Last weekend, I read a long, epic piece of techlore that chronicled the fierce and bitter rivalry between TSMC and Samsung in their fight to become the world’s number 1 chip foundry, which stretched back three decades and continues today.

Among the many dramatic details was the “Nightingale program” that TSMC started in the mid-2010s to jumpstart its R&D, because it was falling behind Samsung and losing Apple’s A9 chip orders to the Korean conglomerate. TSMC conceived of a three-shift, 24-hour non-stop R&D operation, taking a page out of their fellow Taiwanese manufacturing behemoth Foxconn’s assembly operation. The “Nightingales” were engineers and researchers, who were willing to work the “graveyard shift” for a 30% increase in base salary and 50% increase in dividend payout. Due to this program, the total working hours clocked in Taiwan in 2014 was 2135, apparently the most of any economy in the world that year.

TSMC, and arguably Taiwan’s entire economy, was confronting an existential struggle at that time. SMIC (the largest chip foundry in China), and arguably China’s technological and economic future, is confronting a similarly existential struggle on a larger scale.

There are many interconnected elements that, when put together, could determine how China will come out on the other end of this struggle -- RISC-V, foundry technology, the “New Infrastructure” stimulus program, open source, and a few key TSMC personnels, who are now at the helm of China’s semiconductor industry.

Let’s take a look at each of them, sequentially and interconnectedly.

RISC-V: Strengths and Weaknesses

The conversation around China’s journey towards technological self-reliance often involves RISC-V -- an open standard Instruction Set Architecture (ISA) for hardware that’s under open source licenses, thus any one can run, change, copy, and distribute it, in accordance with the four freedoms of open source.

However, RISC-V is still young. Its user-space ISA and privileged ISA wasn’t frozen, and thus ready for large-scale software and hardware development, until June 2019. The technology and community ecosystem is maturing, and support from large Chinese organizations has a lot to do with it. Of the six Premier Members of the official RISC-V foundation, RISC-V International, four are Chinese organizations -- Alibaba, Huawei, RIOS Lab, and the Institute of Computing Technology of the Chinese Academy of Sciences.

But in the near future (say the next five years), what can RISC-V, the technology, realistically enable China to accomplish?

What is it good for? RISC-V is a very good foundation for rapidly prototyping and building special purpose chips. The development cycle and experience feels closer to software than hardware. This speed in development is partly because it’s open-sourced -- no hassle in getting a commercial license, as oppose to its proprietary counterparts like ARM -- and also partly because the ISA itself is simplified and “reduced” (i.e. the R in RISC), as opposed to CISC (the C means “complex”) which underpins more powerful, proprietary ISAs like Intel’s x86. This reduced architecture enables and optimizes simple computation instructions well, literally elementary school math: addition, subtraction, multiplication, division, etc. It’s less capable of supporting complex mathematical operations, like matrix multiplication and partial derivative (used widely in Deep Learning AI).

Thus, in reality, chips designed using RISC-V have been used most commonly in IoT and embedded systems scenarios. Because of its simplicity and malleability, RISC-V chips also tend to have low power consumption, which is a good attribute when battery life is an issue, e.g. wearable devices. This reduced simplicity also means that the compiler (the software layer that translates code, like C, into machine instructions for a chip to execute) does not need to be purposefully designed to optimize performance on RISC-V. Using some common compilers like GCC, which RISC-V supports, will do.

What does it lack? As you might’ve guessed, RISC-V’s reduced simplicity is also the source of its limitations. While many people like to pit RISC-V against a general purpose ISAs, like Intel’s, they are more complements than competitors. In fact, special purpose RISC-V chips that accelerate certain computations for AI workloads do run side-by-side along general purpose Intel chips in the cloud. It’ll be a long time (more than five years, in my opinion) before RISC-V can enable the design of a general purpose chip that powers our iPhones, laptops, or cloud computing servers in a data center, with enough developers incentivized to both extend the ISA and the compiler and other infrastructure software on top of it.

Can RISC-V become general purpose some day? Of course. But that’s not an inevitability. It’s a strategic choice that the RISC-V community can make and work towards, with all the complexity in upstream coordination, developer community building, and open governance, not to mention the work of building the technology itself, that must be executed collectively. That possible future is perhaps the most interesting question when we think about China’s self-reliance, which I’ll discuss in more detail below in the context of fostering open source.

“New Infrastructure”

With the strengths and weaknesses of RISC-V in mind, let’s see where RISC-V chips could get deployed in China’s economy and infrastructure in the foreseeable future.

It’s no secret that central government industrial policy matters a lot in China, even though its market-driven economy is what materializes much of that vision. The most relevant piece of policy is the “New Infrastructure” spending plan that came out of the National Development and Reform Commission, as a response to the COVID-19 pandemic to boost the economy. This infrastructure stimulus plan sits in a larger context of two other long-term strategic plans: Made in China 2025 and China Standards 2035.

The details of this “New Infrastructure” plan have emerged in the last couple months, with major emphasis in IT and digital infrastructure, not just traditional infrastructure like highways and railroads. As it often happens in China, the signals sent from the top have already shifted private investment dollars. Nascent chip startups, all of a sudden, are enjoying investor attention and bubbly valuations.

With that said, here are some of the “New Infrastructure” sectors that I think RISC-V could play an immediate role in, given its strengths:

- IoT

- Smart transportation

- New energy vehicle chargers

- Limited AI (specific workloads that need customized acceleration)

- Autonomous vehicles (limited to certain types of sensors and data collection)

And as for sectors that I don’t see RISC-V making much of a dent, given its current limitations:

- Cloud computing

- 5G (both base station construction and consumer devices)

- Blockchain

- Data centers

- Big data

- Large-scale AI training and production deployment

As you can see, RISC-V impact would be limited, but not insignificant. The logical next step would be for China to help evolve RISC-V into a more general purpose ISA, and reduce its reliance on proprietary solutions from ARM or Intel that could always be subjected to more sanctions.

The path to that end would have to be fostering open source and doing it the right way.

Fostering Open Source, the Right Way

Open source has been popping up in a lot of discussions in various Chinese technical and R&D communities, triggered in particular by MATLAB being now off-limit to Chinese universities that are on the U.S. export control entity list. The discussion inevitably leads to open source: are there open source alternatives to MATLAB? What about CAD softwares, like EDA tools, which every chip foundry needs? Will there be an open source EDA option?

Implicit in these discussions is a predominant “takers” mentality towards open source. In China, open source solutions are mostly seen as “free stuff” that you can take and use, without any expectation or incentive to give back (or in open source parlance: “contribute upstream”).

It’s already happening in RISC-V. Alibaba sports the fastest RISC-V based processor to date, but there’s no intention to my knowledge for the design to also be open-sourced or at least publicly shared for the benefit of the ecosystem. Many small startups in China, now showered with new investments, are doing the same -- using RISC-V to make special purpose chips that are effectively proprietary.

(This is not to generalize that all Chinese organizations are bad open source players; some are contributing a lot and have open source in their DNA. I’ve profiled many of the big tech firms and some startups from the lens in Part II of my “Open Source in China” series.)

If China hopes to evolve RISC-V into a more powerful, general-purpose building block to achieve semiconductor self-reliance, Chinese organizations, both individually and collectively, would have to shift from a zero-sum “takers” mentality to a positive-sum “stakeholders” mentality. What that means in reality is absorbing and practicing the open source way of doing things -- not just contributing code upstream and being more willing to share, but also behaviors like transparent governance, open discussions with other stakeholders and developers, and clear due process for decision-making, big and small. These are both technical and human complexities.

With an existential struggle at hand, there’s reason to believe that Chinese companies may behave differently for the sake of achieving a national imperative and be less concerned about the tit-for-tat, zero-sum nature of market competition, which is quite cutthroat in China. And if done right, RISC-V could unleash massive technological innovation broadly and help China deal with its existential struggle specifically.

Foundries: SMIC, HSMC

Let’s assume that China does help foster a general purpose RISC-V in the next 10 years or so, we still need to look at its chip foundries -- tasked with the arguably harder task of churning out production-grade silicons at scale -- to close the loop on true self-reliance.

The most well-funded and relatively high-profiled domestic foundry in China is SMIC (Semiconductor Manufacturing International Corporation), who delisted from the NASDAQ last year and is about to do a “patriotic IPO” in Shanghai’s STAR market this year. Another foundry that has almost no public profile that’s noteworthy is HSMC (Wuhan Hongxin Semiconductor Manufacturing), an upstart founded in 2017.

I’m singling out these two foundries, because their top leadership has direct lineage to the early days of TSMC. SMIC’s co-CEO is Liang Mong-song, who was part of TSMC’s founding team and played a critical role in TSMC’s big technical breakthrough in the early 2000s that reduced its reliance on IBM’s technology. HSMC’s CEO is Chiang Shang-Yi, who was TSMC’s first CTO and led the R&D effort that leapfrogged IBM. Chiang did a brief stint as a board director at SMIC, and Liang was one of his top students from back in the days.

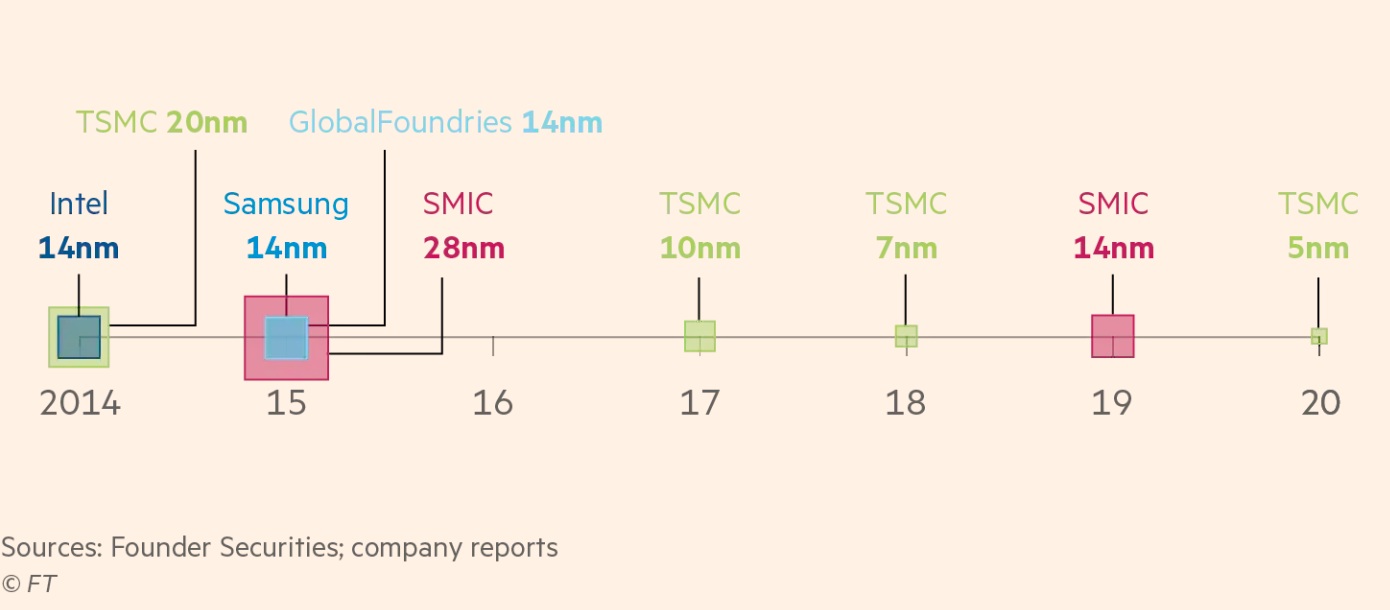

One more piece of palace intrigue that is particularly relevant to technology: Liang left TSMC for Samsung in 2011 and was apparently instrumental in helping Samsung leapfrog TSMC to first achieve the 14nm manufacturing capability, which led to TSMC’s “Nightingale program” to catch up. (Liang’s employment with Samsung was also the subject of a major non-compete and trade secret lawsuit that went all the way to Taiwan’s Supreme Court.) And after Liang joined SMIC as co-CEO in 2017, the foundry reached the 14nm level in just three quarters.

Currently, both SMIC and HSMC’s 14nm technology lags behind TSMC’s 5nm capability, though there is reporting that HSMC is attempting to produce 7nm chips. That being said, there is nothing computationally a 5nm chip can do that a 14nm chip cannot do (the nm count measures the density of transistors; lower the number, higher the density). The key difference, in plain terms, is just that the 14nm chip is bigger, thus uses up more raw material (silicon) and may consume more power relative to its performance. These factors are also affected by the chip’s design, the foundry’s own design rules, the yield rate out of each wafer, and overall manufacturing and operational quality.

So what does this technological gap mean in real life, if we consider RISC-V and “New Infrastructure” in tandem?

- SMIC or HSMC should be able to meet domestic chip demand in use cases where the form factor of the chip, aka its size, is not a major constraint, e.g. data centers, autonomous vehicles, big data and AI in cloud computing, certain IoT devices. Some of these chips could be RISC-V based, while others won’t be due to RISC-V’s technical limitations as noted above.

- For the foreseeable future, these foundries won’t be able to meet the demand for high-end, high-performance chips that will go into say, the newest 5G-enabled smartphones that can also play AR games or the sleekest smartwatch or drone.

After a fight in strategic direction with his other co-CEO, there is indication that Liang has won the argument and will focus SMIC on R&D advancement, instead of improving production efficiencies with its current technology. However, there are still immense challenges going against all Chinese foundries that are less in their control.

Will The Nightingales Return?

The forces working against Chinese foundries -- forces that did not apply to TSMC or Samsung when they were at a similar stage -- are well-documented. The United States is not only prohibiting finished semiconductor products that are touched by American technologies from being sold to China, it is also using its international sphere of influence to pressure other countries to do the same. The order cancellation on a Chinese customer (rumored to be SMIC) by the Dutch company, ASML, who has the best lithography technology, due to pressure from the Trump administration on the Dutch government, was a case in point (a topic I explored in detail in “Chips, Geopolitics, Elections”). Over-reliance on foreign-made EDA tools is a major concern: 95% of the EDA suppliers in China are foreign companies, e.g. Synopsys, Cadence, Siemens, Ansys; domestic EDA makers barely have any market share. Without a steady acquisition of quality EDA equipements, you can’t turn any chip design, RISC-V or otherwise, into working silicons at scale.

However, as many analysts in the space rightfully noted, while financial investment is important in the chip business, human talent is even more important. In this regard, there are forces working in China's favor.

If Liang decides to recreate the Nightingale program at SMIC (or Chiang at HSMC), there is little cultural or regulatory hurdle that will stand in his way. Foxconn’s factories and many others in Shenzhen have been running literal around-the-clock shifts for years.

It’s possible that China’s aggressive acquisition of engineering talent from Taiwan may hit a snag, as Taiwan’s public opinion on China turns increasingly negative. (The percentage of people in Taiwan who now self-identify as "Taiwanese" instead of “Chinese” is at 70%, an all-time high.) But the anti-immigration policy and rhetoric in America may more than fill the gap.

There’s never been more Chinese engineering talent, working in American tech companies and researching in American universities -- and also more open hostility towards them (see Trump’s ban on H1B visas and Tom Cotton’s SECURE CAMPUS Act). The semiconductor industry has always had a tight connection with patriotism. A patriotic call-to-action jumpstarted the founding of TSMC, where Taiwanese technical talent like Chiang, Liang, and others, who were working at AMD or Texas Instrument or doing research at Berkeley or Cornell, answered the call. Samsung did the same thing, calling on overseas ethnic Korean talent to help build its foundry.

With a now rich China fully committed to financing its own semiconductor industry for the long haul, I can see SMIC and HSMC making a similar call to action to recruit their own “Nightingales” from overseas, even though that human movement may not occur until the coronavirus is under control.

And that brings me to my final point: America.

America is facing its own struggle for self-reliance. The recent announcement of TSMC’s plan to build a foundry in Arizona, which I expressed ample skepticism of as naked electioneering in a 2020 swing state, painfully exposes how thin Team America’s “semiconductor bench” really is. Three Democratic Senators -- Schumer, Leahy, Reed -- later voiced their concern of TSMC on national security grounds and named Micron, GlobalFoundries, and Cree as American alternatives.

I’m not sure if the three senators or their staffers know this, but much of what became GlobalFoundries was IBM’s inferior technology, after it was defeated by TSMC (Chiang, Liang, et. al.) and exited the chip foundry business. GlobalFoundries is also owned by Mubadala Investment Company based in the UAE.

China’s existential struggle with self-reliance is in plain sight, but America has a similar challenge. Perhaps due to its strength in other areas of the semiconductor manufacturing supply chain, the American struggle is less-discussed and less-reflected on, but it’s no less existential. Congress’s intention to direct $22.8 billion in aid to help the American semiconductor industry is a welcoming step. But like we discussed just now, it’s not just about the money, it’s about the people.

In the techlore of TSMC vs. Samsung, one anecdote stood out to me. When TSMC overtook Intel in the chip business in 2017, supposedly a few Intel engineers visited TSMC to find out how they got beat. Their TSMC counterpart’s answer was: “you guys sleep too much, sleep too long.”

Any country that hopes to be self-reliant perhaps needs its own “Nightingales”.

Special thanks to Josh Su, a good friend and investor at SK Hynix America’s corporate venture arm, for helping me understand the various technical and economic tradeoffs of the chip foundry business. Shoutout to Jeff Ding and Joy Dantong Ma for their epic Chinese-to-English translation of the TSMC vs. Samsung story, so both language audiences can access this story. (If you’d like to read it, see the Chinese original and their English translation.)

New posts will be delivered to your inbox (twice per week). Follow and interact with me on: Twitter, LinkedIn.

RISC-V,中国,夜莺

上周末,我读了一篇像小说一样的长篇科技文章,记述了台积电和三星争夺全球芯片铸造厂领头羊地位的激烈竞争。这场竞赛持续了30年,至今仍在继续。

在众多细节中让我印象最深的是,台积电在五六年前启动的 “夜莺计划”为了加速研发进程,因为当时在技术上落后于三星,苹果A9芯片的订单也被这家韩国巨头夺走了。台积电设计了一个三班制、24小时不停的研发运作,效仿另外一家台湾制造业巨头富士康的生产线运维做法。这些“夜莺”即是愿意上夜班的工程师和研发人员,并给他们的底薪加30%和分红加50%。由于这项计划,2014年台湾的总工时为2135小时,显然是当年全球所有经济体中最多的。

台积电,甚至可以说整个台湾经济,当时面临着一场生死之争。中芯国际,甚至可以说整个中国的科技和经济未来,也正面临着一场规模更大的生死之争。

有许多相互关联的因素,如果放在一起看,也许会帮我们分析和预测这场斗争的最终结果:RISC-V,芯片铸造技术,“新基建”计划,开源,以及现在正在领导中国半导体行业的一些台积电的元老们。

让我们依次地、“互联地”看一看这些因素。

RISC-V:强项与弱项

围绕中国走向科技自力更生之旅的讨论中经常涉及RISC-V,它是一种基于有开源许可的硬件指令集体系结构(Instruction Set Architecture,ISA)的一个开放标准。因为是开源的,任何人都可以根据开源理念的四大自由去运行、更改、复制和分发它。

但是RISC-V还很年轻。直到2019年6月,它的用户空间ISA和特权ISA看终于“冻结”,因此可以允许大规模的软件和硬件开发。技术和社区生态系统正在逐渐成熟,中国企业的大力支持与此有很大关系。在RISC-V基金会的六位最高级别成员中,有四家是国内组织:阿里巴巴、华为、RIOS Lab和中国科学院计算技术研究所。

但在不远的将来(比如说未来五年),RISC-V这门技术能让中国科技具体实现什么呢?

强项:RISC-V是一个可以快速迭代和设计专用芯片的很好的技术基础。开发周期和体验更接近于软件而不是硬件。开发速度如此之快的一部分原因是开源。与ARM等专有的同类ISA相比,使用RISC-V不需要任何商业许可。另一部分原因则是RISC-V ISA本身是“简化”的(即RISC中的R是英文 “reduced”),而并不是另一种CISC(C代表“complex”,复杂)ISA可以支撑的功能更多的芯片设计,比如Intel的x86。这种简化的体系结构能够很好地实现和优化最基本的计算指令,比如小学数学:加,减、乘、除等等。它不太能支持复杂的数学运算,比如矩阵乘法和偏导数(广泛用于深度学习人工智能中)。

因此,在现实中,用RISC-V设计出来的芯片在物联网和嵌入式系统场景中最为常见。由于它的简单性和延展性,RISC-V芯片也趋向于低功耗,所以对电池寿命敏感的场景也比较好用,比如某些智能穿戴设备。这种简化也意味着系统编译器(将代码,如C语言,转换成机器指令以供芯片执行的软件层)不需要专门设计来为RISC-V优化性能。用一些通用的编译器(如RISC-V支持的GCC)就可以了。

弱项:正如您可能已经猜到的,RISC-V的简化特点也是它局限的根源。虽然许多人喜欢拿RISC-V与通用处理器的ISA(如Intel)比高低,但它们目前的关系更是互补而不是直接竞争。现实中,某些用RISC-V设计的专用芯片就在云里肩并肩的跑在Intel的通用芯片来加速具体的一些AI负载和计算。RISC-V还需要很长一段时间(在我看来,超过五年)才能演变成一个能设计出一款通用芯片的ISA,为我们的iPhone、笔记本电脑或云计算数据中心提供动力。同时也需要激励足够多的开发者为RISC-V延伸ISA、编译器和其他基础设施软件。

RISC-V会有一天能用来设计通用芯片吗?当然可以。但这并非必然。这是RISC-V社区可以做出并努力实现的一个战略选择,因为从代码的上游贡献和协调,到开发者社区建设和开放式治理方面都存在许多复杂性,更不用说打造技术本身的工作,而且需要集体执行。当我们在想中国科技自力更生时,这个可能的未来也许是值得思考的问题。(我将在下文中在促进开源的话题下更详细地讨论这个问题。)

“新基建”

考虑到RISC-V的优缺点,让我们看看在可预见的将来,RISC-V芯片会在中国经济和基础设施中的那些地方得到部署。

众所周知,中央政府的工业政策极为重要,尽管市场经济是具体实现政策的主要因素。最相关的政策是国家发改委出台的“新基建”计划,为了扭转新冠疫情对经济的影响。这项基础设施刺激计划是在另外两个长期战略计划的大背景下制定的:中国制造2025和中国标准2035。

这项“新基建”计划的细节在过去几个月开始浮出水面,重点是信息技术和数字化基础设施,而不仅仅是像高速公路和铁路这样的传统基础设施。高层发出的信号已经开始引导私有投资的资金去向。许多才刚刚起步的芯片创业公司突然间受到了投资人的关注和接近泡沫的估值。

话虽如此,鉴于RISC-V的优势,我认为RISC-V可以发挥作用的“新基建”领域如下:

- 物联网

- 智能交通

- 新能源汽车充电

- 有限的人工智能(需要定制加速的特定负载)

- 无人驾驶(仅限于某些类型的传感器和数据采集)

而鉴于它的局限性,RISC-V对以下行业的影响不会太大:

- 云计算

- 5G(基站建设和大众产品)

- 区块链

- 数据中心

- 大数据

- 大规模人工智能训练和生产部署

RISC-V的影响力是有限的,但并非是可以忽略的。符合逻辑的下一步,即是中国帮助培养和发展RISC-V成为一个更通用的ISA,从而减少对ARM或Intel的闭源ISA的依赖,因为他们随时可能会被经济制裁而被限制。

实现这一目标的途径则必须是以正确的方式培养开源。

正确的培养开源

开源在中国各个技术和研发群体里的讨论中层出不穷,尤其是在近期MATLAB遭禁这一新闻发生后。许多议论都会被目光转向开源:有没有MATLAB的开源替代品来?那CAD软件,像每个芯片厂都需要的EDA工具今后怎么办?会不会有开源的EDA能来替代?

这些讨论中隐含的对开源的总体态度是一个“收受者”心态。在中国,开源解决方案大多被视为“免费的东西”,可以随时拿走随便用,而没有太多为社区贡献和回报的行动和动机(用开源的话语说,就是缺乏“上游贡献”)。

这个现象在RISC-V生态中已经在发生。阿里拥有迄今为止最快的基于RISC-V设计的处理器,但目前并没有想给整个社区公开或贡献这个设计的计划。国内许多小型创业公司,现在虽然有了大量的新投资,但也在做同样的事情——使用RISC-V来设计制造专用芯片,而这些芯片实际意义上是闭源的。

(需要澄清的是:并不是所有的中国企业都是不好的开源玩家;还是有公司对开源的贡献很大,DNA里有开源。在我的“中国开源世界”系列文章的第二篇中,我从这个角度介绍了一些国内的科技巨头和初创企业。)

如果中国希望将RISC-V发展成为一个更强大、更通用的硬件构件科技,以实现半导体科技的自力更生,那么所有中国组织,无论是单个还是集体,都必须从一个“收受者”(taker)心态转变为“利益参与者”(stakeholder)心态。从一个务实的层面来看,这就意味着要吸收和实践开源的做事方式:不仅仅是为上游贡献代码,增进分享,还要包括透明的治理方式、与其他利益参与者和开发者进行公开讨论,以及清晰透明的决策过程,无论决策大小。这里有许多技术复杂性,也有许多人性复杂性。

面对这场科技独立的生死之争,还是有理由相信,中国企业可能会为了实现国家使命而改变行为,增加内外公开的合作,而越过为了在残酷的市场竞争中生存的零和(zero-sum)思想。如果整体推动得当,RISC-V将会在全球释放大规模的技术创新,同时也帮助会中国应对自己的生死之战。

芯片铸造厂:中芯国际、武汉弘芯

假设中国在未来10年确实培育出了一款通用RISC-V,我们仍然需要关注国内芯片铸造厂的水平。他们的任务,也就是大规模生产可用的硅从而彻底达到自力更生的水平,可以说是更加艰巨。

中国资金最雄厚、知名度相对较高的芯片铸造企业是中芯国际(SMIC)。该公司去年从NASDAQ退市,今年即将在上海科创板做一次“爱国企业上市”。另一家几乎没有知名度的铸造厂是武汉弘芯(HSMC),成立于2017年。

我挑选了这两家企业,因为他们的最高领导层与台积电早期团队有直接的渊源。中芯国际的co-CEO是梁孟松。他曾经是台积电创始团队的一员,在台积电21世纪初成功跳跃了IBM而研究出的技术突破中发挥了关键作用。武汉弘芯的CEO是蒋尚义。他是台积电的第一位CTO,领导了超越IBM技术的研发工作。蒋尚义曾经在中芯国际担短暂的任过一段董事,而梁孟松是他当年的得意门生。

另一件与技术特别相关的“内幕”:梁孟松在2011年离开台积电后,投奔三星,并帮助三星超越台积电,率先实现14nm的芯片制造能力。也因此导致了台积电的“夜莺计划”。(梁孟松与三星的雇佣关系后来也演变成一场竞业禁止和商业秘密的大官司,最终告到了台湾最高法院。)2017年梁孟松加入中芯国际担任co-CEO后,中芯仅用了三个季度的时间就达到了14nm的技术水平。

目前,中芯国际和武汉弘芯的14nm技术都落后于台积电的5nm,不过也有报道称,武汉弘芯正试图生产7nm芯片。通俗且客观的说,从计算层面看,一枚5nm芯片能做到的事情14nm芯片都做得到(nm这个计数指的是晶体管的密度;计数越底,密度越高)。更关键的差别在于,14nm芯片更大些,可能会消耗更多的原材料(硅),相对于其性能比也可能会消耗更多的能源。这些因素还受芯片本身的设计、铸造厂自身的设计规则、每片晶圆的成品率以及整个铸造厂的制造和操作质量的影响。

那么,如果我们再把RISC-V和“新基建”这两个因素加进来,目前的半导体生产技术的差距意味着什么呢?

- 中芯或弘芯应该能满足国内芯片的某些需求,这些需求对芯片的大小要求没有那么高,例如数据中心、无人车、云计算支持的大数据和人工智能、某些物联网设备。这些芯片中有些可能是基于RISC-V的,而另一些则不会是,因为我们上面已提到的RISC-V的技术限制。

- 在可预见的未来,这些国内的铸造厂将无法满足高端、高性能芯片的需求,例如最新的5G智能手机同时还可以玩AR游戏,或是最时尚的智能手表或无人机。

在与另一位co-CEO有过战略方向的争执后,有迹象表明,梁孟松赢了这场争论,而将把中芯的未来重点放在研发上,而不是用现有技术提高的生产效率。然而,还有许多中国铸造厂们无法控制的因素会阻挠他们的进度。

夜莺重奏?

制裁中国铸造厂的力量已经众所周知。这些力量在台积电和三星当年处于类似发展阶段时是没有的。美国不仅禁止被美国技术触及的半导体成品出售给中国,同时还在使用自己的外交势力向其他国家施压。一个很好的例子:由于特朗普政府对荷兰政府施加压力,拥有最顶尖的光刻技术的荷兰公司ASML取消了给一名中国客户(传闻是中芯国际)的订单。(这件事情,我在“芯片,地缘政治,与大选”一文中做了详细探讨。)过度依赖国外公司的EDA工具是个极大的挑战:在中国95%的EDA供应商是外国公司,例如Synopsys、Cadence、Siemens、Ansys;国内的EDA制造商几乎没有任何市场份额。如果没有稳定而且高质量的EDA设备供应,无论有没有RISC-V,都无法量产半导体。

但正如许多业内分析师正确指出的,虽然钱在芯片行业里很重要,但人才更为重要。在这方面,倒是有些对中国有利的力量。

如果中芯的梁孟松(或弘芯的蒋尚义)在此打造一次“夜莺计划” ,在中国几乎不会有任何文化或监管障碍会阻止他。富士康以及在深圳的许多工厂多年来一直在运作昼夜不停地生产线。

随着台湾对中国的态度越来越负面,大陆继续从台湾引进半导体科技人才的计划可能会遇到障碍。(台湾现在自称是“台湾人”而不是“中国人”的比例达到70%,创历史新高。)但美国的反移民政策和言论可能不止会填补这一空白。

在美国科技公司工作、在美国大学做研究的中国技术人才数量也应该是历史新高,而对他们的公开敌意也日益严重(见特朗普禁止H1B签证和参议员Tom Cotton提议的《校园安全法案》)。半导体工业一直与爱国主义紧密相连。台积电成立后利用爱国主义的号召,吸引了像蒋尚义,梁孟松,及其他台湾裔的技术人才回台湾效力。当时他们都在像AMD或德州仪器这种大厂工作,或在伯克利或康奈尔做科研。三星也做过同样的事情,呼吁海外韩裔人才回韩国帮助建立自己的铸造厂。

现在富裕的中国已经致力于要长期打造自己的半导体产业,可以想象中芯和弘芯发出类似的爱国主义呼吁,从海外招募自己的“夜莺”,尽管在冠状疫情被完全控制之前,这种人才流动还不会发生。

这就引出了我想说的最后一点:美国。

美国正面临着自己为科技自力更生的斗争。最近,台积电宣布计划在Arizona州建立一家铸造厂的新闻,我对此表达了满肚子的怀疑,这显然是一种为了赢得2020大选的重要摇摆州而做出的赤裸裸的拉票行为。这条新闻也痛苦地暴露了美国队的“半导体板凳”有多么单薄。三位民主党参议员,Schumer,Leahy,Reed,后来以国家安全为由表达了对台积电的担忧,并将Micron, GlobalFoundries, and Cree应该被考虑的美国制造商。

我不知道这三位参议员或他们团队是否知道这一点,但在IBM在被台积电(包括有蒋尚义和梁孟松的“研发六君子”)击败后,就退出了芯片铸造业务并把自己较差的技术甩给了GlobalFoundries。GlobalFoundries现在的大老板则是阿联酋的穆巴达拉投资公司。

中国自力更生的生死斗争显而易见,但美国其实也有类似的挑战。也许是由于美国在半导体制造业供应链的其他领域还是很有实力,美国的斗争很少被讨论或有深度反思,但它仍然是存在的。美国国会打算向半导体行业提供228亿美元的援助是个值得庆幸的一步。但正如我们刚才讨论到的,这不仅仅是钱的问题,而是人的问题。

在台积电与三星格斗的故事中,有一个轶事让我印象深刻。2017年,当台积电在芯片业务上超越了Intel的时候,据说有几位Intel工程师去台湾拜访台积电,像搞清楚他们是如何被打败的。台积电同行的回答是:“你们睡觉,睡太多,睡太久了。”

任何一个希望自力更生的国家也许都要有自己的“夜莺”才行。

特别感谢SK Hynix在美国的风险投资部的好友兼投资人 Josh Su,帮助我理解了芯片铸造行业里的各种技术和经济效应的权衡。也感谢 Jeff Ding和Joy Dantong Ma 精彩的携手翻译,让中英文两种语言的读者都能看到台积电与三星的故事。(有兴趣的读者请看这里的中文原文和他们的英文翻译。)

如果您喜欢所读的内容,请用email订阅加入“互联”。每周两次,新的文章将会直接送达您的邮箱。请在Twitter、LinkedIn上给个follow,与我交流互动!