Welcome to Interconnected Capital’s first half (H1) of 2024 investment performance letter, which I write on a quarterly basis. (You can find my Q1 letter here.)

To new and old readers alike, a friendly reminder: I run a global technology equity portfolio focused on investing in the “picks and shovels” of the interconnected global digital AI economy. I draw on my technology business operator's experience and geopolitical antennas to bring an edge to how I assess a tech company’s rhythm and prospects in a constantly changing world.[1]

Before I dive into the first half’s performance and share what I learned along the way, a quick update on last year’s performance. My 2023 annual performance was examined and verified by a third-party independent accounting firm (Spicer Jeffries). The result is 170.13%, net of all management and performance fees. If you are an accredited investor, who is interested in the report or learn more about Interconnected Capital, you can email me at: xu.kevin@interconnectedcapital.com. You can also read about my reflection of 2023 in last year’s annual letter (which will make an appearance again later in this letter).

During the last few months, I garnered a few PR exposures in the New York Times, Financial Times, Wall Street Journal, and Bloomberg’s Odd Lots Podcast, sharing my thoughts and comments on (you guessed it) generative AI! This massive technology platform shift continues to dominate the zeitgeist, and it has been fun to contribute to all the public discourse surrounding it.

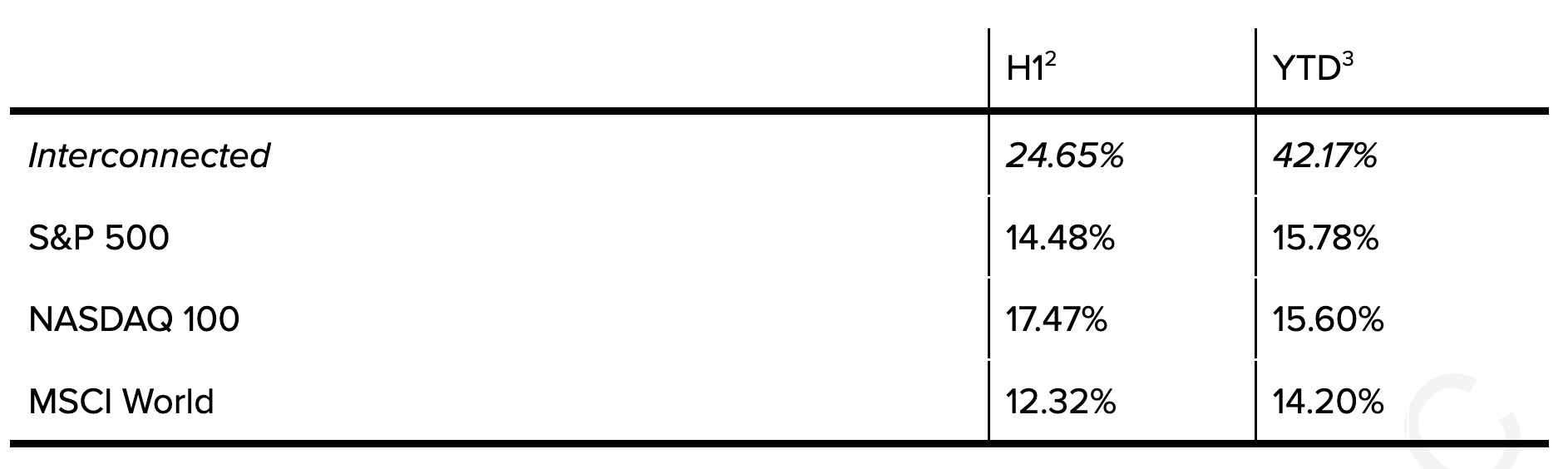

Of course, you can’t feed a family with PR hits. (At least I have not figured out a way to do it.) So here is my H1 2024 performance (ending on and inclusive of June 30) and YTD performance (ending on and inclusive of July 31), as well as comparisons to three relevant benchmarks – NASDAQ 100, S&P 500, MSCI World.

1 My past experiences include: senior leadership position at GitHub (the world’s largest developer and open source technology platform, now owned by Microsoft), a unicorn database startup, early stage VC, and the White House and Department of Commerce during the Obama administration. I studied law and computer science at Stanford; international relations at Brown.

2 Through June 30, 2024. Unaudited.

3 Through July 31, 2024. Unaudited.

Portfolio holdings in alphabetical order (ending on and inclusive of July 31, 2024):

- ALIBABA GROUP HOLDING

- ATLASSIAN CORP

- ELASTIC NV

- GITLAB INC

- NVIDIA CORP

- TWILIO INC

I invest within a tight circle of competence – cloud computing infrastructure, DevOps, developer tools, open source, semiconductors. My process is value-oriented and bottoms-up, starting from the technology, then the business model, then the people and management, and ultimately, perhaps most importantly, the price – marrying technological fundamentals with financial fundamentals.

Taking My Own Medicine

While the performance so far has been satisfactory and market-beating enough, as I reflect on everything that happened in the last seven months, it was littered with mistakes and misexecutions. In a nutshell, these misexecutions can be summed up in one notion: not taking my own medicine – the medicine I ironically featured in my 2023 annual letter: Less is More.

If the secret to my 2023 success was achieving more by doing less, 2024 so far has been marked by the opposite. After a close examination of all the in’s and out’s of the Interconnected portfolio, I should have sat on my ass and did nothing a lot more than I did. The good ideas I generated and executed on were not given the fullness of time to play out. Instead, they were replaced by bad ideas that were poorly executed. It is difficult to pinpoint the causes of unnecessary, counter-productive activities. Perhaps an over-absorption of information and third-party analysis (thank you sell-side). Perhaps an over-calibration of the exogenous events (thank you electoral politics). Perhaps an over-indexing of “someone” who “told” me that “another pod just blew up” (thank you Twitter). There is a lot of blame I can conveniently distribute to explain away this folly.

But at the end of the day, the responsibility rests in the investor alone. Me! Disciplining my own psychology vis-a-vis the mass psychology of the market is of the utmost importance to hone and improve. And it starts with heeding my own advice and taking my own medicine – less is more – especially if I want to achieve my inner scorecard of 30% average annual return for 30 years (or “30 for 30”).

Expectations Investing

To that end, I’m excited to add a new element to strengthen my investing (and self disciplining) process: expectations investing. Inspired by Alfred Rappaport and Michael Mauboussin’s book, it is an elegant and quantitatively sound framework that investigates what a given stock price on a given day says about the information and expectations the market tries to convey about that company. It solves for the mass psychology of the market, without taking a view on the price itself.

Price, at least in public equities, is but an aggregation of the collective hopes or fears of the market at a given moment. It does not have to make sense. It is also full of useful clues. The expectations investing framework helps me discover those clues. I’m still in the early stages of deploying this model to my universe; I will share more about my learnings in future letters.

Arrogant Humility

Interconnected is still a young fund, though even in this early stage, I feel comfortable with our arsenals. I can lean on my first-hand experience as a technologist and a DC political hand to assess both technological fundamentals and how certain technology plays in the shifting dynamics of geopolitics. I can lean on our extensive network of operators to evaluate the organizational rhythm of companies that pique my interest. Tools like the expectations investing framework will improve price discipline and risk management further.

If all this sounds a touch too confident, even arrogant, then I must emphasize that I’m communicating this with the utmost humility. Achieving the “impossible balance between arrogance and humility” is what the journey of being an investor is all about. I borrowed this wonderful phrase (also inspired the title of this letter) from William de Gale, a seasoned global technology investor out of the UK. During an interview on the Algy’s Investment Podcast, an excellent and under the radar investing podcast, he uttered this phrase when asked to given advice to new, budding fund managers:

“What you are trying to achieve is an almost impossible balance between arrogance and humility.”

Impossible indeed. Yet, achieving that impossible state of arrogant humility (or should it be humble arrogance?) is what makes the pursuit of investing ever so stimulating, challenging, and rewarding.

Thank you for being on this (impossible) journey with me.

Until next quarter. Sincerely,

Kevin S. Xu

Date: August 1, 2024

(You can access the original letter in a view-only Google Doc link HERE.)

LEGAL INFORMATION AND DISCLOSURE

This letter expresses the views of the author as of the date indicated and such views are subject to change without notice. Interconnected Capital, LLC (“Interconnected”) has no duty or obligation to update the information contained herein.

Further, Interconnected makes no representation, and it should not be assumed that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

This letter is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources.

Interconnected believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

All figures are unaudited. Interconnected does not undertake to update any information contained herein as a result of audit adjustments or other corrections. Past performance is not indicative of future results.

This letter, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of Interconnected.