Next week is the start of the second quarter earnings season on Wall Street. It’s perhaps the most consequential quarter of financial guidance we’ve had since the Great Depression.

During the last few weeks, companies have been pulling their previous earning guidance left and right, because the information is quickly becoming obsolete and stale, due to the economic impact of COVID-19.

However, there’s a deeper question to examine: was the ritual of quarterly earning guidance ever a useful indicator to predict the future? Was it ever not stale?

Earning Guidance Kabuki Dance

The most generous interpretation of the usefulness of quarterly guidance is that it helps investors prepare for changes in either the market conditions or the company. In reality, it’s a kabuki dance between the company management slash investor relations office and the analysts who cover the company. They both manipulate and coordinate with each other in subtle ways, so most, if not all, of the time, the company’s earnings exceed the analysts’ expectations.

The class of Wall Street analysts is an essential element of the financial media industry. Just like the media, they like to fuel a storyline and pick winners and losers. However, they seem to never be held accountable for being wrong. I’ve yet to see an analyst get fired for being wrong on his or her price target prediction. Since there’s no deadline on when a prediction expires, you can always argue that given enough time, a prediction will be right eventually, thus you are never “wrong”.

As long as analysts play along, there are three types of levers that company management can pull to “control” the earnings it reports -- real, accrual, and expectation management -- according to this paper written by Professor Thomas King of Case Western University.

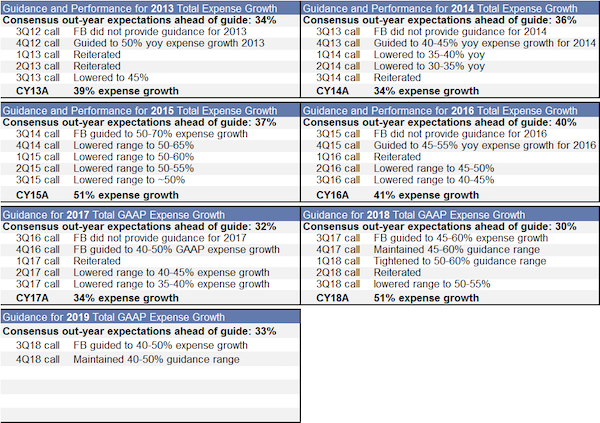

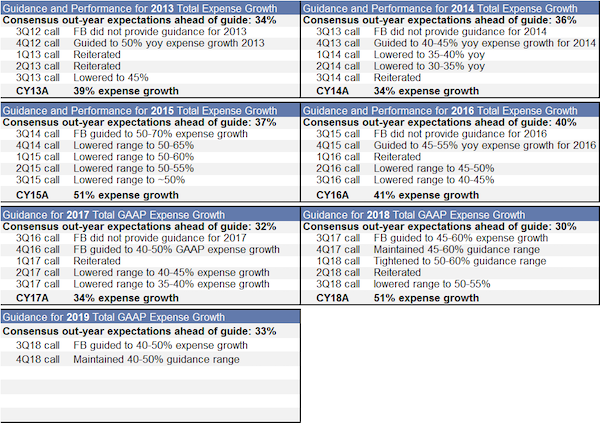

In plain terms, “real” is an operational lever to control or cut costs in R&D, marketing budget, headcount, etc. which can all be done, more or less, with the snap of a finger by upper management. When the amount and/or growth of your expenses become a relevant factor in your guidance, controlling them can help the company score consistent earnings beats. For example, see how from 2013-2018 Facebook has used its guidance to have its expenses always come under or in-line with expectations:

“Accrual” is basically accounting tricks applied to increase earnings by changing some underlying assumptions about either the asset or liability portion of the company’s balance sheet, so it gets valued differently enough to make earnings look good.

“Expectation management” is more or less “sandbagging” the Wall Street analysts. By chatting via private conversations, the CEOs and other executives can get into the analysts’ heads, so whatever is the consensus expected earnings these analysts come up with, the company management has a good idea of what they are and figure out ways to beat them.

(An aside: this type of “expectation management” is quite common in political campaigns, where a campaign’s spokesperson (“investor relations”) constantly massages the expectations of the news media (“analysts”) heading into a big debate, so the candidate always “wins” the debate by exceeding those expectations (“an earnings beat”). Not surprisingly, the best political communications talent often ends up working in corporate communications of big companies when they leave politics.)

One common method that’s been in vogue is stock buyback programs to boost earnings-per-share (EPS) -- one of the two most important numbers to beat in guidance; the other being revenue.

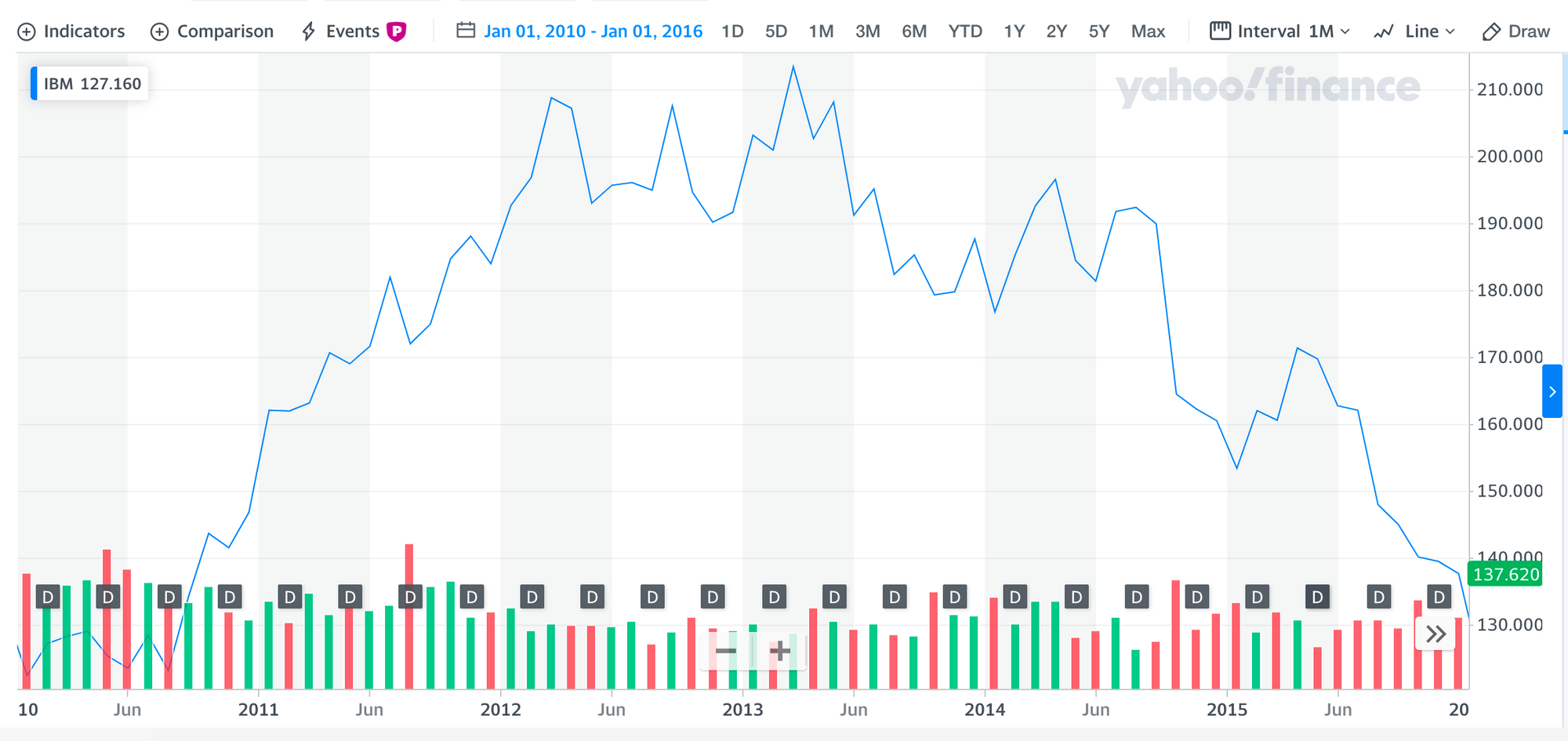

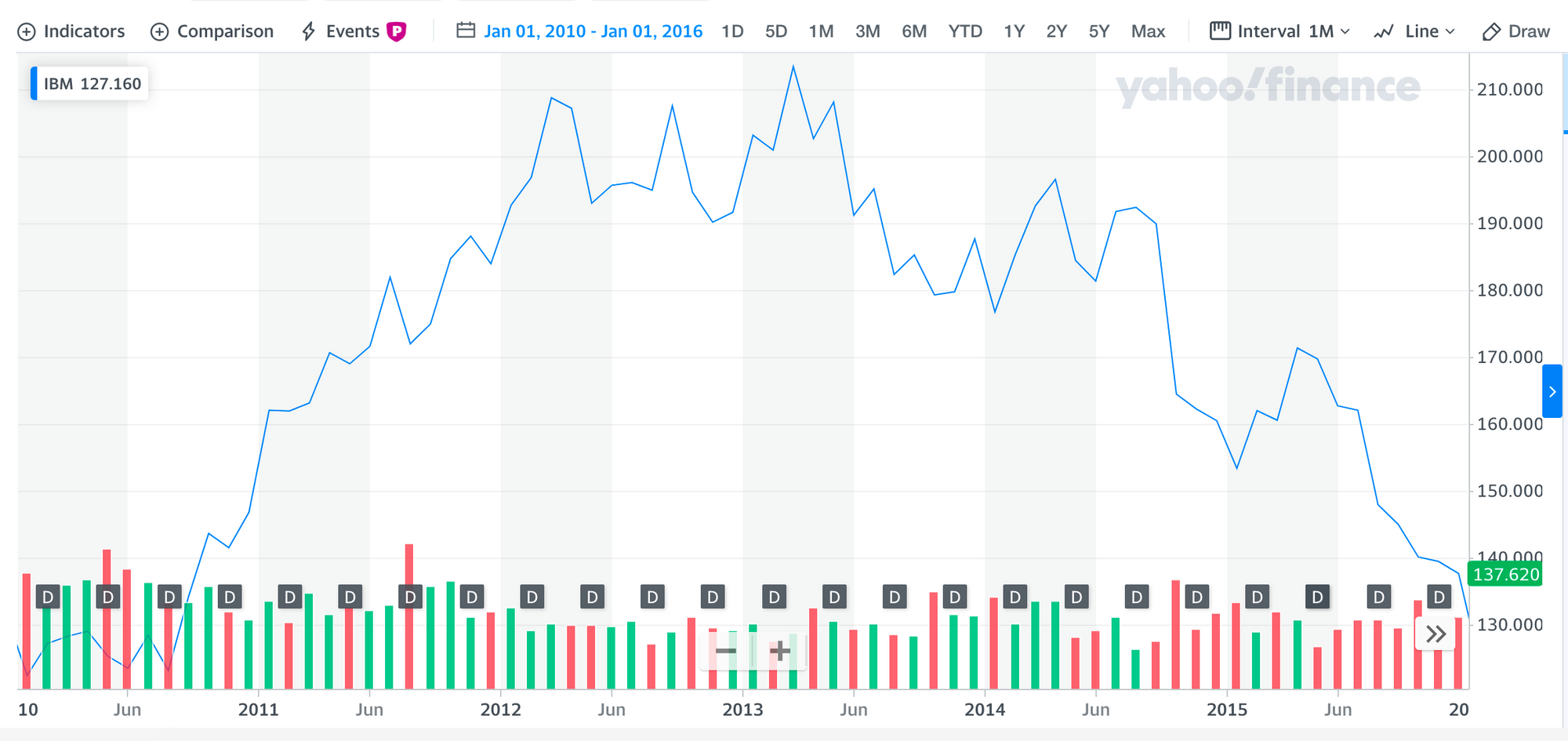

Perhaps the most expensive example of stock buyback in the last decade was IBM’s, which amounted to nearly $40 billion USD between 2010-2015, for the purpose of achieving its highly-public pledge to shareholders of achieving $20 operating EPS over those five years. Consequently, its share price during the same period increased quite a bit for some time, but eventually ended up where it started:

Were those billions of dollars in cash well spent? I don’t think so. I’ve been skeptical of stock buyback programs, especially for companies that need growth drivers and product innovation, like Dropbox. IBM falls in that category too, as it tries to catch up to AWS, Azure, and others in the cloud market.

This earning guidance kabuki dance is both laborious and expensive for company management. So why go through with it every quarter?

CEO Compensation and Credibility

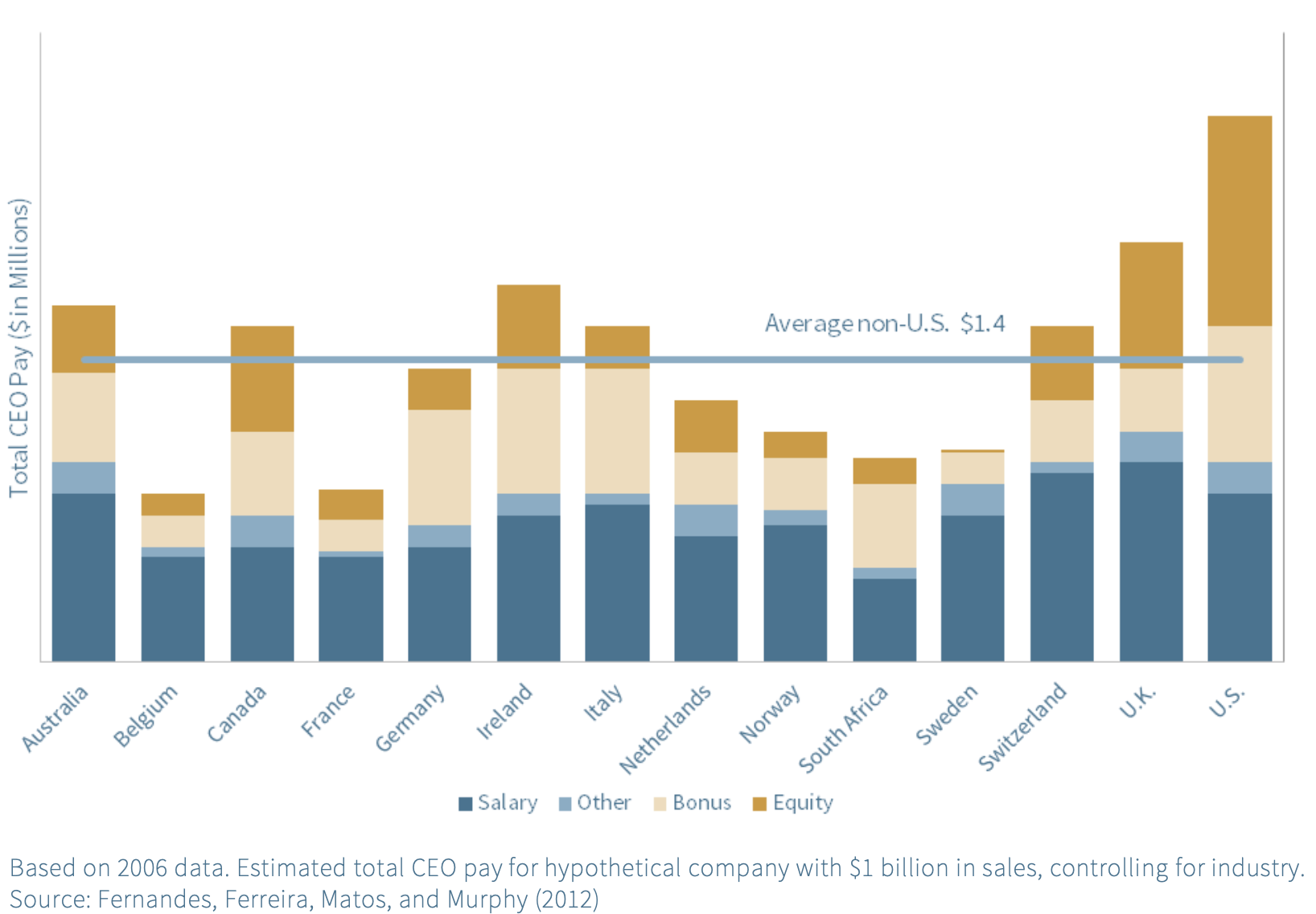

The obvious answer, which happens to be by-and-large the right answer, is the CEO’s equity-based compensation. Positive future predictability, as demonstrated by consistent earnings beats, is rewarded with a higher valuation and stock prices. It’s partially why SaaS companies, with their supposedly predictable business model of recurring subscription revenue, have been rewarded with high valuations relative to their revenue. And higher stock prices lead to more compensation for the CEO, because more and more of CEO compensation is tied to some form of equity, either stock or options.

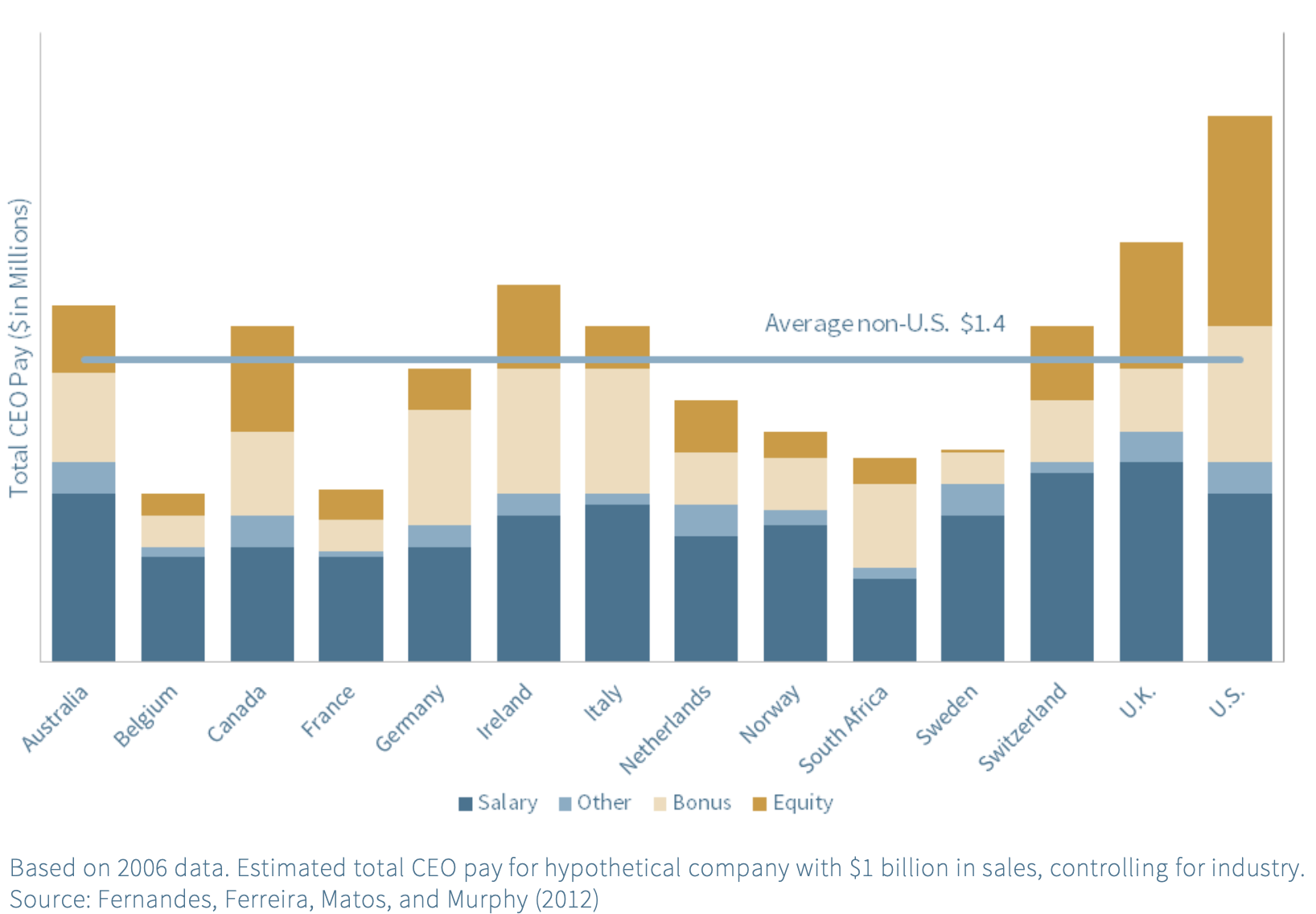

Based on research by Stanford’s Graduate School of Business, more than half of a CEO’s compensation package is equity-based -- a trend that is growing rather quickly during the last couple of decades.

Combining this trend with a steady decline in median CEO tenure from six years in 2013 to five years in 2017, as shown in this Harvard Law School research, it’s not surprising that earning guidance is being used and abused to maximize share price increase in the short-term.

To be clear: this is not just another one of the many articles out there railing on CEO pay. CEOs are not completely to blame for this phenomenon. There are two other dimensions at play here.

One dimension is the lack of oversight from independent directors on the Board. These directors are supposed to keep the CEO accountable, and stop him or her from doing things that would harm the long-term prospect of the company. Yet, many of these directors are paid purely or mostly in cash, meaning they have little vested interest in shaping the company but every interest to not be a pain in the neck to the CEO, in order to keep the directorship. From a compensation perspective, these independent directors are about as invested as the hourly worker or part-time contractor; they just want to get paid and go home. Checking how a public company’s directors are paid by reading their SEC 14A filings is a good way to evaluate their incentives. This observation is not new. Warren Buffett has criticized this phenomenon publicly, to no avail.

The other dimension is the strange logic that consistent quarterly earnings beat is how a company shows managerial competency and credibility. In fact, of the CEOs and CFOs interviewed in Thomas King’s paper mentioned above, quite a few expressed that being able to deliver on a guidance’s promise directly impacts the CEO’s credibility and trustworthiness, even on a personal level. This is strange because each guidance is supposed to be an honest attempt at predicting the business’s future. We all intellectually know that it’s impossible to consistently predict the future. A company that can always predict its own future ought to seem fishy and less credible, not more. A company whose future forecasts sometimes hit and sometimes miss should be deemed more credible, if only because its prediction track record is more reflective of reality. Judging from this dimension, it’s no wonder controlling operational costs, applying accounting tricks, buying back shares, and other methods are used to make the future seem more “predictable”; they are all under the CEO’s control and out of the realm of natural future uncertainty.

Incentive Reset

As an operator, I’m sympathetic to the CEO position, no matter how big or small the company is. It’s the toughest job, the loneliest job, and the buck must stop with whoever has that job. The problem is not that we have a bunch of terrible short-term thinking CEOs and need to be replaced with better long-term thinking CEOs. The problem is the CEO’s current incentives, situated in a complex web of actors with their own incentives, that are all out of whack. Every person, no matter how intelligent, capable, or honest, is a prisoner of his or her incentives.

While COVID-19’s economic impact is still unfolding in real-time, it’s likely that the American economy will never return to its former self. Nor should it. One silver lining of the coronavirus pandemic is that it ruthlessly exposes the corporate excess, income inequality, government ineptness, and structural fragility in our society.

There’s no good reason to hold on to any of that and yearn for the good ol’ days. Certainly not a ritual as stale and counterproductive as the quarterly guidance. Corporate Europe has already mostly gotten rid of it. Maybe it’s time for Corporate America to do the same, reset, look inward, and, as Charlie Munger’s timeless wisdom suggests, “get the incentives right.”

Thank you to a good investor friend of mine whose newsletter inspired this topic and discussion.

If you like what you've read, please SUBSCRIBE to the Interconnected email list. New posts will be delivered to your inbox (twice per week). Follow and interact with me on: Twitter, LinkedIn.

财报指导过期了;留着还有用吗?

下周是华尔街第二季度财报的开始。此季度也许是自美国Great Depression以来最重要的一次财报和收益导向。

在过去的几周里,由于COVID-19对经济的影响,许多公司都取消了之前的收益导向,因为信息更变太快,“保质期”太短。

然而,这里还有一个更深层次的问题需要讨论:每个季度宣布收益导向的惯例是否真正对预测未来有用?还有必要留着吗?

收益导向的歌舞伎

对每季度收益导向的价值的最慷慨理解,也就是它可能帮助投资者为未来的市场状况或公司的变化做好准备。实际上,这是公司管理层和股东关系办公室与分析师们之间的歌舞伎。两方都以微妙的方式相互操纵和协调,因此,大多数情况下,公司的季报总会超出分析师对收益的预期。

华尔街分析师阶层是金融媒体行业的重要成员。就像媒体一样,他们喜欢为一个故事火上浇油,挑选赢家和输家。然而,他们似乎从来不为自己的错误负责。我还没有看到哪个分析师因为在股价目标预测上的错误而被解雇。这种预测不过期,所以总是可以为自己辩护说,只要等足够的时间,预测早晚会成真,永远不会“错”。

Case Western大学的Thomas King教授的一篇论文指出,只要分析师配合,公司管理层就可以利用三种方法来“控制”每季度报告的收益:运维管理、财务管理和预期管理。

简单地说,“运维管理”就是控制或削减研发、营销预算、人员多少等成本的操作。这些变动都或多或少是管理层单方说了算。当公司的支出数额和开销增长成为收益导向里的一个相关因素时,控制它们可以帮助公司的收益长期超过市场的预期。2013-2018年Facebook利用财报指导控制开支,使其一直符合华尔街的预期, 就是个好例子:

“财务管理”无疑就是用各种各样的会计手段,改变对公司资产负债表各个方面的一些假设和估值方式,从而在某种程度上增加收益。

“预期管理”其实就是有技巧的降低华尔街分析师们的预期。通过私下交谈,首席执行官和其他高管可以了解和影响分析师的思考,因此无论他们得出的收益预期是什么,公司管理层都很清楚,再去使用各种可以“超出预期”的方法来制作财报指导。

(旁白:这种“期望管理”在政治大选中很常见。大选团队的发言人(“股东关系”)会在一个重要的政治活动前夕,比如候选人辩论,不断地推敲新闻媒体(“分析师”)的期望,因此候选人在辩论结束后总会“胜出”,因为他超出了人们的预期(“超出收益预期”)。不足为奇,最优秀的政治传播人才往往在离开政界后去大公司的传播部门就职。)

还有一种普遍流行的方法是股票回购,从而提高每股收益的数字(earnings-per-share,EPS)。这个数字是收益导向中最重要的两个指标之一;另一个是收入。

在过去十年中,或许最昂贵的股票回购例子是IBM,在2010-2015年间,IBM的股票回购总额接近400亿美元,目的是实现其对股东的高调承诺,即在这五年内实现20美元的运营每股收益。在同一时期,IBM股价在一段时间内上涨了不少,但最终以落回到起点的股价而收场:

那数十亿美元现金花得值吗?我觉得不值。我一直对股票回购计划持怀疑态度,特别是对于那些需要增长和产品创新的公司,比如Dropbox。IBM也属于这一类,因为它需要快速追赶AWS、Azure和其他领先的云厂商。

这种收益导向的歌舞伎对公司管理层来说既费力又昂贵。为什么每个季度还要做呢?

CEO薪酬与信誉

显而易见的答案,也是大体上正确的答案,是CEO基于股权的薪酬。长期持续的超越收益导向的预期,会让公司的生意看起来更有预测性,也就会带来更高的估值和股价。这个关系和在某种程度上可以解释SaaS公司的市价为什么偏高,因为它们的订阅收入模式的可预测性看似很高。而股票价格的上涨会给CEO带来更多的薪酬,因为越来越多的CEO薪酬与某种形式的股票或期权挂钩。

根据斯坦福大学商学院的研究,CEO的薪酬成分有一半以上是基于股权的。这一趋势在过去几十年里发展得相当迅速。

把这一趋势与另外一个趋势结合起来:首席执行官任期中位数从2013年的6年下降至2017年的5年(哈佛法学院的研究), 利用和滥用收益导向来短期内推高股价的这种行为也就不足为奇了。

需要说清楚:本文不是众多文章中又一篇抨击CEO薪酬的文章。这种现象不能完全归咎于CEO。还有另外两个因素在起作用。

一个因素是独立董事在董事会里监督的缺乏。这些董事的职责是监督首席执行官,阻止他做损害公司长期前景和利益的事情。然而,许多独立董事的薪酬是纯现金或大部分现金,这意味着他们没有什么动力介入和影响公司的长期走向,但有很大的动力保住做董事的这块肥缺,而不想和CEO打对台。从薪酬特性的角度来看,这些独立董事对公司的态度与小时工或兼职承包商差不多;他们只想拿工资回家。大家可以从每个在美国上市的公司给美国证券交易委员会(SEC)提交的14A文件中,了解到每个董事的薪酬情况,也是个评估他们激励机制合不合理的好方法。这个观点并不新鲜。Warren Buffett已经公开批评过这一现象,但目前毫无效果。

另一个因素则是收益导向背后的奇怪逻辑。一家公司如果想证明自己的管理能力和信誉,每个季度的业绩都要超过收益导向的预期。在Thomas King教授的论文中采访的首席执行官和首席财务官中,有不少人表示,能不能兑现收益导向的承诺会直接影响到CEO的可信度,甚至包括对他个人的诚信。这个逻辑很奇怪。每一份收益导向都是在某种程度上预测企业的未来。我们都知道永远成功的预测未来是不可能的。一家总是能预测自己未来的公司应该显得可疑,而不可信。一家在预测未来过程中有时成功,有时失败的公司反到应该更可信,因为它预测未来的成绩更接近于现实。

从这个角度来看,CEO和高管用控制运营成本、运用会计技巧、回购股票等方法,让未来看起来更“可预测”也就不足为奇了。这些因素都在CEO的全权掌控之下,脱离了未来本有的不确定性。

重新思考激励体制

作为一个做过企业运营的人,我很同情CEO的职位,无论公司多大多小。CEO是份最艰难的工作,最孤独的工作,所有责任必须由你来承担。问题不在于世界上有一群糟糕的CEO只会短期思维,只要换一批善于长期思维的CEO就行了。问题在于CEO们目前自己的薪酬与激励机制,加上大环境里其他复杂角色的激励机制,都是不正常、不鼓励长期思维的。每个人,无论多么聪明、能干或诚实,都是他眼前的激励机制的“俘虏“。

尽管COVID-19对经济的整体影响还不可预知,但美国经济很可能永远不会回到从前。它也不应该回到从前。冠状疫情发生后的一个正面后果就是无情地暴露了企业过剩、收入不平等、政府无能以及整个社会结构的脆弱性。

没有什么好理由去保留这些现象,去向往“美好的过去”,尤其是像季度收益导向这种陈腐无用的惯例。欧洲企业已经基本脱离了它,也许是时候让美国企业也这样做了。重新定位,反思自己,像Charlie Munger大智慧的建议所说的,“搞定激励机制”。

感谢我的一位做投资的好朋友的博客激发了对这个话题的讨论。

如果您喜欢所读的内容,请用email订阅加入“互联”。每周两次,新的文章将会直接送达您的邮箱。请在Twitter、LinkedIn上给个follow,与我交流互动!