During Alibaba’s Q4 2023 earnings call, Daniel Zhang, Alibaba Group’s CEO, expressed a rather romantic optimism that “we would love…to see one of these little Alibaba's spinning off from Alibaba becoming another big Alibaba.” Among the six “little Alibaba’s” that emerged from the tech giant’s big reorg, the one that Zhang believes has the best shot of becoming the next Alibaba is clearly AliCloud.

Sure, FreshHippo may IPO first (supposedly within the next six to 12 months), possibly followed by Cainiao, its domestic and international logistics arm, as Alibaba leadership has telegraphed. But AliCloud, the cloud market leader in China (and decently competitive elsewhere), holds the most potential and has the strongest secular tailwind – digital transformation generally and generative AI specifically. It is no surprise that Zhang decided to be the CEO of AliCloud; he could’ve chosen any of the six “little Alibaba’s.”

I’ve been following AliCloud closely for more than three years; one of the first posts on Interconnected was a deep dive called “Alibaba Cloud: The Ignored Cloud.” As AliCloud spins out to become a separate public company – making it the largest pure play hyperscaler in the public market – the time is ripe to assess how likely AliCloud would become the next Alibaba.

Still In “Land Grab Mode”

AliCloud started in 2009, three years behind AWS. 14 years later, it is still in what I call “land grab mode.” There are three tailwinds fueling this mode.

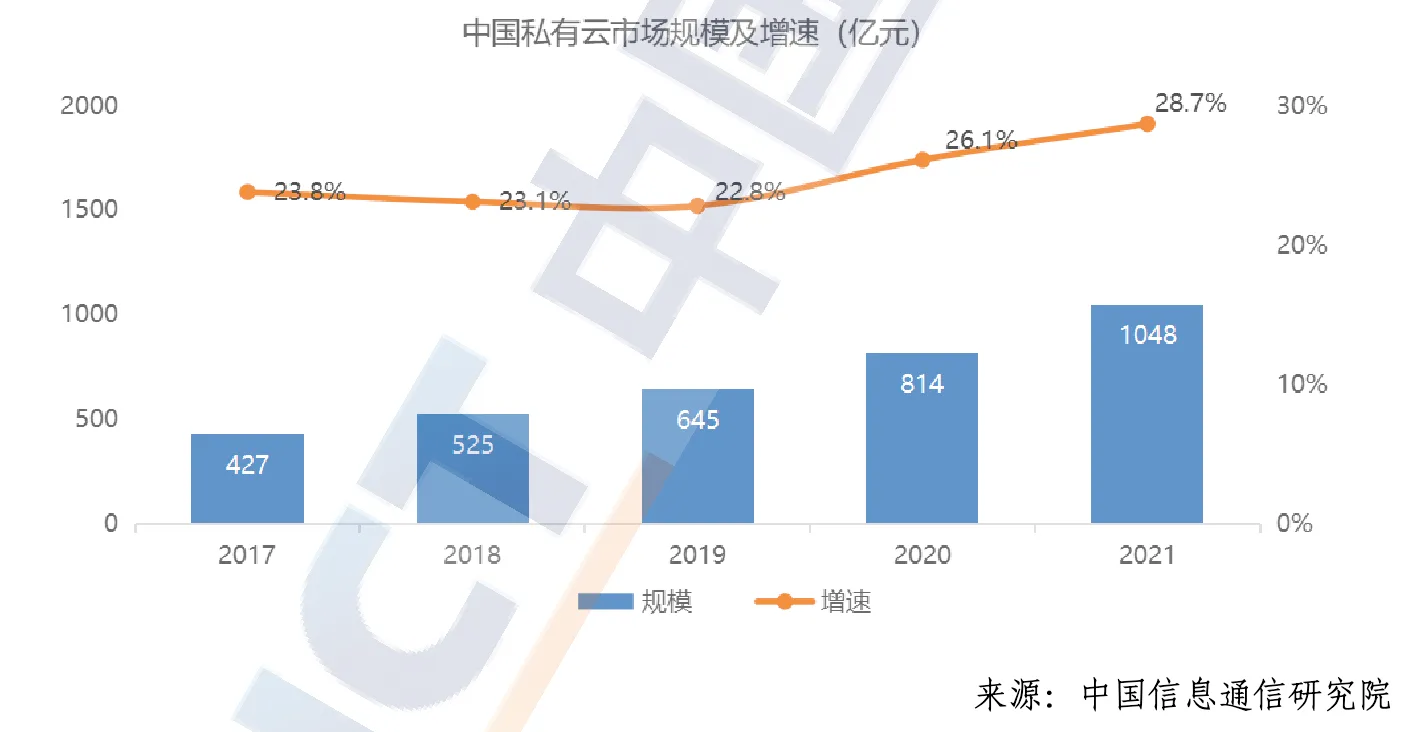

The domestic secular tailwind is China’s current state of cloud computing growth. As our analysis of a government-affiliated think tank (the China Academy of Information and Communications Technology) whitepaper suggested, China’s cloud transformation is still in its infancy and just starting to permeate industries outside of the Internet / tech-native sectors. Furthermore, and contrary to conventional wisdom, China’s public cloud segment is both larger and growing faster than its private cloud segment. As of 2021, the country’s public cloud is about twice as large as its private cloud (218.1 billion RMB vs 104.8 billion RMB) and growing more than twice as fast (70.8% vs 28.7%). (See graph below, first one is private cloud, second one is public cloud.)

AliCloud no doubt suffered when China’s Internet sector shrunk due to a combination of regulatory changes and unprecedented geopolitical challenges. Ed-tech customers disappeared overnight. Gaming companies drastically contracted. Zero Covid diminished all forms of consumption. ByteDance, once one-third of AliCloud’s revenue, moved its overseas workload to Oracle, so it can credibly talk about protecting American users' data. These headwinds resulted in a -2% revenue contraction in its most recent quarter. Replacing all that lost revenue with the slower-moving non-Internet sectors won’t be easy. Yet, AliCloud continues to maintain the largest market share in both the IaaS and PaaS layer. Zhang reiterated that “Alibaba Cloud is very focused on public cloud” – doubling down to ride the secular public cloud tailwind to grab more market share.

The second tailwind is unique to this spinoff. One factor that has ironically diminished AliCloud’s growth potential in the past is its parent-child relationship with Alibaba Group. By being tied so closely to the Alibaba empire, certain sectors simply don’t trust AliCloud as a cloud provider due to possible conflict of interest. No e-commerce companies of any scale would trust AliCloud. Banks and other financial services were also suspicious of it, because of its close ties, real or perceived, with Ant Financial. (AliCloud and Ant do share quite a bit of cloud infrastructure overlap.) This conflict of interest problem is not unique to AliCloud. AWS has encountered similar challenges, unsurprisingly, in the e-commerce and retail space, because of Amazon’s dominance. Walmart choosing Microsoft Azure as its strategic cloud provider is not entirely based on the result of a head-to-head product bake off.

When the AliCloud spin off completes, which should be sometime in the next 12 months according to Alibaba internal communications, the Alibaba corporate umbrella will no longer own any share of AliCloud. This gives the cloud unit an opportunity, in theory, to finally be truly independent. Its recent price cut of up to 50% across core products is a clear indication AliCloud is kicking “land grab mode” into high gear, now that it can go after all sectors without having the “conflict of interest albatross” around its neck. It will, of course, take more than a corporate spinoff to convince the market and prospective customers. The incoming “external strategic investors,” now mentioned a few times as part of the spinoff, is likely intended to give credibility to AliCloud’s independence and neutrality. I suspect that some of these strategic investors will come from the financial service sector, in addition to perhaps a government-affiliated fund, or even a sovereign wealth fund from overseas to support AliCloud’s global ambitions.

That brings us to the third tailwind: the global growth of cloud. While all cloud hyperscalers have experienced dramatically slower growth this year, much of that is due to an unprecedented pull-forward of cloud adoption during the height of Covid, which caused a lot of “indigestion.” The euphemism is “cloud optimization”, which just means few companies are buying more cloud and instead focusing on figuring out how to best use all the cloud resources they already bought! (Macro uncertainty is a big factor too.) However, this is likely a multi-quarter obstacle, not a multi-year trend. And there is no way of knowing whether the generative AI wave, which is a global phenomenon, would shorten this temporary deceleration.

AliCloud, in all honesty, is not a purely global cloud player. It has been boxed out of the US market, still the most lucrative cloud market in the world, despite trying to break in since 2015. Geopolitics could further dampen its global reach in other western countries. However, it is still a major player in many markets outside of China and investing heavily in building new data centers to, quite literally, grab more land.

In April of 2020, AliCloud announced a 3-year, $28.2 billion dollars investment in cloud infrastructure. Three years later, what has that investment yield in terms of overseas footprint? New data centers in Bangkok, Manila, and Seoul, with more to come.

The locations of new data centers are an obvious clue to where the company believes its future opportunities lie. The less obvious clue that data center locations give is how their density improves economies of scale and technical redundancy for other geographically adjacent markets, especially when they are situated in the same rough time zone and longitudinal band. A Manila data center can strengthen the cloud infrastructure in Sydney. A Seoul data center can strengthen the cloud infrastructure in Tokyo, barring data residency requirements of course. You get the idea.

While these overseas data center expansions are not headline-grabbing, they do improve AliCloud’s economies of scale overall in both East Asia and Southeast Asia. The lever of economies of scale is key to justifying the steep price and its ability to turn land grabbing into future profits.

How to Value AliCloud?

With its late-breaking 7% layoff announcement, AliCloud is trimming fat, getting lean, and doing whatever it can to get in good shape to be an independent public company. So how should we value AliCloud? Does it really have a chance to become the next Alibaba? (UPDATE: since this post’s publication, Alibaba has disputed the layoff news, stating it is hiring 15,000 people across all its business units.)

Valuing hyperscalers is notoriously difficult, partly because there are few comparable publicly-listed cloud platforms, partly because the financial disclosures around these hyperscalers are not that transparent.

AliCloud has actually been one of the most transparent clouds when it comes to financial disclosure. Not only does Alibaba share AliCloud’s revenue and adjusted EBITDA every quarter, it also shares another revenue number that removes “inter-segment” businesses, meaning revenue generated from providing cloud services to other Alibaba units. Excluding the inter-segment business is meaningful because including Taobao, for example, as a “customer” and revenue stream to size up AliCloud is almost like cheating.

Yet, this form of light cheating is the status quo in the financial statements of other tech giants who also operate a hyperscaler. No one knows how much of “revenue” AWS generates from Amazon Prime. No one knows how much “revenue” GCP generates from YouTube. No one knows how much “revenue” Azure generates from LinkedIn. AliCloud deserves more credit for its transparency than it is currently getting. Perhaps its habit of transparency and disclosure will serve it well, when it goes public.

As for comparable publicly-traded pure play cloud platforms, the two that come to mind are Digital Ocean and Rackspace. Both are significantly smaller than AliCloud. Digital Ocean’s trailing-twelve-months (TTM) revenue is $576 million, the company is trading at a EV/Sales (TTM) multiple of 6.8x, and Wall Street expects it to grow 22% in the next twelve months. Rackspace’s TTM revenue is $3.1 billion, the company is trading at a EV/Sales (TTM) multiple of 1.3x, and analysts expect it to have a negative growth rate of -5.6% in the next twelve months.

Based on Alibaba’s Q4 2023 and full fiscal year earnings, AliCloud generated $11 billion in revenue with a year-on-year growth rate of 4%, though as we mentioned earlier, its Q4 revenue alone represented a negative -2% decline year-over-year. Earlier this month, Goldman Sachs assigned AliCloud a valuation of $41 billion, which implies a EV/Sales (TTM) multiple of 3.7x.

Given the sheer difference in scale, comparing AliCloud to either Digital Ocean or Rackspace is a bit silly. But if you are an analyst tasked with valuing AliCloud, there is not much else you have to work with. That’s probably why the EV/Sales multiple Goldman came up with is right in the middle of Digital Ocean (small but faster growing) and Rackspace (bigger but declining).

Valuation of this type is much more art than science. EV/Sales (TTM) multiple is just one way to do it, maybe the only available way for now, since we don't have forward-looking guidance for AliCloud. But for the sake of continuing this mental exercise, if Goldman is roughly on point, and we spin out AliCloud from today’s Alibaba, a roughly $215 billion market cap company, can AliCloud one day grow into a $174 billion market cap company – fulfilling Zhang’s dream of creating another Alibaba out of Alibaba? (215 - 41 = 174)

It’s a tall order, but not exactly crazy or mission impossible. On a 10 year horizon, an AliCloud that is four to five times bigger than today is not inconceivable. I don’t have a crystal ball. But as an investor focused on cloud infrastructure, I’m just glad we will finally have a legitimate pure play hyperscaler in the public market soon. And I hope other tech giants follow suit.