Snap, the creator of Snapchat among other things, announced their Q1 2020 earnings last week. Wall Street apparently liked it, and the stock popped around 30% the next day.

In my mind though, the true winner here isn’t Snap. It’s AWS and GCP. Cloud has become a fixed cost to many types of businesses, not a variable cost as cloud’s usage flexibility may suggest. That’s especially true for an ad-supported social network business like Snap.

Let’s look at how Snap uniquely drives so much cloud usage.

Compute, Network Transfer, Store, Compute Some More

Snap uses both AWS and GCP as its cloud infrastructure -- a multi-cloud setup. Snap’s system is also “not fully redundant on these two platforms”, according to its SEC filings. Put differently, AWS and GCP are each deployed differently for different workloads and use cases.

The nature of Snap’s “visual communications” products drive more intensive cloud resource usage than other types of technology companies, even other social networks. Because Snap’s primary mode of communication is visual snaps, its social network needs a ton of computing resources to render the snaps, network bandwidth to transfer or send those snaps, storage to keep user behavior data and probably metadata on those snaps, then more compute to update its social graph to generate new recommendations for users to follow or friend. And those are just the foundational workloads.

In its Q1 2020 earnings, Snap showed both notable user base growth (20% year over year) and higher average time spent on the network (more than 20%), matching the broad expectation that more people are engaging with digital entertainment during COVID-19. To just keep the lights on with this growth, Snap needs to spend a lot on cloud.

Snap is also a market leader in VR. As Jeremi Gorman, the Chief Business Officer, shared during the earnings call, “VR now accounts for over 50% of our overall revenue.” While we don’t know how profitable this VR revenue will be, or how widely VR will be adopted in general, we know for sure that serving up VR experiences consumes a lot of compute power and further adds to Snap’s cloud bills.

Self-Service Auction Advertisement

Then there are ads. Snap at the very least needs to store enough user data and metadata about their snaps to make any ads targeting functional, while letting the snaps and stories themselves disappear. This type of monetizable data is stored forever, because their value increases over time as more data accumulates along dimensions that marketers care about, e.g. demographics, interest groups, etc. They also need to be stored in a part of the company’s technical infrastructure that’s easily accessible, the so-called “hot storage”, which typically needs more expensive types of memory.

Layering on top of this “hot storage” is Snap’s self-service auction-based ad platform, which it has been building since 2016. Building such an ad platform is no easy technical feat. Maintaining and improving it over time is even more difficult and costly. The platform constantly needs new data, filters, targets, and bid optimizations to show and increase ROI for marketers. The entire system needs to be always available -- any downtime or outage directly costs Snap revenue and trust with customers. Behind all this work is more cloud usage.

Why do these observations matter?

Fixed, Not Variable, Cost

They show that the technical infrastructure cost is fixed for Snap and decoupled from any growth or contraction. This is markedly different from companies like Uber and Lyft, where fewer rides mean both less revenue and less cost. Similar variable cost dynamics exist for other two-sided marketplaces, delivery services, or e-commerce businesses. But for Snap, infrastructure cost will either stay constant or grow regardless of whether its user base, engagement level, or ad revenue grows or not.

In a scenario of a prolonged period of coronavirus shelter-in-place and economic stagnation, which looks increasingly likely, Snap’s prospect does not look as rosy as the 30% stock price pop would suggest. Meanwhile, it’s business as usual for the cloud providers.

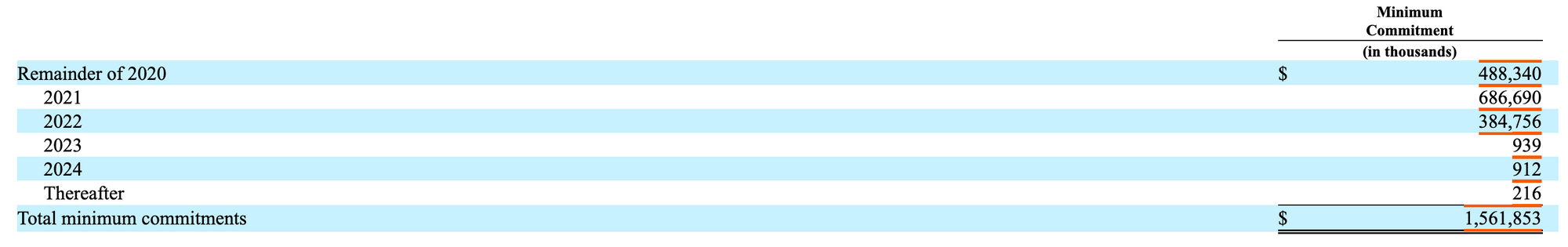

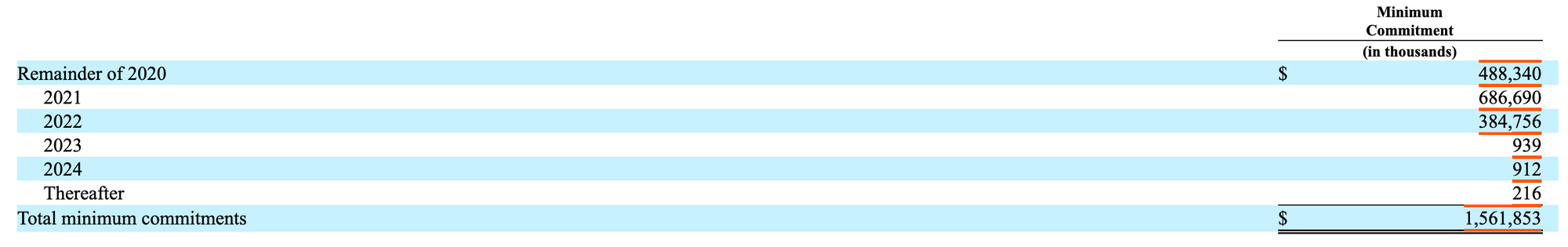

Snap has been aware of this dynamic for some time and has done its part to lock in multi-year deals with both AWS and GCP. Its agreement with AWS dictates a minimum spend of $1.1 billion USD on AWS services between January 2017 and December 2022. Its agreement with GCP is worth $2.0 billion USD over five years, starting also in January 2017, with at least $400 million USD spending per year. These long term agreements tend to have steep discounts, as much as 70%-80% off of “sticker price.” I would expect Snap to have received a discount of that proportion, given the timing of these agreements was a couple of months before Snap’s IPO in March 2017, when the company’s negotiation position was at its strongest.

Of course, Snap’s stock price has been on a rollercoaster ride since then, mostly for the worse. Snap’s SEC filings may paint a picture of falling infrastructure and computing costs after 2022, but chances are these costs will stay the same or rise when agreement reup time comes.

Theoretically, Snap could build its own cloud. The largest social networks in the world -- all of Facebook’s properties, Tencent’s WeChat, Bytedance’s TikTok and other apps -- all live on their own infrastructure. However, smaller social networks all use third-party cloud providers: Twitter on GCP, Pinterest on AWS, and Snap on both.

As I argued in my two-part analysis of Dropbox, building your own cloud only makes sense if you are big enough and growth is predictable enough that you can calculate the cost-benefit tradeoffs going forward many years. Dropbox reached that point in the U.S., so it built its own private cloud to save money and leave AWS. Dropbox has not reached that point in other markets, like the EU, Japan, and Australia, so it is using AWS in those regions to expand.

Without that predictability and stability (not to mention technical expertise), public cloud still provides the optionality you would want to cover a wide range of scenarios (like a global pandemic that forces millions of people to stay at home all day).

Snap’s user growth is nowhere near predictable. Snap’s revenue growth is nowhere near predictable. So regardless of what happens to its business, the only thing we know will grow is Snap’s dependence on AWS and GCP.

If you like what you've read, please SUBSCRIBE to the Interconnected email list. New posts will be delivered to your inbox (twice per week). Follow and interact with me on: Twitter, LinkedIn.

AWS和GCP才是Snapchat增长的真正赢家

创造Snapchat的公司,Snap,上周宣布了他们2020年第一季度的财报。华尔街显然很喜欢其公报的成绩,第二天股价就暴涨了30%左右。

不过,在我看来,真正的赢家并不是Snap,而是AWS和GCP。云计算已经成为许多企业的固定成本,而不是可变成本,与云的灵活使用性是有些冲突的。对于像Snap这样的以广告支持的社交网络业务来说尤其如此。

让我们看看Snap本身的独特之处为什么会推动很多的云计算资源使用。

计算,网络发送,储存,再计算

Snap使用AWS和GCP作为自己云基础设施,是一个多云(multi-cloud)的设置。根据Snap提交给美国证券交易委员会(SEC)的文件,Snap的后台系统“在这两个平台上并没有完全冗余”。换句话说,AWS和GCP的部署和使用是针对不同的工作负载和用例的。

Snap独特的“视觉通信”产品驱动了比其他类型的技术公司,甚至其他差不多大小的社交网络更多的云资源使用。因为Snap的主要通信模式是snap(所谓的快照),所以它的社交网络需要大量的计算资源来呈现那些快照、网络带宽来传输或发送快照、存储用户行为数据和快照的一些元数据,并且要用更多的计算随时更新自己的“社交图”以为用户生成新的好友和追随建议。而这些只是一个社交网络的基本工作量。

Snap在其2020年第1季度的财报中显示,用户群显著增长(年同比增长20%),平均使用时间也更高(超过20%),与疫情期间更多人看娱乐的总体预期相符。而为了支持增长势头,Snap需要在云上花很多钱。

Snap也是虚拟现实(VR)领域的领先者。正如首席业务官Jeremi Gorman在财报电话会议上所说的,“VR现在占我们总收入的50%以上。” 虽然我们不知道VR收入将有多大的利润,也不知道VR未来会不会被普遍大众接受。但我们可以确信的是,提供VR体验会消耗大量的计算资源,进一步增加了Snap的云计算费用。

自助拍卖广告

广告也是个大头。Snap至少需要存储足够的用户数据和与快照有关的元数据,以允许广告有基本的“用户目标”(user targeting)功能,同时保证快照和故事(stories)都会消失。这类有商业价值的数据必须被永久存储,因为数据积累得越多,打广告的客户们就觉得越有价值。这种数据还需要存在基础设施中比较容易访问的部分,即所谓的“热存储”。“热存储”通常需要更昂贵的内存类型来满足需求。

Snap的自助式拍卖广告平台(self-service auction-based ad platform)搭建在这些“热存储”之上。自2016年以来,Snap一直在构建这一平台。建立这种广告平台并非易事。而维护和改进它更加困难和昂贵。平台不断需要新的数据、过滤、目标和拍卖出价优化,以显示和增加广告客户的投资回报率。整个系统必须高可用,任何服务中断都会让Snap直接损失收入和客户的信任。所有这些工作的背后都是更多的云。

那这些现象为什么重要呢?

固定成本,非可变成本

这些现象表明,Snap的云基础设施成本是固定的,与业务增长或收缩是脱钩的。这与Uber和Lyft等公司明显不同:共享乘车次数越少,收入和成本都会降低。其他双边市场类型的公司、送货服务或电商企业也有类似的业务与成本的线性关系。但对于Snap来说,无论其用户群、使用度或广告收入是否增长,基础设施成本要么保持不变,要么增长。

在新冠疫情很有可能继续延伸并长期影响经济复苏的情况下,Snap的前景并不像30%股价暴涨所给的信号那么乐观。但对云厂商来说,该赚钱的照样赚。

Snap意识到这一点已经有一段时间了,并且也尽己所能锁定了与AWS和GCP的多年长期合同。它与AWS的协议规定,在2017年1月至2022年12月期间,在AWS上至少花费11亿美元。它与GCP的协议是5年价值20亿美元,每年至少花费4亿美元,从2017年1月开始。这些长期协议往往会有大幅度折扣,比标价能少70%-80%。鉴于这些协议的开始时间是在2017年3月Snap IPO的前两个月,我预计Snap当时拿到的折扣不小,因为当时公司的谈判杠杆和优势最强。

当然,自从上市后Snap的股价一直处于“过山车”状态,大多情况是往下走。虽然Snap在给SEC提交的文件中也许描绘了一个2022年后基础设施成本会大幅度下降的前景,但更有可能的是在与AWS和GCP的合同到期需要谈续约的时候,成本保持不变或者上升。

理论上,Snap可以构建自己的云。世界上最大的几个社交网络——Facebook拥有的所有apps、腾讯的微信、字节跳动的TikTok和其他apps——都搭建在自己的基础设施上。然而,较小的社交网络都使用第三方云厂商:Twitter用GCP、Pinterest用AWS,Snap两个都用。

正如我以前关于Dropbox的分析中所提到的,公司的业务必须足够大,增长的可预测性比较高,才能有效地计算自己建云在未来多年的成本效益权衡。Dropbox在美国市场达到了这一点,因此它构建了自己的私有云,节省了成本,离开了AWS。但Dropbox在其他市场(如欧盟、日本和澳大利亚)还没有达到这一点,因此它在这些地区里还在使用AWS来扩展自己的业务。

如果没有这种可预测性和稳定性(更不用说建云的专业技术能力),公有云仍然是更合理的选择,可以覆盖更多的不可预测的未来场景(比如全球疫情迫使数百万人整天呆在家里)。

Snap的用户增长无法预测,Snap的收入增长也无法预测。因此,不管它的业务今后会怎么发展,唯一可以预测的“增长”是它对AWS和GCP的依赖。

如果您喜欢所读的内容,请用email订阅加入“互联”。每周两次,新的文章将会直接送达您的邮箱。请在Twitter、LinkedIn上给个follow,与我交流互动!