I always try to live by the framework of “strong opinion, weakly held”. That’s how I treat all my thoughts shared on Interconnected. I write, not just to share what I know, but also to learn from others, absorb new information, and update my thinking.

Back in March, during the height of the coronavirus pandemic, I wrote a piece called “Is Leaving the China Supply Chain a Pipe Dream?”, where I shared my skepticism of how quickly and how much Apple’s manufacturing would “decouple” away from China to India. It looks like that shift is happening faster than I’d thought, with the newest iPhone 12 possibly being assembled in India as early as 2021.

Time to update my thinking, dig into what’s driving this shift, and what I missed from before.

Taiwan

While geopolitical narratives have always influenced the conversation around supply chain decoupling, they are usually in the context of the so-called “major-country” relations between the US and China. One element that has always been important, but hasn’t been prominent until recently is Taiwan.

I have written quite a few posts about Taiwan’s dominance and strategic importance in the semiconductor industry, almost becoming the global single point of dependence. What I failed to realize is how important Taiwan is in Apple’s supply chain, and how that is being impacted by the recent deterioration of the triangle “romance” between China, the US, and Taiwan.

Although it’s well known that the bulk of Apple’s manufacturing is in China, the companies who run those manufacturing plants are mainly Taiwanese -- Foxconn, Pegatron, Wistron. When geopolitical relationships are stable (not necessarily good, just stable), manufacturing in China as a Taiwanese outfit to supply American tech companies, is straightforward enough. However, stability is no longer the default when it comes to Taiwan.

Just in the last few months, a US cabinet secretary conducted an official visit to Taiwan (the highest level visit in four decades), President Trump submitted proposals to sell advanced weapons to Taiwan ($1.8 billion of which was just approved), and DC’s policymaking circle is openly talking about updating the US’s position on Taiwan from “strategic ambiguity” to “strategic clarity” (“clarity” here means if China attacks Taiwan, the US will definitely intervene, as opposed to an angry face and shrug emoji).

Also in the last few months, Foxconn announced a $1 billion USD investment in expanding its factory capacity in southern India. Pegatron registered its own Indian subsidiary a few days after Foxconn’s announcement. Wistron, which already began assembling lower-end iPhones in 2017, plans to hire 10,000 more Indian employees to make iPhone 12.

Of course, there are business motivations to make these investments too, which we will discuss later. Taiwan’s geopolitical significance is just one of many factors at play. As I wrote in the most recent Interconnected Weekly issue, “we shouldn’t over-apply geopolitics to explain everything.”

But with geopolitics in flux everywhere, and especially between the US and China, no one really knows what the rules of the game are anymore. For these giant Taiwanese manufacturing companies, some geographical diversity and redundancy away from China to India seems prudent.

A New Tariff World

The worldwide erection of tariffs has been underway for the last four years, between US-China, US-EU, US-Canada, etc. The impact of these tariffs on things like farm goods are straightforward, but more convoluted when it comes to consumer electronics, with components and assemblies from a variety of regions.

What I failed to think deeply about before was that even in a tariff-filled world, it’s not necessary to make wholesale shifts away from China to circumvent them to keep a product’s cost low. If you know which batch of products are being sold to a tariff country, just shift the manufacturing of those products to a non-tariff country!

A crude, hypothetical example: if iPhone 12’s with serial numbers 1, 2, and 3 are ordered by American customers, make sure *those* iPhones are made and assembled outside of China.

(This example obviously does not apply to current conditions, because Tim Cook has been deft at maneuvering the Trump administration to make sure Apple products are exempt from the latest presidential tariff temper tantrum, but you can extrapolate this to all other electronics with a heavy supply chain reliance on China.)

So far, the beneficiaries of these “partial decouplings” are Mexico, Vietnam, and of course India. The benefactors are not just American companies, but any company (Chinese, South Korean, Finnish, pick your favorite country) that seeks to avoid tariffs when selling their products to either the US, China, the EU, or any country with a tariff problem.

Now, there are legitimate concerns about how these middle-income countries can rise to the occasion. The overall manufacturing quality, support infrastructure, density of component suppliers, and labor cost versus skills tradeoffs (comparable Indian workers cost about 75% less than their Chinese counterparts) are all poor compared to China. There are other hard constraints like availability of land to build more factories, as well as local government regulations. China’s powerhouse status as the world’s manufacturer did not materialize overnight, thus it will take many years for any country to develop into a full-fledged alternative.

However, this move doesn’t need to be wholesale, but just enough to offset the impact of tariffs on cost while maintaining product quality -- a complex dance that more and more electronic brands and their contract manufacturers will have to figure out. I think that’s partly what’s driving Apple’s manufacturing shift to India, as well as circumventing India’s own tariffs in order to grow in its domestic market (more on that in the next section).

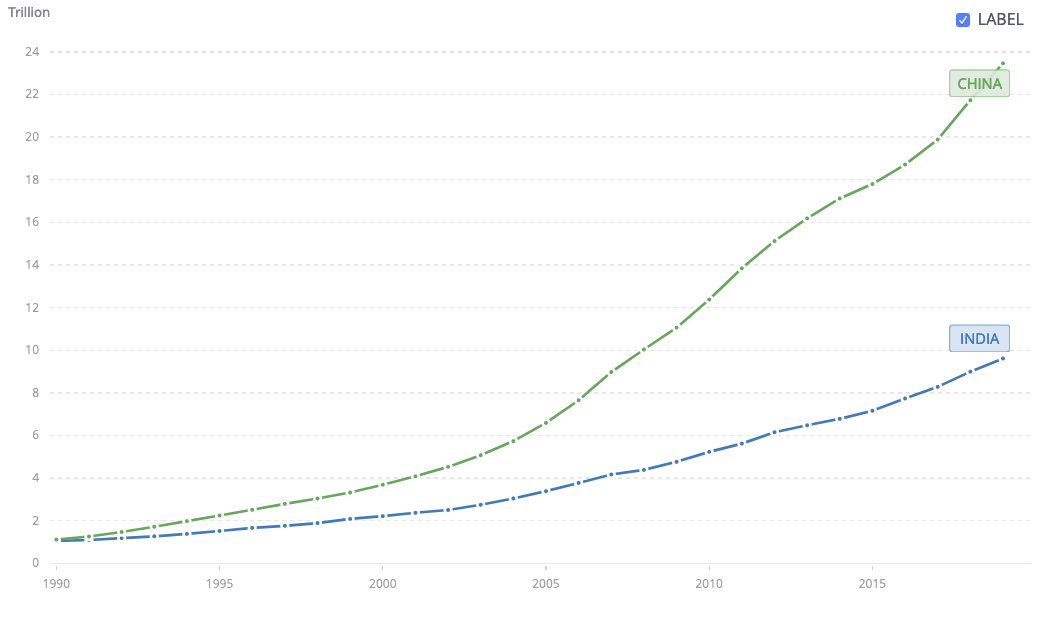

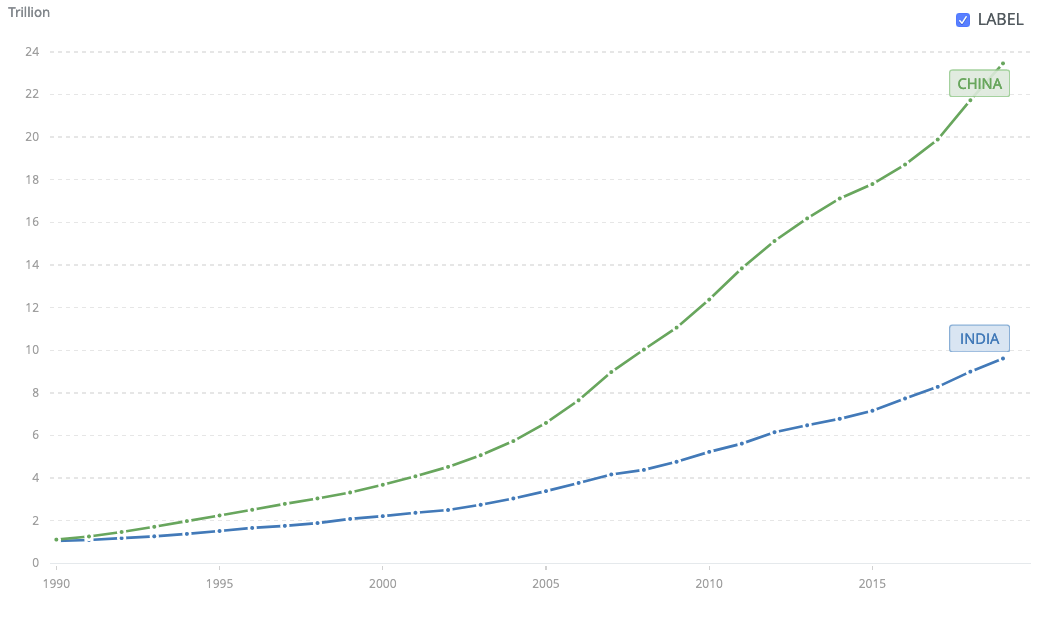

As this graphic by Reuters shows, Apple’s slow, methodical manufacturing shift has been happening for the last five years:

If these tariffs are here to stay, regardless of who wins the American presidency, I see a “balkanization of the supply chain”, where manufacturing capacities are replicated in certain countries that can both circumvent export tariffs and have a large enough domestic market to sell to, in order to make the redundancy worthwhile.

India most definitely has a large enough domestic market.

India: Apple’s Next Story

The final piece of Apple’s shift to India is to position the country as its next growth story. Currently, Apple’s smartphone market share there barely registers; close to 90% of the market is split up between Xiaomi, Samsung, Vivo, Oppo, and other players.

But if we dig into the footnotes, there’s more optimism for Apple. In the “ultra-premium” segment (defined as phones that cost ~$600 USD), Apple has a 55% market share. It also grew 78% year-over-year (albeit from a tiny base), driven by strong shipments of the iPhone 11. This growth will only continue, as Foxconn begins assembling iPhone 11’s in India and Wistron prepares to assemble iPhone 12’s next year, all of which will remove the 22% in import duty imposed by the Indian government. This means more affordable new iPhones, not just the cheaper ones, for India’s humongous consumer market that is bound to get richer over time.

With its main markets -- the US, EU, China -- all fully matured or declining slightly, India has to be Apple’s next growth story. And Apple has the cash and patience for India to grow. Even though the country has been on a growth trajectory for decades, its GDP per capita is still roughly half of China’s.

Not only will personal income have to increase, India’s government and institutions will also have to mature. Despite being the world’s largest democracy, India is laden with corruption and lacks strong campaign finance regulations (no one ever said democracies can’t be corrupt). On Transparency International’s Corruption Perceptions Index, India is ranked 80 out of 180 countries with a score of 40 out of 100 (coincidentally the same score as China’s).

The Ministry of Electronics and Information Technology’s production linked incentive (PLI) plan is an interesting way to localize production and boost income growth. How it works (simplistically explained) is an incentive of up to 6% on all incremental sales of all electronics priced at Rs 15,000 (~$200 USD) or more. An iPhone would certainly qualify. Coupled with its strong, nationalistic “Make in India” initiative, not unlike “Made in China 2025”, I believe India’s manufacturing capabilities will improve to handle more iPhones and other high-end consumer electronics.

How fast India can get there will depend on its officials staying true to the mission with integrity and not being seduced by the largess and power of top-down government programs -- and more than a few clever tweets from a Minister.

Significant boost to Make in India!

— Piyush Goyal Office (@PiyushGoyalOffc) July 24, 2020

Apple has started manufacturing iPhone 11 in India, bringing a top-of-the-line model for the first time in the country.https://t.co/yjmKYeFCpL

I’m optimistic of India’s future, not in place of China, but in addition to China. On a 10 year horizon, if you are bullish on Apple, then you have to be bullish on India. And if you are bullish on India, then you have to be bullish on Apple.

Apple’s $2 trillion dollar market cap will only be the tip of the iceberg.

If you like what you've read, please SUBSCRIBE to the Interconnected email list. To read all previous posts, please check out the Archive section. New content will be delivered to your inbox (twice per week). Follow and interact with me on: Twitter, LinkedIn.

iPhone: "中国制造->制造印度?"

我个人的一个生活的思考态度就是 "强势观点,弱势持有 "(“strong opinion, weakly held”),我也是这样对待我在《互联》上分享的所有想法的。我写东西,不仅仅是为了分享我知道的,而更是为了向别人学习,吸收新的信息,更新自己的想法。

早在3月份,在疫情刚开始的时候,我写过一篇文章叫《离开中国供应链是天方夜谭吗?》,里面分享了我对苹果的制造业从中国“脱钩”到印度的速度和进度的质疑态度。看起来这种转变发生的比我想象的要快:最新的iPhone 12可能最早在2021年就会在印度组装。

是时候更新一下我的想法了,挖一挖推动这种转变的原因,以及我之前忽略了的视角。

台湾

虽然地缘政治关系一直影响着围绕供应链“脱钩”的各种讨论和猜测,但它们通常是在中美之间所谓的 "大国关系”的背景下进行的。一个一直很重要、但直到最近才变得突出的因素就是台湾。

我写过不少文章,分析台湾在半导体行业中的主导地位和战略重要性,它几乎已经成为了全球的单点依赖。但我没有意识到的是,台湾在苹果供应链中的重要性,以及最近中美台“三角恋”的恶化对台湾公司的影响。

虽然众所周知,苹果的大部分制造都发生在中国,但经营这些工厂都是台湾公司 -- 富士康、和硕、纬创。当地缘政治关系稳定的时候(不一定关系好,只是稳定而已),作为一家台湾公司要在中国做制造再把东西卖给美国科技公司,这条路还算是可以稳定地走通。然而,在台湾问题上,当下的形势已经不能被默认为稳定了。

就在过去的几个月里,一位美国内阁部长去台湾进行了正式访问(40年来级别最高的一次访问),特朗普总统提交了向台湾出售先进武器的提案(价值18亿美元的武器最近刚被批准),华盛顿的政策圈圈里也在公开谈论更新美国对台湾的立场,从 "战略模糊 "到 "战略清晰"(这里的 "清晰 "指的是如果中国攻打台湾,美国一定会干预,而不只是一脸愤怒和耸肩的表情包)。

同样在过去的几个月里,富士康宣布投资10亿美元扩大在印度南部的工厂。在富士康宣布后几天,和硕就注册了自己的印度子公司。已经在2017年就开始在印度组装低端iPhone的纬创,也计划再雇佣1万名印度员工来生产iPhone 12。

当然,这些投资也是有它的商业动机的,我们一会儿会讨论。台湾的地缘意义只是众多因素中的一个。正如我在最近一期的《互联周刊》中所写到的,"我们也许不该过度用地缘政治的角度来解释一切"。

但随着各地地缘政治关系的不断变化,尤其是在中美之间,没有人真正知道游戏规则到底是什么了。对于这些台湾制造业的巨头来说,从中国移到印度,增加一些地理上的“多元化”和冗余似乎还是谨慎之举。

有关税的新世界

过去四年里,全球各地的关税竖立一直在进行,中美之间、美欧之间、美加之间等等。这些关税对农产品等东西的影响还是比较直接好理解的,但涉及到电子产品时就很复杂了,因为零件和组装都来自许多不同的地区。

我之前没有考虑到的是,即使在这个充满关税的世界里,也并不一定要完全与中国脱钩,从中转移出来,就可以避免关税对产品成本的影响。如果厂家知道哪一批产品是卖给有关税的国家,只要把那些产品的生产转移到非关税国就可以了!

一个粗旷、假设的例子:如果美国用户订购了序号1、2、3的iPhone 12,只要确保这几台iPhone是在中国以外的地方制造组装的就可以了。

(这个例子当然不能适用于当前的状况,因为Tim Cook一直在巧妙地影响特朗普政府,以确保苹果产品能免于各种最新的“总统关税脾气”,但您可以用这个例子去想所有其他供应链依赖于中国的电子产品。)

目前来看,这种“局部脱钩”的受益国是墨西哥和越南,当然也包括印度。而受益的公司不仅仅来自美国,也包括向美国、中国、欧盟或任何有关税问题的国家销售产品时寻求避免关税的所有公司:中国公司、韩国公司、芬兰公司,随便选一个您喜欢的国家的公司。

人们对这些中等收入国家能不能“顶上去”持有各种合理的担忧。与中国相比,它们整体的制造质量、基础设施、零部件供应商的密度以及劳动力成本与技能的权衡(可比的印度工人成本比中国同行低75%左右)都还比较差。还有其他一些硬性制约,比如是否有足够的土地造工厂,以及当地政府的管制和规定。中国作为“世界的工厂”这个地位不是一夜之间实现的,因此,任何国家要发展成为一个成熟的替代选择都需要很多年。

然而,任何转移或“脱钩”目前都不需要是全面的,只需要足以抵消关税对成本的影响,同时保持产品质量就可以了。这是一套复杂的供应链调整,越来越多的电子产品品牌及其制造商都不得不弄清楚。我认为,这也是推动苹果将制造供应链部分转移到印度的原因,同时也规避了印度自身的关税,以便在其国内市场发展(下一段将详细分析这一点)。

正如路透社的这张图所显示的,苹果缓慢而有条不紊的产业链转移在过去五年内一直在进行:

如果关税会一直存在下去,不管谁是下一位美国总统,我觉得未来很可能是个 "供应链巴尔干化"的时代,各个阶段的制造能力会被复制到某些国家,这些国家既能避免关税又有足够大的国内市场可以发展,既而支持这种复制的必要性和长期价值。

印度绝对有足够大的国内市场。

印度: 苹果的下一个增长故事

苹果向印度转移的最后一块缘由是把印度定位为其下一个增长点。目前,苹果在那里的智能手机市场份额几乎为零,接近90%的市场被小米、三星、Vivo、Oppo和其他玩家瓜分。

但如果我们深挖一些细节,其实苹果还有很多值得乐观的地方。在 "超高端 "消费层里(定义为售价约600美元的手机),苹果占据了55%的份额。在iPhone 11的强劲推动下,苹果同期比增长了78%(尽管基数很小)。这种增长只会持续下去,因为富士康已经开始在印度组装iPhone 11了,纬创也准备明年组装iPhone 12,这些举动都将消除印度政府征收的22%进口税。这意味着面对印度庞大的消费市场来说,将有更多价格实惠的新iPhone,而不仅仅是低档iPhone,被卖给消费者。随着时间的推移,印度的消费者也必将变得更加富裕。

在其主要市场--美国、欧盟、中国--都开始饱和或略有下降的情况下,印度必定成为苹果的下一个增长点。而苹果也有现金和耐心等待印度的成长。虽然印度在进几十年来一直处于增长趋势,但其人均GDP仍只有中国的一半左右。

不仅个人收入要增长,印度的政府和有关机构也要成熟起来。尽管印度是世界上最大的民主国家,但却腐败丛生,缺乏强有力的大选募资监管(没人说民主国家就不会腐败)。在Transparency International,一个国际反腐非政府组织的Corruption Perceptions Index中,印度在180个国家中排名第80,仅得40分,满分100分(凑巧与中国的得分一样)。

印度的电子和信息技术部最近出炉的“生产挂钩激励计划”(production linked incentive,PLI)是一套值得关注的、可以实现生产本地化又促进收入增长的政府计划。简单解释一下,这套计划的运作方式基本是对所有价格在15,000卢比(约200美元)以上的电子产品的所有增量销售额给予最高达到6%的奖励。iPhone当然肯定符合这个条件。再加上印度强势的、富有民族色彩 "印度制造 "计划(与 "中国制造2025 "并无二致),我相信印度的制造能力会得到提高,可以吸收和组装更多的iPhone以及其他高端电子产品。

印度能以多快的速度达到这一程度,将取决于其政府高官是否能以诚信的态度忠于使命,而不会被政府项目的慷慨和权力所诱惑变得腐败,以及部长能不能继续写出“巧妙”的推文。

Significant boost to Make in India!

— Piyush Goyal Office (@PiyushGoyalOffc) July 24, 2020

Apple has started manufacturing iPhone 11 in India, bringing a top-of-the-line model for the first time in the country.https://t.co/yjmKYeFCpL

我看好印度的未来,但它不会替代中国,而会是中国以外的另一个强国。在10年的时间段里,如果您看好苹果,那您必须看好印度。如果您看好印度,那也就必须看好苹果。

苹果2万亿美元的市值只会是冰山一角。

如果您喜欢所读的内容,请用email订阅加入“互联”。要想读以前的文章,请查阅《互联档案》。每周两次,新的文章将会直接送达您的邮箱。请在Twitter、LinkedIn上给个follow,和我交流互动!