I’ve been writing a lot about various aspects of the “big four” clouds -- AWS, Alibaba Cloud, Azure, GCP -- from comparing their financial earnings, to global data center coverage, to how each of these tech giants’ other businesses stress test the reliability of their public cloud offerings.

Of course, there are other public cloud platforms besides these four. In this post, I’m going to apply roughly the same analytical framework to evaluate these other competitors: IBM, Oracle, Tencent.

A public cloud is a complex product. There are definitely other ways to evaluate them, from quality and availability of services, to network cable speed, to documentation and API user experience. (I will certainly explore these other areas in future writing.) But I do believe these three elements -- financials, data center coverage, and stress testing by other businesses -- provide the most straightforward and somewhat least subjective analysis of public clouds. And staying analytically consistent provides the most meaningful comparison.

I’m intentionally leaving out standalone clouds like Digital Ocean, Rackspace, UCloud, etc., because they don’t have other non-cloud businesses, ones with no meaningful global data center coverage, like JD Cloud, and ones that aren’t public companies, like Huawei, because there’s no publicly auditable financials to examine. Again, I’m making this choice to keep the framework consistent. The cloud market pie is expanding rapidly for the foreseeable future, more than double by 2023 according to IDC. There’s plenty of room for everyone to grow in their own way.

IBM Cloud

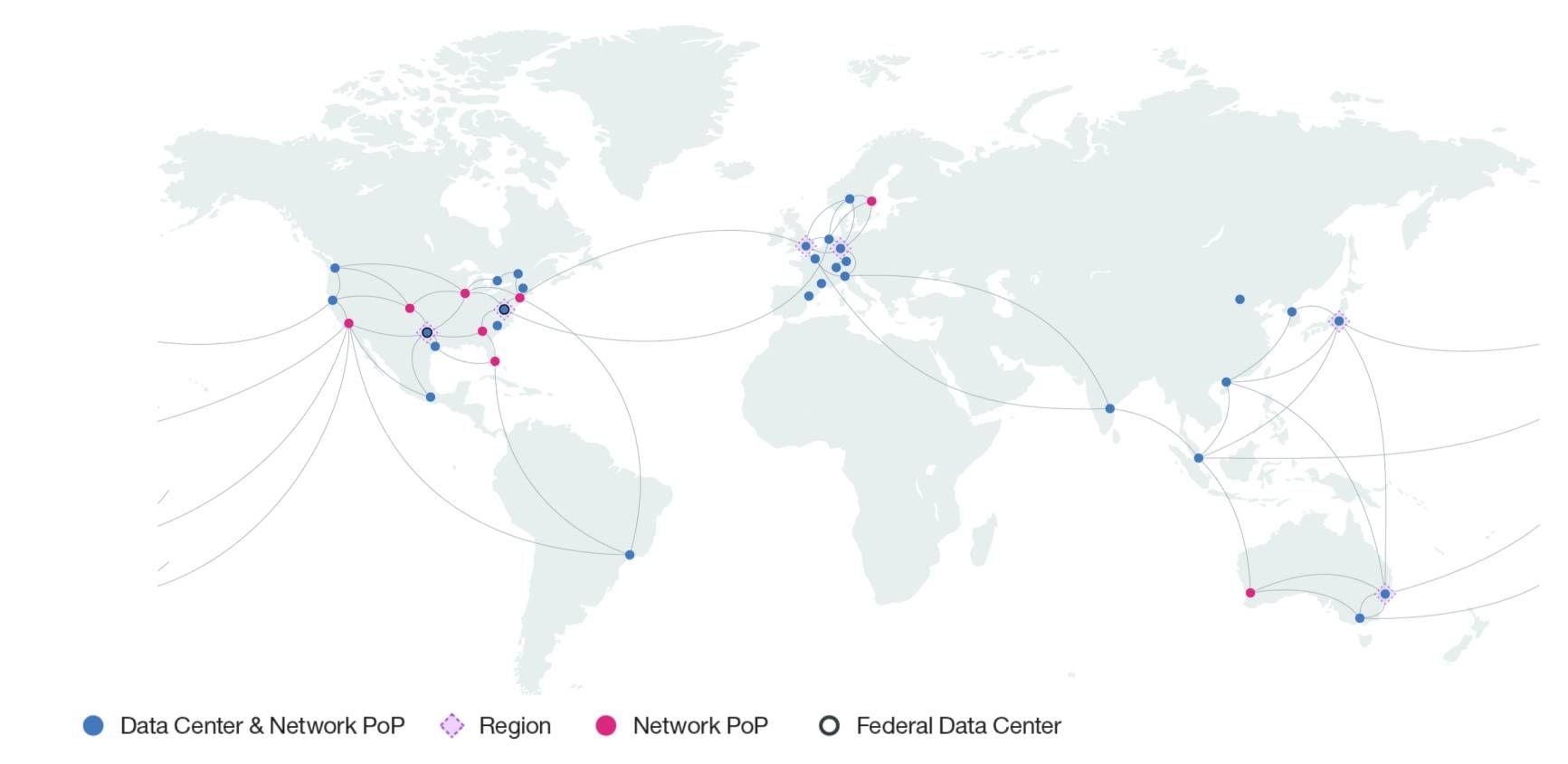

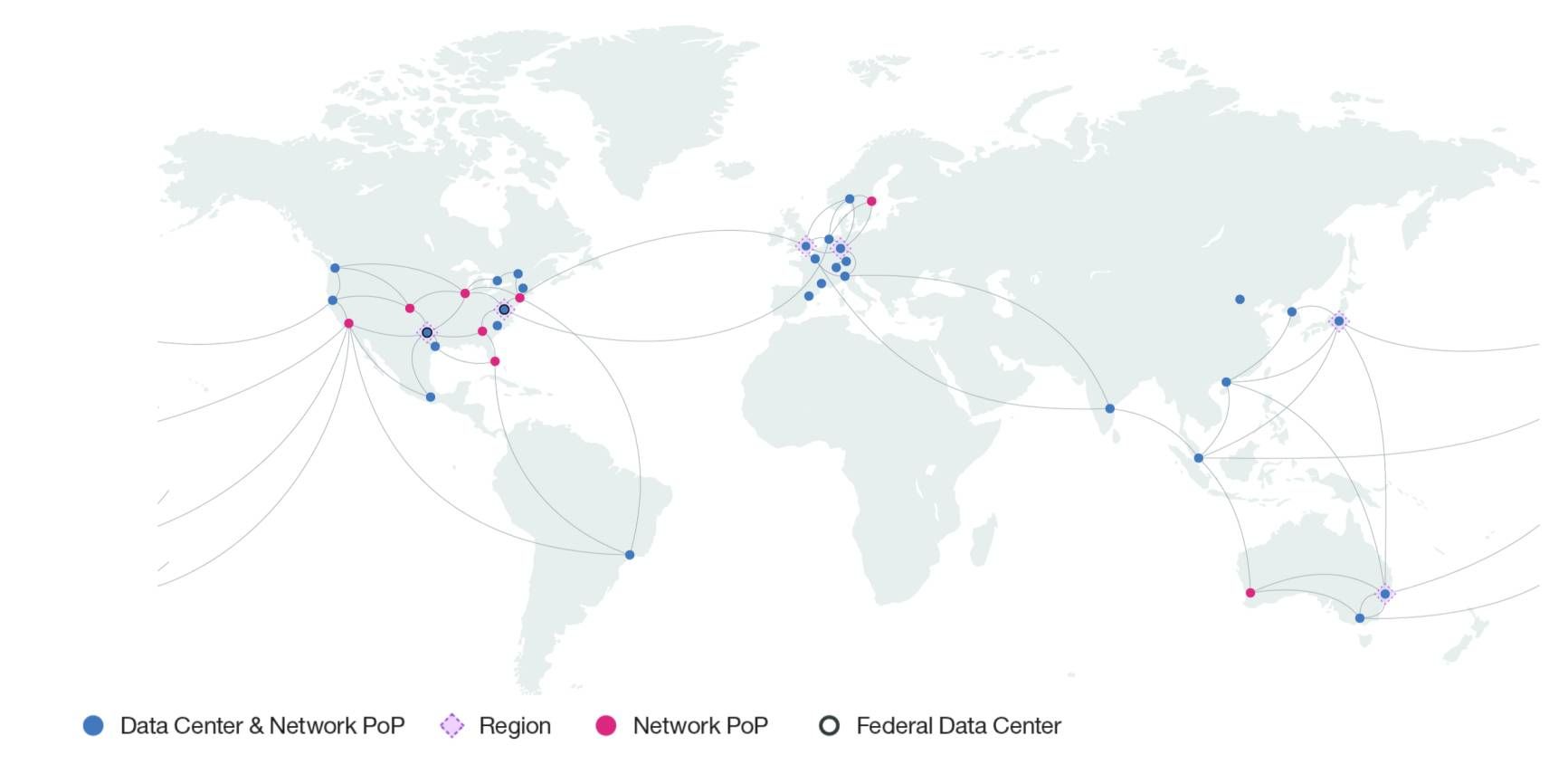

Data Center Coverage:

Total Regions: 29 (IBM uses a different terminology: Data Center & Network PoP - Point of Presence)

Multi vs. Single-AZ Regions: 8 vs. 21

Geographies: North America, Europe, Latin America, China, other APAC countries

Noteworthy Observations: IBM Cloud’s data center coverage resembles that of AWS, Azure and GCP quite a bit, with strong presence in North America and Europe, plus some in Asia, and relatively scant presence everywhere else. That indicates to me that they are all competing in roughly the same customers in the same markets. IBM Cloud also has a similar deficiency as Azure in that most of its Regions are single-AZ, not multi-AZ. I’ve written previously about why that’s a problem, but the cliffnotes is that multi-AZ architectural design makes a cloud Region much more reliable and less prone to outages when disasters happen.

Other Businesses:

IBM is the mother of all technology companies, having started in 1911. Because of that history and legacy, most of its businesses come from making, selling, and servicing hardware, from microprocessors to mainframe servers, with limited software experience. It has also been operating an IT outsourcing business with data centers around the world, which now becomes its cloud unit. After all, a public cloud is not that different from traditional IT outsourcing, except with more flexible pricing and more attractive economics for the user.

Given this history, IBM does not have either the Internet-scale infrastructure experience or the software prowess of Amazon or Google. IBM recognizes this too. That’s the rationale behind its $34 billion USD acquisition of Red Hat in mid 2019, one of the largest acquisitions in the tech sector in history. Many believe (myself included) that the crown jewel of this acquisition is Open Shift, a Red Hat product that can manage multiple different clouds by leveraging an open-source technology called Kubernetes, which was once a Google internal tool called Borg.

It’s too early to tell whether the Red Hat acquisition will catapult IBM to the top-tier of public cloud platforms, given that its data center coverage and software stack both have some catching up to do. IBM does have decades of enterprise sales and service experience, having had some of the largest companies and governments as customers. When its cloud product is more on par with market leaders, those experiences could be a difference maker.

Financials:

Based on its most recent earning report, Q4 and full year 2019, its “cloud” revenue was: $6.8 billion USD for the quarter, and $21.2 billion USD for the year 2019. I put “cloud” in quotes because even though the category’s results look impressive, in fact more than 2x bigger than Google Cloud’s revenue of the same time frame, IBM’s definition of “cloud” is packed with confusion. The category is technically called “Cloud & Cognitive Software”, which includes IBM Cloud, Red Hat, security products, IoT, and so called “cognitive applications” aka Watson. This convolution and lack of transparency is no better than Microsoft’s “Commercial Cloud” category, which I’m not a fan of.

The most important news that came out of this particular IBM earnings report, though, was the CEO switch with Ginny Rometty stepping down and Arvind Krishna taking the helm. Mr. Krishna has been at IBM since 1990, and more interestingly, in senior positions of the company’s Cloud & Cognitive Software unit for the last three years according to his LinkedIn profile.

Thus, this CEO change is a strong signal that IBM sees its cloud unit as the main source of growth for the future. And grow it must, because its overall revenue has been either down or flat since 2011.

Oracle Cloud

Data Center Coverage:

Total Regions: 22

Multi vs. Single-AZ Regions: all 3-AZ Regions

Geographies: North America, Europe, Latin America, Middle East, APAC minus China

Noteworthy Observations: Oracle cloud has five Regions in the U.S. that are marked specifically for government use, more than AWS’s, though there’s no way to know their technical and capacity differences. The massive investment in government-compliant data centers is likely part of Oracle’s aggressive fight for the U.S. Department of Defense’s Joint Enterprise Defense Infrastructure (JEDI) contract, worth $10 billion USD, and future businesses with the government. Oracle still lost the bid (along with IBM), though the future of JEDI is still uncertain and being fought between AWS and Azure in a lawsuit.

Other Businesses:

Oracle is one of the largest database and enterprise resource planning (ERP) software companies in the world. Building and running a reliable database takes at least a decade, and Oracle has been around since 1977. There’s no doubt that Oracle’s core database offering is rock solid, though tagged with a steep price. Given its old-school license-based enterprise DNA, Oracle lacks experience in running global-scale Internet services, and its cloud has not been stress tested to nearly the same scale as Amazon on AWS, Google on GCP, or Alibaba on Alibaba Cloud. Thus, its focus on winning large government contracts is understandable because that scenario plays into its strength as a company steeped in the wheeling and dealing of large enterprise selling and servicing.

Financials:

If you take Oracle’s earnings at face value, you would think it’s entirely a cloud company. In its most recent quarter earnings, Q3 for FY2020, the “Cloud services and license support” and “Cloud license and on-premise license” categories combine for $8.2 billion USD in revenue, which accounts for a whopping 83% of the entire quarter’s revenue. Of course, taking any earning reports at face value is a bad idea, especially when it comes to cloud. We’ve already seen with Microsoft, Google, and IBM’s earnings that “cloud” means different things to different companies. And that thing is usually whatever helps the company tell its narrative to Wall Street. The Oracle narrative is: despite missing the cloud train early, it is catching up quickly, so quickly that almost all of its revenue has the word “cloud” in it.

One common way companies “massage” their revenue to look more “cloud-like” is to change the way customers are billed from a licensing model to a subscription model. And that is in fact what’s happening at Oracle, where lots of customers are aggressively encouraged to move from the traditional, on-premise licensing version of their database and ERP products to a subscription-based model hosted on Oracle’s cloud system. In all fairness, Microsoft is doing quite a bit of that too with its Office 365 suite of products, which I noted in my earlier post.

Regardless of how the financials are structured and marketed, Oracle’s public cloud platform still has ways to go, thus its performance is conveniently obscured in its earnings.

Tencent Cloud

Data Center Coverage:

Total Regions: 17

Multi vs. Single-AZ Regions: unspecified

Total Colocation Regions: 8

Geographies: North America, Europe, Latin America, China, other APAC countries

Noteworthy Observations: there are two curious things about Tencent Cloud’s data center coverage. First, while it claims that each of its Regions contain multiple AZs, it doesn’t specify how many AZs are there in each Region, which the “big four” all do. Second, it has quite a few locations in all of its geographies that are called “Overseas cooperative infrastructure”, which I re-named “Colocation Regions”. In plain language, it means Tencent doesn’t own and operate those facilities entirely. They are shared with other companies in a co-location set up, which is how companies used to set up and use server resources in the pre-cloud era. The only difference is that you are now renting those resources out to others. Put it another way, Tencent is more like a “subletter” or “Airbnb host” of those facilities, of which it either doesn’t own at all or only owns partially. This distinction matters, because if Tencent does not control those physical data centers outright, all its guarantees in disaster recovery, reliability, security, and compliance at those locations should be discounted.

Other Businesses:

Tencent makes most of its revenue from gaming, and has its DNA in building messaging and social platforms. Its first messaging product, QQ, and later WeChat, are ubiquitously in China. WeChat Pay, its native payment gateway, is also used everywhere from the fanciest department stores to peasant vendors selling at the morning farmer’s markets. Its products’ stickiness is the envy of every Silicon Valley social media company.

Tencent’s core services have the same “always-on”, unpredictable nature as Google’s services. One big caveat: because the vast majority of its users are in China, Tencent has never needed to extend the resilience of its services to a global scale, in the ways that Google does. Then again, very few companies do. Facebook is probably the only comparable company in this regard, but it does not operate a public cloud service.

From a technical perspective, the operational expertise from running a product like WeChat bodes well for Tencent Cloud’s capabilities and resiliency. Its team knows what true “stress test” means.

Financials:

Tencent puts its cloud platform revenue under the “Business Services” category, which also includes its other B2B SaaS products, like WeChat Work, a workplace productivity and collaboration application. In its most recent earnings report, Q3 of 2019, Tencent Cloud’s revenue grew 80% year-on-year with revenue around $670 million USD.

Although its growth rate is impressive, the starting base is small and its overall size is significantly smaller than its other competitors. But from a transparency perspective, Tencent at least does not try to obscure its cloud’s size through “creative categorization”, which IBM and Oracle are both at fault for doing.

Who Can Catch Up?

Building a public cloud platform is an expensive endeavor that requires billions of capital expenditure up front. In fact, that is one of the main reasons why cloud is attractive to its users. Instead of building and owning your own data centers, as a form of capital expenditure (CapEx), you can just rent the resources built by one of these tech giants, as a form of operational expenditure (OpEx). CapEx and OpEx are treated very differently in corporate accounting.

Looking at these companies’ balance sheets, both Oracle and Tencent have between $25 to $30 billion USD of cash, though Oracle’s debt ($51 billion USD) is about twice as much as Tencent’s. Basically, they both have the cash to spend and build if they choose to. IBM’s situation is a bit less rosy, with $8.9 billion USD of cash and $68 billion USD of debt. Of course, IBM has been a big spender on its cloud future already. Its acquisition of Red Hat may prove to be the difference maker, since Red Hat’s superior technology and reputation is now IBM’s asset.

Both IBM and Oracle, being legacy players in the enterprise technology space, desperately need growth drivers. And both see the cloud as the path forward. That desperation may drive its progress for quite some time. Tencent, on the other hand, never had the enterprise DNA like IBM and Oracle, and isn’t as desperate for growth, so its cloud ambition will take longer to materialize. It is also fending off threats on its core business from Bytedance’s multiple popular short video streaming apps, so growing its cloud unit may not be a top priority.

As I said earlier in the post, the cloud pie is large and growing quickly with plenty to eat for multiple players. There won’t be a single winner, even though that’s what everyone wants to be.

If you like what you've read, please SUBSCRIBE to the Interconnected email list. New posts will be delivered to your inbox (twice per week). Follow and interact with me on: Twitter, LinkedIn.

压力测试(其他)公有云: IBM、Oracle、腾讯

最近写了好几篇分析“四大”公有云的文章——AWS、阿里云、Azure、GCP——从比较它们的财务收益,到全球数据中心覆盖率,到这些科技巨头的其他业务如何对其公有云产品进行各种各样的压力测试。

除了这四个平台之外,还有其他公有云。在这篇文章中,我想使用大致一样的分析框架来看看其他几个厂商的公有云:IBM、Oracle、腾讯。

公有云是一个复杂的产品,可以从很多方面评估它,比如平台上各种服务的质量和可用性、网线速度、文档和API用户体验等。(我会在未来的文章中探讨这些其他领域。)但我觉得用这三方面——金融、数据中心覆盖率、其他业务的压力测试——评估公有云相对比较直观,少一些主观成分。保持分析框架的一致才能看出有意义的比较。

我在这篇文章里有意没提Digital Ocean、Rackspace、UCloud等独立云,因为它们没有其他非云业务做压力测试;也没提京东云,因为它目前的数据中心覆盖还没全球化;也没提华为云,因为华为没有上市,所以没有可靠的财务季报。据行业分析所IDC的数据显示,云市场的这块饼很大而且还在迅速扩大,到2023年将翻一番以上。每个厂商都应该有足够的空间以自己独特的方式成长。

IBM云

数据中心覆盖范围:

Regions总数:29个(IBM使用不同的术语:数据中心和网络存在点)

多AZ vs 单AZ:8 vs 21

地域覆盖:北美、欧洲、拉丁美洲、中国、其他亚太国家

值得注意点:IBM Cloud的数据中心覆盖范围与AWS、Azure和GCP很相似,在北美和欧洲以及亚太都有相当密度的覆盖,而在其他地域则相对较少。我想这意味着,他们都在一样的市场里在竞争类似的客户。IBM Cloud也有类似于Azure的缺陷:它的大部分Region都是单AZ,而不是多AZ。我其他的文章里提过为什么这是一个问题,简单的说,多AZ架构设计使云更加可靠,在灾难发生时服务不易中断。

其他业务:

IBM是所老牌科技公司,成立于1911年。由于这段历史和传统,它的大部分业务都围绕着硬件的制造、销售和服务,从芯片到主机服务器。软件经验有限。它也一直在运营一个庞大的IT外包生意,也自然而然的变成了现在的公有云。毕竟,公有云与传统IT外包没什么太大区别,只是定价收费更灵活,有些更吸引客户用户的经济效应。

鉴于这个背景,IBM既没有亚马逊或谷歌的运维互联网规模基础设施的经验,也没有他们的软件实力。IBM也明白这一点。这就是为什么2019年年中它以340亿美元的高价收购红帽(Red Hat),这也是科技行业历史上最大的收购之一。许多人(包括本人)认为,买的最有价值的是Open Shift,一款红帽的产品,可以利用一种名为Kuberentes的开源技术来管理多个不同的云平台。Kubernetes曾是谷歌内部的一个工具,名为Borg。

考虑到IBM的数据中心覆盖率和软件技术都有些落后,现在判断其对红帽的收购是否会将IBM推到公有云行业的领先位置还为时过早。IBM拥有数十年的企业销售和服务经验,很多大公司和政府都是客户。当它的公有云产品更能与“四大”媲美时,这些经验会很有帮助。

财务状况:

根据其最新的盈利报告,Q4及2019整年里,其所谓的“云”收入为:季度收入68亿美元,2019整年收入为212亿美元。我把“云”打了个大引号是因为它表面数字看起来很大,比“谷歌云”的收入高出2倍多,但IBM对“云”的定义并不严谨。在财报里的全名是“云和智能软件”,包括IBM Cloud、Red Hat、网络安全产品、IOT以及所谓的“智能应用程序”,也就是Watson,可见其“云”的名号里包括的内容五花八门。这种复杂和缺乏透明度的季报方式,不比微软季报里的“商业云”好多少。

不过,这次IBM季报中最重要的新闻是替换CEO,Ginny Rometty下台,Arvind Krishna接班。根据Krishna先生的LinkedIn资料显示,他从1990年起就在IBM工作,而且他在过去三年里一直担任IBM的“云和智能软件”部门的高管。

这次CEO变动是个相当强烈的信号,表明IBM将其云部门视为未来增长的主要来源。所有公司都需要增长,尤其是IBM,因为自2011年以来,它的总收入要么下降,要么持平。

Oracle云

数据中心覆盖范围:

Regions总数:22个

多AZ vs 单AZ:都是三个AZ的Region

地域覆盖:北美、欧洲、拉丁美洲、中东、亚太地区(除中国)

值得注意点:Oracle云在美国境内有五个Regions专门为政府业务服务,要比AWS的政府业务Regions多,但没有足够的信息比较它们之间的技术质量和能力的差异。对符合政府要求的数据中心大规模投资,可能是Oracle为投标美国国防部价值100亿美元的“联合防御基础设施”(JEDI)项目和未来投标其他政府业务而准备的。可惜,Oracle和IBM都没有投标成功,尽管JEDI的未来还不确定,正卡在AWS和Azure之间的官司中。

其他业务:

Oracle是世界上最大的数据库和企业资源管理(ERP)软件公司之一。做一个靠得住的数据库至少需要十年的时间,而甲骨文从1977年就成立了。甲骨文的核心数据库产品坚如磐石,尽管价格很高。作为一个老牌企业软件公司,甲骨文在运维全球规模的互联网服务方面没什么实战经验,所以没有像亚马逊用AWS、谷歌用GCP、阿里巴巴用阿里云进行的这种压力测试。因此,它把重点放在赢得大型政府业务合同上也是合理的。毕竟这种传统商业环境是它擅长的,能体现出它的优势。

财务状况:

如果从表面上看甲骨文的收益和季报,你会认为它已经完全转型为一个云计算公司了。在其最近一次季报中(2020财年第三季度),所谓“云服务和License支持”和“云License和传统License”两个类别加起来的收入为82亿美元,占整个季度收入的83%!当然,仅从表面看任何季报都是不明智的,尤其是在涉及云这个行业的时候。我们已经从微软、谷歌和IBM的季报中看到,每个公司对“云”的定义都不一样。而定义的内容通常是要有利于公司面对华尔街要讲的故事。甲骨文的故事是:尽管先前错过了云这个机会,但正在迅速赶上,你看,现在几乎所有的收入是有“云”的了!

一种很多公司企图把收入变得更像“云”的常见方式,就是把现有客户的计费方式从许可证(Licensing)模式转为订阅模式。这正是甲骨文所做的。许多甲骨文客户都被大力鼓励从用传统许可制度的数据库和ERP产品,转向同样的产品,唯一的区别是订阅模式并托管在甲骨文自己的云平台上。公平地说,微软在转移Office 365产品套件上做过同样的事情,我之前的文章中也提到了。

无论宣传财务数据有什么花样,甲骨文的公有云平台仍然差距较大,这也是为什么它在季报的业绩里被巧妙掩盖了。

腾讯云

数据中心覆盖范围:

Regions总数:17个

多AZ vs 单AZ:无信息

共享Regions:8个

地域覆盖:北美、欧洲、拉丁美洲、中国、其他亚太国家

值得注意点:腾讯云的数据中心覆盖率有两个奇怪的地方。首先,虽然它声称每个区域都是多AZ,但它没有标出那个Region有多少个AZ。“四大”公有云都标得很清楚。其次,它在每个地域都有几个Region被称为“海外合作基础设施”,我把它称为“共享Regions”。什么意思呢?简单地说,就是腾讯并不完全拥有这些Regions的数据中心设施,而是与其他公司共享。这和在有云之前,公司如何设置和使用服务器资源没什么区别。唯一不一样的就是现在把这些资源再转租给了别人。换句话说,腾讯更像是这几个数据中心的“二房东”,要么完全不拥有这些设施,要么只拥有部分设施。这一点很重要,因为如果腾讯不完全控制这些数据中心,那么它在这些Regions里所保障的灾难恢复、可靠性、安全性和法规遵从性,是应该打折扣的。

其他业务:

腾讯的大部分收入来自游戏,且是靠短信和社交平台产品发家的。它的第一款产品QQ和后来的微信在中国无处不在。微信支付也被广泛使用,从最高档的百货商店到早市的小商小贩。没有一个硅谷社交媒体公司不羡慕腾讯产品的粘性。

腾讯的核心服务与谷歌的服务具有类似的“always on”和不可预测性。但一个很大的区别是,由于腾讯绝大多数用户都在中国,它没有像谷歌那样需要在全球范围内的运维自己的产品和服务。当然,全世界也没几个公司有谷歌的这种需求和规模,Facebook可能是唯一可比的公司,但它没有自己的公有云平台。

从技术角度看,腾讯云得益于微信,有运营自己产品的经验和能力。腾讯团队亲身了解过什么是真正的“压力测试”。

财务状况:

腾讯将其云平台收入归入与“商业服务”类别,其中还包括其他B2B SaaS产品,如微信工作(WeChat Work),一款办公加协作的应用程序。在最新发布的2019年第三季度财报中,腾讯云的收入比去年同期增长80%,营收约6.7亿美元。

虽然其增长速度很快,但起点基数较小,整体规模明显小于其他竞争对手。但从透明度的角度来看,腾讯至少没有试图像IBM和甲骨文那样通过“改定义”的方式掩盖云平台的规模。

谁能赶上?

构建一个有规模的公有云平台是个昂贵的项目,需要数十亿的前期资本投入。事实上,这也是云对用户有吸引力的主要原因之一。把传统的IT资本支出(CapEx),通过租用这些科技巨头建的公有云,而变成运营支出(OpEx),这就是云的一大买点。

从这三个公司的资产负债表来看,甲骨文和腾讯的现金都在250亿至300亿美元之间,而甲骨文的债务(510亿美元)大约是腾讯的两倍。总之钱是够的,有足够的现金来继续扩大自己的公有云布局。IBM的情况有点不同,有89亿美元的现金和680亿美元的债务。当然,IBM在自己的云的未来上已经花了不少钱了。买下红帽很可能就是IBM今后脱颖而出的重要因素,因为红帽卓越的技术和行业名声已经是IBM的资产了。

作为企业技术领域的老牌公司,IBM和甲骨文都迫切需要新的增长点。两者都把云看作自己的未来。这种急迫的动力很可能会推动这几年的发展。而腾讯从来没有像IBM和甲骨文那种企业技术产品的基因,也并不急需新的增长点,所以它在云计算方面的野心的实现会漫长一些。同时,腾讯正在抵御字节跳动的多个短视频app对其核心业务的威胁,发展公有云可能并不是当务之急。

正如我之前所说的,云的这块馅饼很大,而且会越变越大,很多玩家都能吃一口。尽管每个公司都想做大赢家,但不会只有一个赢家。

如果您喜欢所读的内容,请用email订阅加入“互联”。每周两次,新的文章将会直接送达您的邮箱。请在Twitter、LinkedIn上给个follow,与我交流互动!