This issue covers the period between August 17 - 23, 2020 with six news stories – three from English language sources, three from Chinese language sources. Disclaimer: all translated article titles are done by me, not official translations from the media outlets.

Before you go on, please check out my latest deep dive post: "Where Can the Chinese Internet Go?"

“Crypto Assets Worth $50 Billion USD Exited China in 2019” (English Source: Blockchain News)

My Thoughts: This finding was first unearthed by the blockchain research firm, Chainalysis, and has gained coverage in some mainstream business media as well, like CNBC and Bloomberg. I chose to highlight Blockchain News instead, because trade publications tend to include more useful technical information which mainstream media gloss over. The cryptocurrency of choice was apparently Tether, a stablecoin that is pegged to the US dollar, making it a good option if you goal is ultimately to get USD. Since this asset outflow is understood to be a form of “capital flight” out of China, where there’s a well-known annual transfer limit of $50,000 USD, choosing Tether for its pegging with USD makes sense. Tether has also been used in cross-border transactions between Chinese and Latin American merchants, many of whom prefer to use cryptocurrencies instead of the dollar. Tether, being a pretty new stablecoin, has had its fair share of controversies, which has become part and parcel in the blockchain space. This news should be contextualized with China central bank’s own digital initiatives, specifically: piloting the Digital RMB in Beijing and Hong Kong, and issuing rules to standardize blockchain applications for the entire financial sector back in July.

“TikTok to challenge U.S. order banning transactions with the video app” (English Source: Reuters)

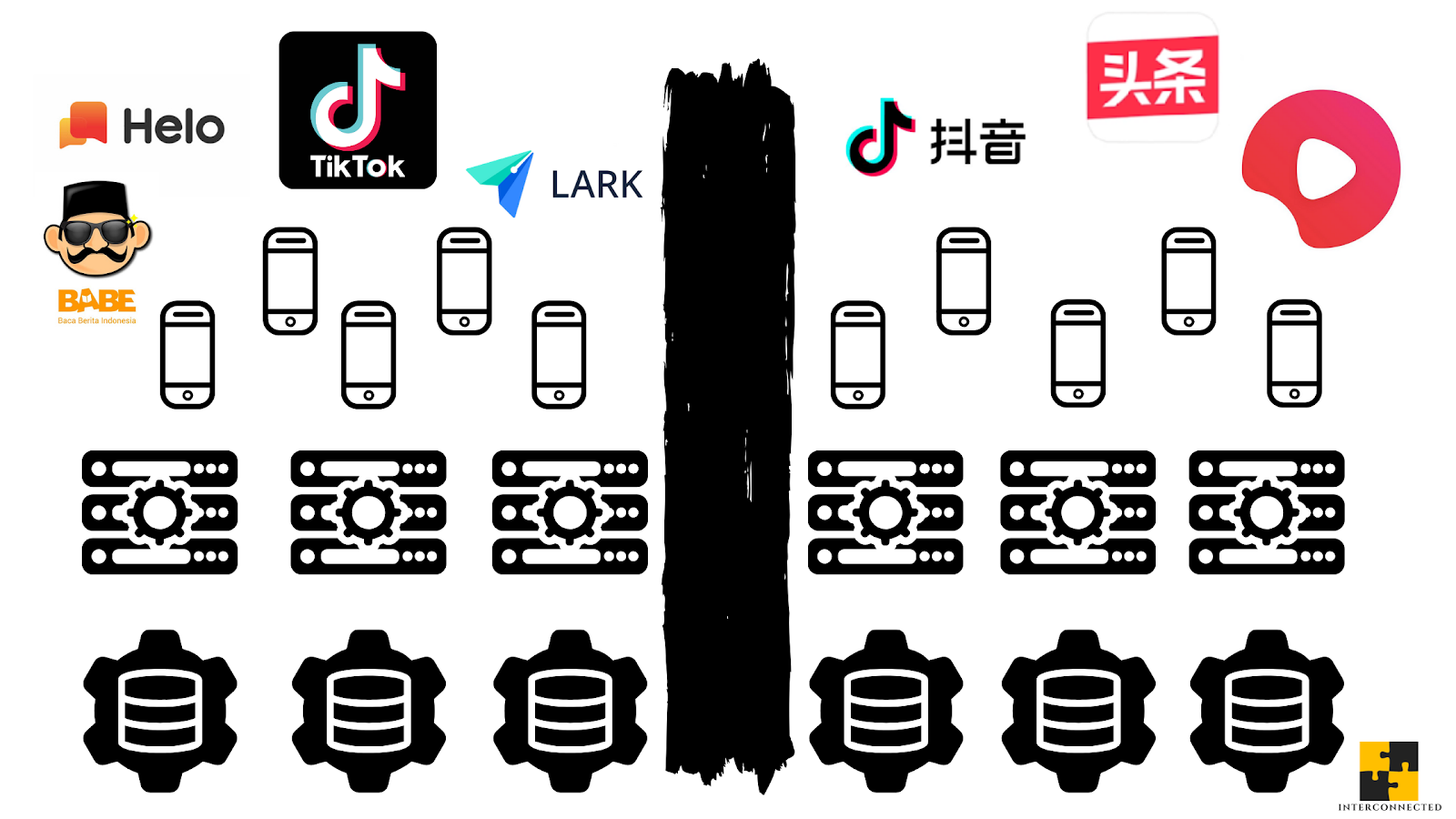

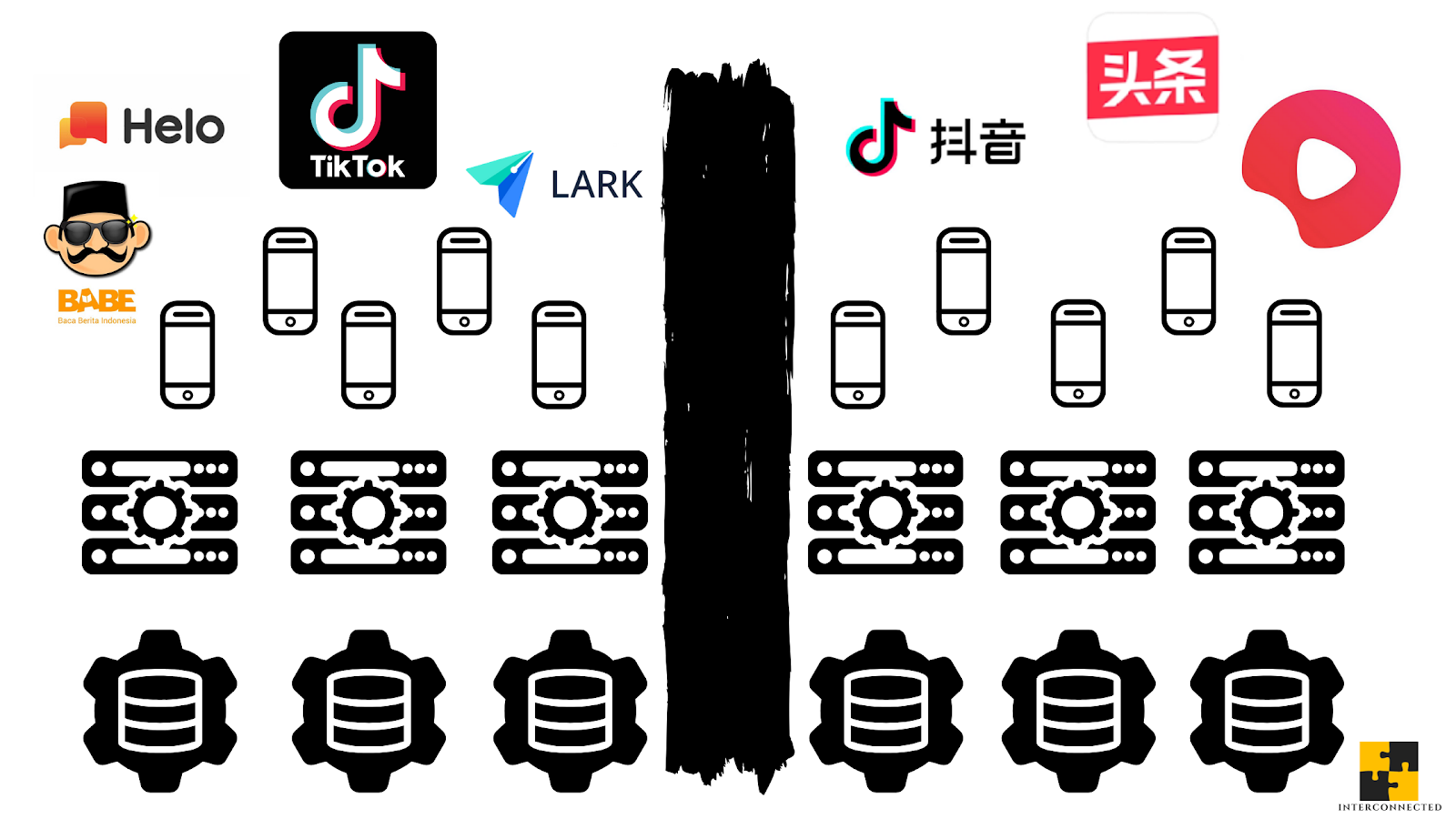

My Thoughts: By the time you read this weekly issue, TikTok may have filed their lawsuit against the Trump administration already. It’s important to note that this lawsuit is only against the executive order issued on August 6, not the new CFIUS order issued last week which we discussed. It also has little impact on the pending acquisition being negotiated with Microsoft or Oracle. The crux of TikTok’s legal argument against the EO is that the order’s “reliance on the International Emergency Economic Powers Act deprives it of due process.” As I have argued in quite a few past deep dive posts (see “A Framework to (Dis)trust and Verify TikTok” and “Can ByteDance Build Trust?”), whatever we do to TikTok (or WeChat, or any other product or company), we must do so with evidence and Due Process. Otherwise, America is no longer American. It’s ironic to say the least that a Chinese company is arguing for Due Process against an American president who could care less about it.

“Microsoft plans cloud contract push with foreign governments after $10 billion JEDI win” (English Source: CNBC)

My Thoughts: The title of this article is misleading, because AWS filed a complaint regarding the JEDI contract decision a few months ago, which is still pending, so I want to call that out first. (For a deep dive on the implications of AWS’s complaint, see a previous post “AWS vs Azure: Return of the JEDI?”). Even with, and perhaps due to, the pending status of JEDI, Microsoft is leveraging its status as the “presumptive” winner of the largest cloud contract in the Defense Department’s history to go after cloud deals (often dubbed “digital transformation” in the industry) of other governments. This article does not specify which governments Microsoft is pursuing, but we can deduce that at least some of the Five Eyes are on the target list, just from the contours of its potential TikTok acquisition, which includes operations in the US, Canada, Australia, and New Zealand. All cloud vendors are still in a linear, land grabbing mode, but Microsoft with Azure seems to be playing multi-dimensional chess.

“Zoom’s big retreat from China” (Chinese Source: InfoQ)

My thoughts: Zoom’s effective exit from the Chinese market will be official starting next week, where the company will only sell its product indirectly via three partners. As I highlighted from a couple of weeks ago, this decision is very much a response to the increasing scrutiny on TikTok and Zoom’s own prior security troubles related to its engineering presence in China. What’s unclear is how many and how quickly Zoom will reduce its R&D headcount in China, while it hires engineers in Pittsburgh and Arizona. Zoom has enjoyed significant engineering arbitrage in China, where junior developer salaries are roughly one-third that of Silicon Valley. (The gap is much smaller though for senior-level talent.) Even within China, Zoom’s engineering hubs are built in cheaper cities like Hefei and Suzhou. This well-researched article also shared Zoom’s plan to expand into the Indian market, with new data centers in Mumbai and Hyderabad and engineering hub in Bangalore, where much engineering arbitrage is happening as well (see what Uber is doing there). This expansion will face both scrutiny from the Indian government (if it thinks Zoom is more Chinese than American like many in America believe), and stiff competition from local giant, Reliance, who already released a Zoom clone called Jio Meet (see visual comparison below). While it’s en vogue to not cooperate in geopolitics these days, cloning to success is still universal.

“Pinduoduo’s Apple and Dyson don't ‘smell good’ anymore?” (Chinese Source: 36Kr)

My thoughts: After releasing its Q2 2020 earnings report last week, Pinduoduo’s stock dropped 10+%. Still it is up more than 120% year to date. This 36Kr article does a good job of analyzing the report in the context of PDD’s overall business model and growth trajectory, which can be confusing for a Western audience. It wraps e-commerce, entertainment, social-buying, local community, and a consumer-to-manufacturing (so-called C2M) distribution model all into one app. In addition, PDD also started the “10 billion subsidy” discount program exactly a year ago to drive user growth and engagement. The program works exactly like it sounds: 5-50% direct subsidy from PDD on top of already cheap prices from merchants on its platform, for everything from top-line consumer electronics like Apple’s Air Pods and Dyson vacuums, to lipsticks and daily necessities. Both Alibaba and JD.com have since copied the program. I will do a deep dive on Pinduoduo in the future. Until then, I recommend you read this excellent white paper on PDD and “interactive e-commerce” by Elliott Zaagman and Matthew Brennan:

A lot of “social e-commerce” isn’t “social” at all.

— Elliott Zaagman (@ElliottZaagman) August 10, 2020

“Social e-commerce” can be an inaccurate buzzword. “Interactive e-commerce” is perhaps a more appropriate term.

In a new paper, @mbrennanchina and I use @PinduoduoInc’s case to show how. 1/https://t.co/KYqftgnMPf

“Ministry of Industry and Information Technology pproves Gitee, domestic open source ecosystem building enters the fast lane” (Chinese Source: Open Source Society or KaiYuanShe)

My thoughts: This official endorsement by MIIT of Gitee is, in my view, the least covered news that’ll have the most impact on the future of technology and US-China relations. By 1. Fully endorsing open source technology on a national and strategic level; and 2. Anointing a Chinese domestic champion to drive open source growth in Gitee, this decision signals a further move towards bifurcation in arguably one of the only threads that’s keep cross-border collaboration alive: open source. In my “Open Source in China” three-part series, I briefly mentioned Gitee -- China’s homegrown Git-based developer collaboration alternative to the Microsoft-owned GitHub. GitHub is where the vast majority of open source technology and development live today. Will Chinese tech companies and developers have to choose between GitHub and Gitee one day? That outcome will have more significant consequences to the global technology landscape than the newest Trump’s EO.

If you like what you've read, please SUBSCRIBE to the Interconnected email list. To read previous posts, please check out the Popular Topics section and the Interconnected Weekly archive. New content will be delivered to your inbox (twice per week). Follow and interact with me on: Twitter, LinkedIn.

本期《每周互联》总结概括的时间段是:2020年8月17至23日,包括本作者挑选的六条新闻:三条原文是英文,三条原文是中文。声明:所有翻译的文章标题都是我做的翻译,不是官方翻译。

还希望大家有空看看我上周最新的深度分析文章:《中国互联网还能去哪里?》

“价值500亿美元的Crypto在2019年离开中国”(英文来源: 区块链新闻)

我的想法: 这条信息首先是由区块链研究公司Chainalysis发掘出来的,在一些主流商业媒体(如CNBC和Bloomberg)上也有报道。我选择了区块链新闻的文章,因为行业小众刊物出版的信息往往包含更多有用的技术信息,主流媒体通常会一笔带过这些细节。用的最多的crypto显然是Tether,一种与美元挂钩的 stablecoin。如果最终目的是获得美元,它是个很合理的选择。由于这些资金外流总体被视为是“资本外逃”,绕过每年5万美元的限额,因此选择与美元挂钩很紧的Tether是有道理的。在中国和拉美商人之间贸易中,也有开始使用各种crypto,而不是美元。Tether作为一个较新的stablecoin,已经有很多争议了,这在区块链行业里也很常见。这条新闻应该与中国央行自己的各种数字化货币举措相结合,特别是:即将在北京和香港引入数字人民币,和早在七月发布的指令要求所有金融行业的区块链应用的标准化。

“TikTok挑战美国禁令”(英文来源: 路透社)

我的想法:当你读到本期周刊时,TikTok可能已经正式对特朗普政府提起诉讼了。需要注意的是,这起诉讼只针对8月6日发布的行政命令,而不包括我们上周讨论过的新CFIUS命令。这起诉讼与微软或甲骨文可能收购TikTok的谈判也没有太大关系。TikTok反对EO的法律论点是:该法令“依赖《国际紧急经济权力法案》而剥夺了其正当程序(Due Process)。” 正如我在过去几篇文章中所说的(请读 “ 一个(不)信任加验证TikTok的监管框架” 和 “字节跳动能在海外建立诚信吗?”),无论我们对TikTok(或微信,或任何其他产品或公司)做什么,都必须有证据和正当程序。否则,美国就不再是美国了。有点讽刺的是,一家中国公司正在与一位从不理睬正当程序的美国总统争论正当程序。

“微软计划在赢得100亿美元的JEDI合同后扩大与外国政府的云合作”(英文来源: CNBC)

我的想法: 这篇文章的标题有点误导性,因为AWS几个月前正对JEDI合同提出了申诉,目前仍悬而未决,所以我想先说明这一点。(要深入了解AWS的投诉,请参阅我之前写的文章 “AWS vs Azure:JEDI重来?”)。虽然JEDI项目还没完全落地,微软已经在利用其作为国防部历史上最大的云合同的“准”赢家的地位,去做他国政府的云生意(在业界通常被称为“数字转型”)。这篇文章没有具体说微软正在追哪几家政府,但我们可以推断,Five Eyes中的一部分国家应该在名单上,仅仅从其可能收购TikTok在美国、加拿大、澳大利亚和新西兰所有业务的这一点。各大云厂商都还在处于一种线性的“抢地盘”模式,但是微软加Azure似乎在玩更深层的“多维象棋”。

“Zoom中国’大撤退’” (中文来源: InfoQ)

我的想法: 从下周开始,Zoom将正式从中国市场退出所有直销,产品只会通过三个合作伙伴间接销售给用户。正如我几周前所强调的那样,这一决定在很大程度上因为美国对TikTok的监管和Zoom自身今年早期因为在中国有工程团队所留下的各种安全问题。目前尚不清楚的是,Zoom会不会在中国减少研发人员,如果会那裁员多少,同时还要在匹兹堡和亚利桑那州招聘工程师补上。Zoom在中国获得了巨大的劳工和工程套利,在中国,初级程序员的薪水大约是硅谷的三分之一。(对高层资深程序员来说,差距要小得多。)即使在中国,Zoom的工程团队也建在像合肥和苏州这种生活相对便宜的城市。这篇文章研究很充分,还分享了Zoom进军印度市场的计划,包括在孟买和海得拉巴建立数据中心,在班加罗尔也有开技术中心,当地也有大量劳工和工程套利(看看Uber在印度的做法就知道了)。这一扩张将面临来自印度政府的监督(如果印度政府认为Zoom更像中国的而不像美国的公司,类似很多美国人的观点),以及来自本土巨头Reliance的激烈竞争。后者已经发布了一款名为Jio Meet的Zoom克隆产品(见下面的UI对比)。虽然当前在地缘政治关系上“不合作”很流行,但为成功而克隆还是很普世的。

“拼多多上的苹果和戴森不香了” (中文来源: 36氪)

我的想法: 上周发布了2020年第二季度盈利报告后,拼多多的股价跌了超过10%。当然今年迄今为止,股价还是不错的,涨了120%以上。这篇36氪的文章很好地分析了PDD的整体商业模式和增长轨迹,很多地方西方读者可能会感到困惑。它将电商、娱乐、社交团购、社区和消费者到制造业(所谓的C2M)分销模式融在了一个app里。此外,PDD去年还启动了“百亿补贴”来推动用户增长和日活月活度,已经整整一年了。该计划的运作方式和名字一样:就是在PDD平台上商家们已经便宜的价格上,再直接加5%至50%的补贴,从苹果的Air Pods和Dyson吸尘器等高端产品,到口红和日用品。阿里和京东已经“抄了作业”,也有自己的“百亿补贴”了。以后我会针对拼多多写一篇深入分析。在那之前,我建议大家看看这篇由Elliott Zaagman和Matthew Brennan写的关于PDD和“互动式电商”的白皮书:

A lot of “social e-commerce” isn’t “social” at all.

— Elliott Zaagman (@ElliottZaagman) August 10, 2020

“Social e-commerce” can be an inaccurate buzzword. “Interactive e-commerce” is perhaps a more appropriate term.

In a new paper, @mbrennanchina and I use @PinduoduoInc’s case to show how. 1/https://t.co/KYqftgnMPf

“工信部携码云 Gitee 入场,国内开源生态建设进入快车道” (中文来源: 开源社)

我的想法: 在我看来,工信部对Gitee的官方认可和支持是对未来科技和中美关系影响最大的一条新闻,因为以下两点:1. 从国家和战略层面全面支持开源技术;2. 这一决定任命Gitee做为推动国内开源生态的“本土冠军”,标志着进一步走向“分化”,而 “分化”的可以说唯一一个能保持跨境合作的力量:开源。在我的“中国的开源世界”系列文章中,有简单提到Gitee——基于Git的开发协作平台,做为针对微软旗下的GitHub的本土替代品。GitHub是当今绝大多数开源技术和开发协作发生的地方。会不会有一天,中国科技公司和开发者们必须在GitHub和Gitee之间选其一?这将比最新的特朗普EO要对全球科技格局的影响要大得多。

如果您喜欢所读的内容,请用email订阅加入“互联”。要想读以前的文章,请查阅“热门话题”和《每周互联》的档案。每周两次,新的文章将会直接送达您的邮箱。请在Twitter、LinkedIn上给个follow,与我交流互动!