南亚扩大的计划。AWS、GCP和Oracle也是一样。

美国和中国科技巨头之间的互相竞争,可能会让东南亚地区看似像是个中美争夺影响力的间接战场。然而,东南亚自己有约7.5亿的人口,年轻又充满活力,完全能够在”不站队“的情况下发展成一支独立的经济和科技力量。

PLCN所暴露的更大问题是在数据访问、治理和主权方面,各国政府之间极度的缺乏信任。美国司法部也许有能力阻止这条光纤电缆网络“碰到”香港。但是现有的许多电缆已经把香港连接到美国,只是间接而不是直接的。这种监管限制到底能走多远?是真正的技术解决方案还只是更多的政治姿态?

目前没有一个国际认可的框架来评估哪个公司或运营商可信,并解释为什么可信。做这种评估的都是各国国内的监管机构,它们的认知和视角有限,并会被国内的政治压力所影响。这比重新调整几条光缆能解决的问题要复杂得多。

如果您喜欢所读的内容,请用email订阅加入“互联”。每周两次,新的文章将会直接送达您的邮箱。请在Twitter、LinkedIn上给个follow,与我交流互动!