Tesla may well be the biggest driver of China’s journey towards technological self-reliance, as the “Tech Cold War” between the U.S. and China deepens. This observation wasn’t obvious to me until I listened (three times) to Elon Musk’s Q&A session at the 2020 World Artificial Intelligence Conference in Shanghai earlier this month.

While most of the media coverage focused on Musk’s bold proclamation that Tesla is very close to achieving Level-5 autonomous driving capabilities, the entirety of what he said during the Q&A has far-reaching implications, technologically and geopolitically.

Local Hire, Original Engineering, Open Patents

Musk’s Q&A was, first and foremost, an aggressive recruiting pitch for the engineering team that Tesla is building in China. What’s most noteworthy is his emphasis that the Tesla China team will be doing “original engineering”.

This emphasis is important for three reasons:

1. Local optimization: for self-driving to work well, where your engineers are physically located play a surprisingly important role. Musk shared that Tesla’s Autopilot works best in California, because the company’s engineers are mostly in California, thus they can do local optimization most effectively to adapt to the reality in California. The plan is: once self-driving works well in California, the software can be adapted to other locations with varying degrees of further local optimization.

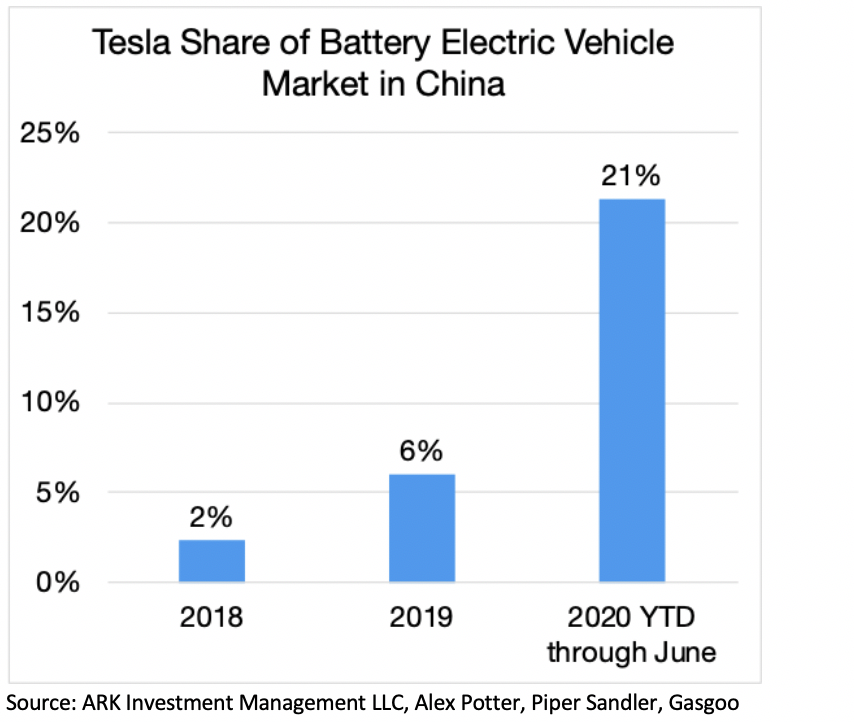

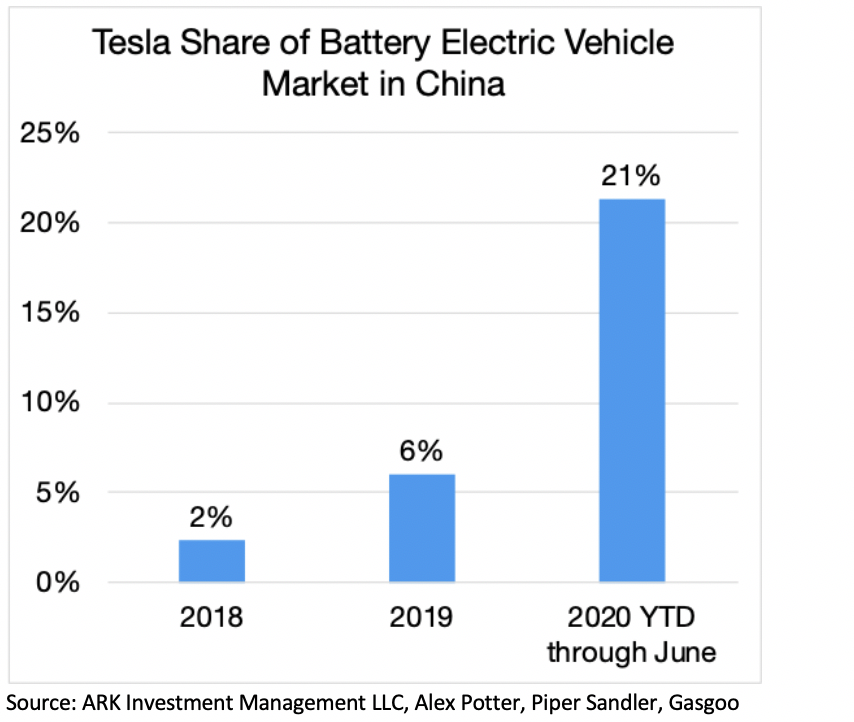

In order for Tesla's Autopilot to work well in China, it needs a local engineering team capable of what its team is doing in California. Thus, “original engineering” makes perfect product sense if Tesla wants to deliver self-driving cars in China -- a growing electric vehicle market where Tesla is taking a large chunk, according to research by ARK Investment. Beyond the engineering and product rationale, it is also a killer recruiting pitch for the best and brightest; no talented engineer wants to spend the day refactoring and adapting someone else’s code.

2. Friendlier regulators: In his Q&A, Musk’s confidence in achieving L5 is tempered by the reality that neither he nor anyone else knows what is the level of safety that must be achieved to convince regulators. Twice as safe as a human driver? 10-times? 100-times? Or in Musk’s words, how many 9’s after 99% is needed? We don’t know.

Regulators play a decisive role in the pace of self-driving advancement, more so than most other tech sectors. For a regulator to make a judgment on the safety threshold, it’s a combination of hard evidence and political will plus incentives. Assuming we have the same safety evidence, then the Chinese government currently has more appetite to experiment with and invest in AI than the U.S. government. Thus, Chinese regulators of all levels are more incentivized to say “yes” to things, while their American counterparts are more incentivized to say “no”. This political will was on full display at this AI conference, where the Party Committee Secretary of Shanghai, Li Qiang, more or less presided over the entire keynote session, where almost every speaker ritualistically praised his leadership at the beginning of each talk. Li’s presence is a big deal, as Shanghai tries to lead China’s AI future, having lost out on the other tech trend booms to Beijing, Shenzhen, and Hangzhou. Tesla’s China GigaFactory is already located in Shanghai. It’s likely that Tesla will continue to receive more favorable regulatory treatment in Shanghai than in California or anywhere else in the U.S.

3. Reduced risk of sanctions: With “original engineering”, Tesla China creates original IP that will not be subjected to future U.S. sanctions. Thus, this approach is effective for recruiting and important for Tesla’s own long-term development. China, in turn, will rightfully have access to the IP generated from Tesla China.

But what’s more important is that Tesla doesn’t care about patents anyways. In 2014, it decided to open source its entire patent portfolio related to building an electric vehicle. In Musk’s mind, patent protection is an impediment not accelerant to technological advancement. In his blog post announcing the no-patent decision, he wrote:

“Technology leadership is not defined by patents, which history has repeatedly shown to be small protection indeed against a determined competitor, but rather by the ability of a company to attract and motivate the world’s most talented engineers. We believe that applying the open source philosophy to our patents will strengthen rather than diminish Tesla’s position in this regard.” [Bold emphasis mine]

Tesla is flexing its muscle to attract and motivate the most talented engineers in China. When they do develop the self-driving technology needed for Tesla (and yes, I believe it is a “when” not “if”), chances are all that technology will be open sourced for anyone in China and the world to do the same. Open source technology, as the Linux Foundation clarified in its whitepaper earlier this month, is not subjected to the U.S. government’s various export control restrictions.

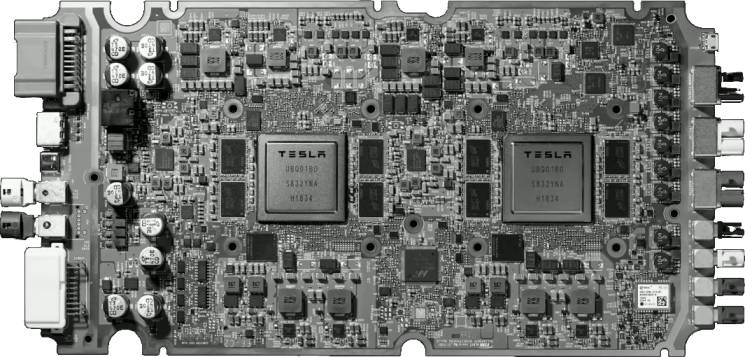

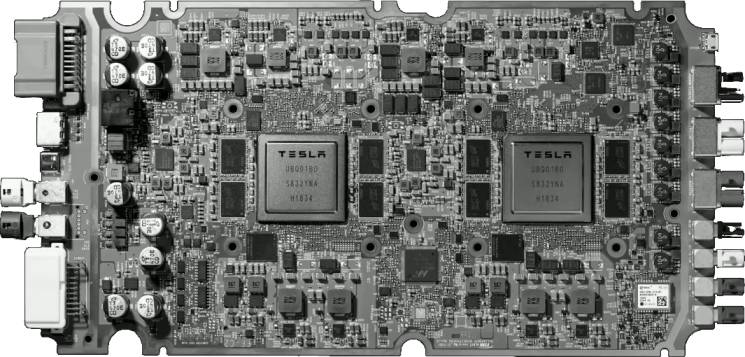

Of course, achieving self-driving is not just an algorithm and software engineering challenge, but also a hardware one. To understand that piece of the puzzle, let’s look at Tesla’s custom-designed Full Self-Driving (FSD) chip in the context of China’s current chip manufacturing capabilities.

What is FSD?

Tesla began developing its own FSD chip in 2016. In 2019, it began volume production and deployed these FSD chips inside Model X, S, and 3. It is an 8-bit chip (not the more powerful 32-bit or 64-bit general purpose chip), in order to satisfy the specific computation needs of a self-driving car but nothing more. Thus far, Samsung manufactures the chips using its 14nm process at its Austin, Texas foundry. A self-driving chip does not have as high a requirement in terms of form factor (or size) as a smartphone or smaller device, thus the 14nm process is sufficient.

The FSD chip is highly optimized to do one particular mathematical operation very efficiently: dot product. It’s how you do matrix multiplications -- an operation that a neural network needs to do many many times, especially for a convolutional neural network. In order for a self-driving car to “see” what’s going on while driving, it has to do a lot of dot products to compute all the image data gathered from its surrounding, frame by frame, before deciding what to do, if anything. And the car must be able to do this constantly for a long time without overheating or slowing down performance. The FSD’s performance apparently exceeds an Nvidia alternative’s by 21-times, while consuming much less power.

Each Tesla car is installed with two of these chips to add redundancy and improve decision-making: if the two chips “disagree”, the decision is thrown out and the computer starts a new compute and inference cycle on new data. Essentially, each Tesla has two “brains” to keep each other honest.

Can China Make FSD?

As I’ve described in a previous deep dive post, “RISC-V, China, Nightingales”, China’s largest chip foundry SMIC does have 14nm capabilities. In fact, SMIC’s co-CEO Liang Mong-song, who is credited with bringing the 14nm capabilities to the foundry, was a TSMC veteran and also instrumental in helping Samsung first achieve its own 14nm process, which is being used to manufacture the FSD chips right now. These chips are designed based on the ARMv8.0-A instruction set architecture (ISA), which isn’t subject to U.S. sanctions since ARM is a UK company.

That being said, the UK recently banned Huawei completely, reversing its earlier decision that allowed Huawei to build the “non-core” portions of its 5G network. This decision may signal a stronger willingness by UK regulators to either push out Chinese companies or prevent technologies from going to China, as it moves closer to the U.S. in this Tech Cold War.

To further muddle the picture, Softbank who owns ARM is mulling a sale after buying it for $32 billion USD four years ago. Meanwhile, RISC-V, the open source ISA, is not yet mature enough to design a self-driving optimized chip like the FSD

Needless to say, there are many moving pieces to keep track of. SMIC is facing many challenges as it grows into a world-class chip foundry. It has had trouble acquiring advanced lithography technology from the Dutch company ASML, due to pressure from the Trump administration. Without ASML’s technology, SMIC will have a hard time advancing beyond the 14nm process to 7nm or denser processes. It will also have trouble acquiring other EDA tools to scale its production capacity, because the dominant suppliers are mostly American. Depending on who you ask, SMIC’s future is still pretty bleak, even with its successful IPO on the Shanghai STAR market.

But at the end of the day, Tesla needs 14nm capabilities and SMIC has them. In fact, it would make sense for Tesla to be a customer of China-made chips for its China-made cars. This arrangement will help Tesla avoid future restrictions if U.S. sanctions widen to include its current chip production in Austin. Producing FSD chips at scale for a high-caliber customer like Tesla will push SMIC to up its game on manufacturing quality and operational efficiencies. Combined with the software advancement in AI from the local engineering team, Tesla can end up giving China’s technology ecosystem quite a boost.

Ambition and Pragmatism

Tesla is not only an ambitious company, it’s also a pragmatic one. Ambitious pragmatism is what a company, and I’d argue a country, needs to both survive and thrive. In the last Cold War between the U.S. and U.S.S.R., there was actually a lot of ambitious pragmatism that catalyzed technological advancements, like rocketry, satellites, and the space program. So far, the current conflict between the U.S. and China looks totally different.

In fact, this “Cold War” comparison between the now and then is a misleading shorthand.

During a time when U.S.-China relations is dominated by ideologues, not pragmatists, Tesla is expanding its Shanghai GigaFactory and aggressively recruiting Chinese AI engineers. Musk is just executing on his own view that “China is the future” and thus an important place to invest in for Tesla to thrive, something he expressed during last year’s World Artificial Intelligence Conference in Shanghai. He’s being ambitiously pragmatic, as an entrepreneur, a technologist, a builder should be.

In the end, California may still be the first place to have L5 self-driving Teslas on the road, thanks to a big head start. But Shanghai won’t be far behind.

If you like what you've read, please SUBSCRIBE to the Interconnected email list. New posts will be delivered to your inbox (twice per week). Follow and interact with me on: Twitter, LinkedIn.

特斯拉,中国,“科技冷战”

随着中美“科技冷战”的极具加深,特斯拉很可能是中国走向技术自力更生之旅的最大推动者。我也最近才明白这一点,因为听了(三遍)Elon Musk在本月早些在上海召开的2020年世界人工智能大会的问答环节。

虽然大部分媒体的报道都集中在Musk大胆宣布特斯拉已经非常接近实现5级无人驾驶能力,但他在问答环节所说的全部内容,无论是在技术上还是地缘政治上都具有深远的意义。

本地雇人,原创工程,公开专利

Musk的问答很大一部分其实是在给特斯拉的中国工程团队做招聘宣传。最值得注意的是他几次强调特斯拉中国团队将从事“原创工程”(original engineering)。

这个强调之所以重要,有三个原因:

1. 当地优化:为了使无人驾驶有好的效果,工程师所在的地理位置有着出乎意料的重要性。Musk分享说,特斯拉的无人驾驶目前在加州最好用,是因为公司的工程师大多数都在加州,因此他们可以最高效地进行当地优化,来适应加州本身的实际情况。设想的计划是:一旦无人驾驶在加州运行良好,软件层可以用来适应其他地区,加一些适应当地状况的优化。

为了让特斯拉的无人驾驶在中国运作的好,它需要一个当地的工程团队。因此,如果特斯拉想在中国销售无人车,那么“原创工程”对产品本身的意义是很大的。根据ARK Investment的研究,中国的电动汽车市场在快速增长,而且特斯拉已经占了很大的份额。除了工程和产品的需求意外,这也是招聘最优秀和最能干的工程师的杀手锏:没有一个有才华和野心的工程师愿意整天重构和修改别人的代码。

2. 更有好的监管体制:在问答中,Musk虽然对实现L5满怀信心,但也给自己泼了点冷水,因为他不知道,整个行业也不知道,无人驾驶到底需要达到多高的安全水准才能通过监管机构的管制。是比人为驾驶更安全两倍?10倍?100倍?或者用Musk的说法,99%之后需要再加多少个9?谁都不知道。

监管者在无人驾驶进步的步伐中扮演着决定性的角色,影响力要比大多数其他科技行业重要的多。对于一个监管机构来说,要对安全门槛做出判断,一部分是要有确凿的证据,另一部分其实是政治意愿加上内在的激励动力方向。假设安全证据是有的,也是一样的,目前来看中国政府比美国政府更有动力去试验和投资人工智能。因此,中国各级监管机构更有动力说“是”,而美国同行则更有动力说“不”。这一政治意愿在这次人工智能大会上得到了充分的体现。上海市委书记李强基本上是整个会议的“大东家”,几乎每一位做了主题发言的人在演讲开始都有郑重仪式性地赞扬了他的领导。李强书记的站台是值得在关注的,因为上海正在试图领导中国人工智能的未来,不想再错过科技行业发展的好几波潮流,而继续输给北京、深圳和杭州等地。特斯拉的中国的GigaFactory已经建在上海。特斯拉很有可能会继续在上海获得比加州或美国其他地方更友好的监管待遇。

3. 降低制裁风险:通过“原创工程”,特斯拉中国团队的成果不会受到未来美国的制裁。因此,这不仅对招聘有好处,对特斯拉自身的长远发展也很重要。中国也理所当然的会拥有特斯拉在中国产出的知识产权。

但更重要的是,特斯拉根本不在乎专利。早在2014年,公司就决定开放与制造电动车相关的全部专利。在Musk眼里,专利保护是技术进步的障碍,并没有促进效果。在宣布“无专利”这个决定的博客中,他写道:

“达到技术领先地位并不是由专利决定的,历史一再证明,专利仅仅是针对一个坚定的竞争对手的小小保护,更重要的是一家公司吸引和激励世界上最有才华的工程师的能力。我们相信,将开源理念应用于我们的专利将增强而不是削弱特斯拉在这方面的地位。”【注:翻译是我写的,不是官方版】

特斯拉正在努力吸引和激励在中国最有才华的工程师。当他们开发出特斯拉所需的无人驾驶技术时(我相信这是一个“何时”而不是“如果”的问题),所有技术和知识产权都会被开源,中国以及世界上的任何人都可以用。正如Linux基金会本月早些时候在篇白皮书中澄清的,开源技术不受美国政府各种出口管制限制的约束。

当然,实现无人驾驶不仅是一个算法和软件工程的挑战,也是一个硬件挑战。为了理解这一层面,我们该结合中国目前的芯片制造能力来看看特斯拉自己研发和定制的全无人驾驶(Full Self-Driving,FSD)芯片。

什么是FSD?

2016年,特斯拉开始开发自创的FSD芯片。2019年,开始量产,并在Model X、S和3中都部署了FSD芯片。它是一个8-bit芯片(不是更强大的32-bit或64-bit通用芯片),仅以满足无人驾驶的特定计算需求为目的。目前大批量生产FSD芯片的厂商是三星在德克萨斯州奥斯汀的铸造厂,使用的是14nm制造工艺。 因为驱动无人驾驶的芯片在外形或尺寸方面没有智能手机或更小的设备要求那么高,所以14nm制造工艺就足够了。

FSD芯片的特点是高度优化一种非常具体的数学运算:点积。这就是做矩阵乘法的方法,也是一个神经网络(neural network)需要做很多次的一种运算,尤其是“卷积神经网络”(convolutional neural network)。一款无人车在开的时候,要想决定自己下一步该做什么,就得先把它周围所吸收的所有图像,一框接一框的做出计算,而且必须能够长时间持续做这些计算,还不会过热或降低性能。FSD的性能超过了英伟达的一款竞品21倍,同时耗电也更少。

每辆特斯拉汽车都安装了两个这样的芯片,以增加冗余和做决定的能力:如果这两个芯片的决定“不一致”,那就被抛弃,从新开始在新数据的基础上做新一轮的计算和推理。通俗点去理解,每一辆特斯拉都有两个“大脑”来互相帮助。

中国能制造FSD吗?

正如我在之前的一篇文章 “RISC-V,中国,夜莺” 中所描述的,中国最大的芯片铸造厂,中芯国际,目前拥有14nm的技术。中芯的联席CEO梁孟松是台积电的元老,也是帮助三星实现自己的14nm工艺的功臣,目前正用于制造FSD芯片。FSD芯片是基于ARMv8.0-A指令集架构(ISA)设计的。因为ARM是家英国公司,目前还不受美国制裁的限制。

尽管如此,英国最近完全封锁了华为,推翻了之前允许华为建设5G网络“非核心”部分的决策。这一决定可能意味着英国监管机构会对更多中国企业做出封锁,或阻止技术流向中国。在这场“科技冷战”中,英国正向美国靠拢。

于此同时,四年前以320亿美元买下ARM的软银,现在正考虑卖掉ARM。开源的ISA,RISC-V,还不够成熟,无法设计出FSD这样的特制芯片。

整个大局势的许多部份都时时刻刻在变动。中芯本身要想成长为世界级芯片铸造厂也面临着许多挑战。由于来自特朗普政府的压力,它很难从荷兰公司ASML获得先进的光刻技术。如果没有ASML的技术,中芯将很难从14nm工艺发展到7nm或更密集的制造工艺。要获取更多的EDA工具来扩大生产力也越来越难,因为主要供应商大多是美国公司。取决于你问谁,但中芯的未来仍然相当暗淡,虽然重返上海科创板的IPO非常成功。

虽然如此,归根结底特斯拉需要14nm制造能力,中芯是有的。特斯拉成为中芯的客户,拿中国芯片铸造厂提供的FSD芯片给在中国制造的汽车使用是很合理的,因为可以避免未来如果美国制裁范围的扩大,很可能影响到目前在德州奥斯汀的芯片生产。为特斯拉这种高水准客户大规模生产FSD芯片,也将推动中芯在制造质量和运营效率上的提升。再加上本地工程团队在人工智能方面的软件开发进步,特斯拉最终很可能成为中国科技生态进步的一个相当大的推动力。

野心与务实

特斯拉不仅是一家雄心勃勃的公司,也是一家极为务实的公司。野心与务实是一家公司,甚至我认为是一个国家,想要生存和繁荣的必备特征。在上一次美苏冷战期间,实际上有很多野心与务实推动了科技发展,如火箭、卫星和太空计划。到目前为止,中美之间的冲突看起来完全不同。

用“冷战”这个历史参考形容现在的状况其实是有误导性的。

在中美关系以意识形态为主,实用主义为次的时代,特斯拉正在扩大上海的GigaFactory,积极的招聘中国人工智能工程师。Musk也仅仅是在操作落实自己的观点,即“中国是未来”,因此也自然而然是特斯拉要想继续发展的重要投资地,去年在上海举行的世界人工智能大会上,Musk就表达了这一观点。作为一个企业家,一个技术专家,一个创造者,他就应该这样。

最终,加州可能还是第一个会有L5能力无人驾驶特斯拉的地方,毕竟起步早。但上海不会落后太远。

如果您喜欢所读的内容,请用email订阅加入“互联”。每周两次,新的文章将会直接送达您的邮箱。请在Twitter、LinkedIn上给个follow,与我交流互动!