As the notion of “sovereign AI” takes a stronger hold in the global AI infrastructure build out, I closely tracked the European Union’s rollout of its “Apply AI strategy” last week. After all, it was Europe’s AI4EU project that first coined the term in 2019. During the Apply AI announcement press conference, Henna Virkkunen, the EU’s executive vice president in charge of all things AI and technology, faced a poignant question in the end. An Austrian reporter asked if pushing the continent so aggressively into using AI would just open it up for more dominance from big tech players from the US and China, neither of which the Europeans fully trust (and for good reasons).

Virkkunen’s answer was rather demurred and unconvincing, running through a laundry list of Europe’s remaining advantages: good research talent, 7,000 startups doing AI, etc. But it was a tough question to answer – some would argue the toughest question for the EU to overcome to make “sovereign AI” real – so I don’t blame her for defaulting to talking points when being put on the spot. That’s what disciplined officials do.

I have also picked up on this weak positioning during my recent trip to Europe. Between both closed-door discussions on AI and casual chats with investors and technologists, I heard both a strong desire to achieve sovereignty over AI and a lack of confidence in believing that Europe can do so. As I look further into the European stack, however, I think there is at least one company that is ready now and has the full-stack talent and expertise to turn Europe’s hope for sovereignty over the machine god into reality – the Netherlands-based GPU neocloud upstart: Nebius.

Nebius: the EuroStack’s Best Hope

Readers of the Interconnected newsletter know well that I have written multiple deep-dive articles on Nebius over the course of this year, from the company’s core technology and business potential, to its developer experience and company history. (Links: I, II, III, IV, if you want to dig in.) It is also an important position in Interconnected Capital, the long-only fund I run, so I want to disclose this upfront.

However, the nexus between Nebius and sovereign AI in Europe is a side bar and not core to my investment thesis. Any deal or partnership with countries and governments is a nice-to-have icing on the ballooning AI cake. The company makes for a compelling investment because of its cloud platform’s smooth developer experience, its full-stack in-house expertise, and its management’s ambition to become the “AWS of GPU cloud” (however lofty that may sound).

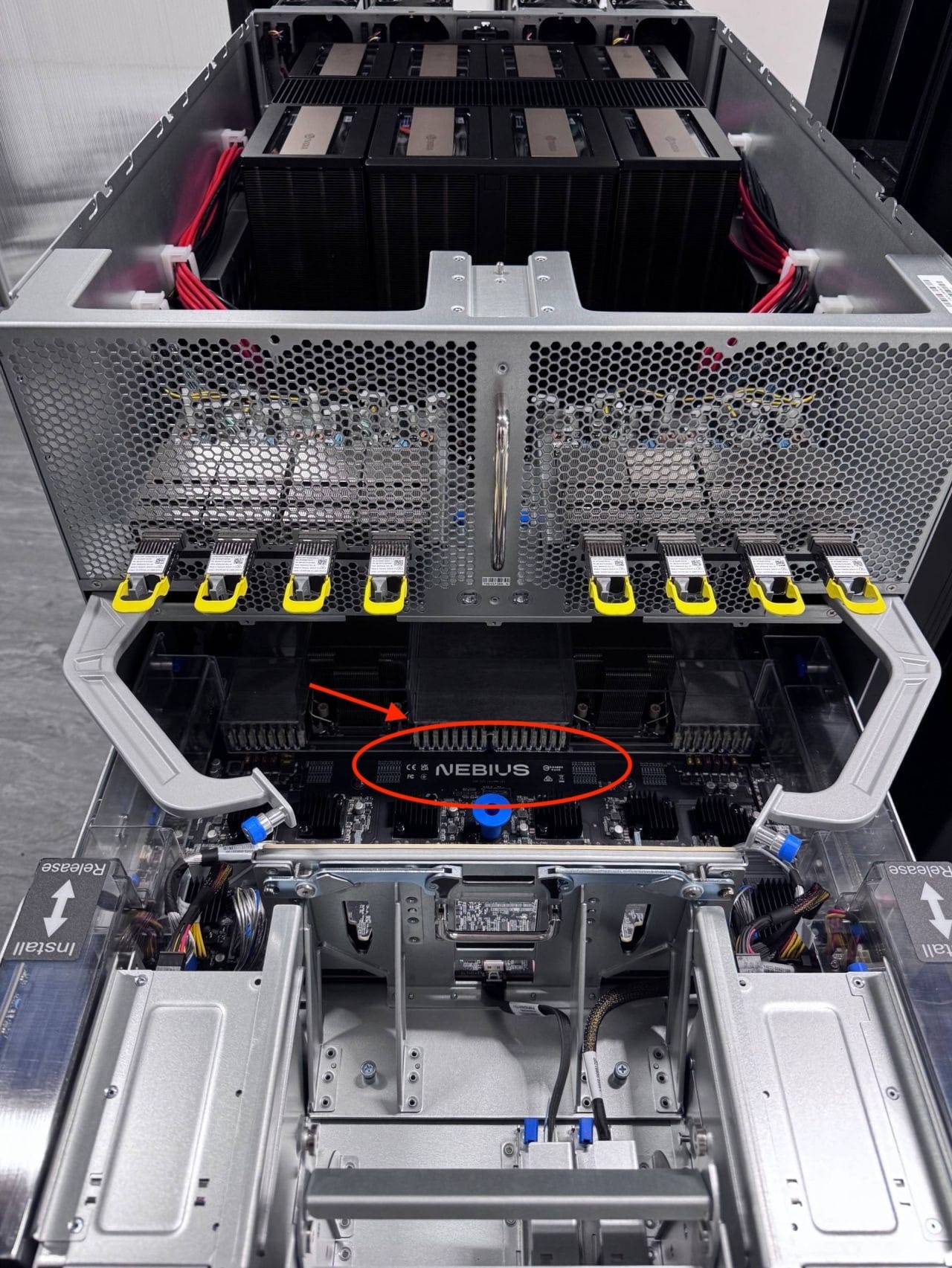

But if you think hard about what sovereignty really means in the context of AI and technology – full control and self-sufficiency of the entire hardware and software stack – Nebius is one of the few European-based companies that can deliver on that meaning. Its in-house engineering capabilities as an OEM (original equipment manufacture) of GPU servers is underappreciated by the market, and even more so if we layer AI sovereignty on top of it. From a financial perspective, because Nebius can design its own server racks, it cuts out an important layer of middlemen from the picture every time it designs and builds a new cluster of GPU-filled data centers, thus improving its cost-optimization and profitability over time. These middlemen, e.g. Dell, HP Enterprise, Supermicro, and their server products feed most of the rising cohort of GPU neoclouds. Nebius doesn’t need them.

From a sovereignty angle, Nebius’s OEM capabilities mean a deeper level of technology control, while lowering dependency on foreign companies in the supply chain of building AI factories. This reduction in dependency is by no means complete, of course. Nebius’s racks are still designed to run NVIDIA GPUs. While some European policymakers may take comfort in the fact that these GPUs are supported by CPUs designed based on Arm, a UK company, it is nevertheless owned by Softbank. And these servers, which are increasingly complex with every new generation of GPUs, are mostly assembled by companies in Taiwan and other parts of Asia. Still, for a continent fighting for sovereignty and relevancy in AI, you have to start with what you have. And Nebius is a great start.

It can be hard to visualize why being an OEM matters in this context. Luckily, as Nebius delivers on its initial build out of an AI data center in the UK, we got a glimpse of Nebius-branded Nvidia Blackwell Ultra – the top-of-the-line GPU system money can buy.

A Nebius brand is a European brand, if the European Commission knows how to leverage it. What’s more important is that this brand is actually competitive in the global market place. In fact, Nebius’s competitiveness in the American AI market, a position solidified by its multi-year partnership with Microsoft to deliver AI training workload, is precisely what makes it an attractive option to build the EuroStack.

Somewhat counter-intuitively, if you are Henna Virkkunen or EU President Ursula von der Leyen, your best bet in achieving European AI sovereignty is to lean on European companies that are actually competitive outside of Europe!

Sovereign Regulatory Capture

There are other European tech companies that are globally competitive, of course. SAP, the German software giant, still has a solid book of business in the US and elsewhere, while its transition to the cloud is going well. Schneider Electric is a key player in modernizing data centers to be more suited for liquid cooling. ASML maintains its global monopoly on high-end lithography machines for chip making. A handful of fast-growing AI-native startups, from ElevenLabs to Lovable, continue to attract customers and capital. (And we already gave a nod to the Masa-owned Arm.)

However, when it comes to the heart of AI infrastructure and foundational development, some previous prominent European players are falling dangerously out of relevance and surviving on what I call "sovereign regulatory capture” – winning businesses only based on country of incorporation, not capacity for innovation.

Mistral, the once high-flying French foundation model startup, is falling dangerously into this category. Aleph Alpha, a German AI model upstart, is already there, having given up on developing foundation models and pivot to essentially provide consulting services for enterprise clients. OVH Cloud, a regional cloud player headquartered in France, who is saddled with debt got a new breath of life only thanks to the Trump administration’s aggressive, sometimes hostile, posture towards its European “allies” that has sown local distrust (so much so that a company executive quipped that Trump should be named OVH’s “employee of the month”). Nscale, another crypto-miner turned GPU cloud builder with no track record, received much of the limelight during Trump's most recent state visit to the UK to announce a series of sovereign AI deals thanks to its rather fortunate choice of incorporation location being the UK. (The company started in Norway two years ago, and its $1.1 billion funding round announced after this UK sovereign AI deal was led by Aker ASA, a Norwegian industrial and investment group.)

Meanwhile, Nebius is quietly installing and bringing online its branded AI racks in the UK and elsewhere in Europe and the US, while competing for business from the most demanding of enterprise customers, the likes of Microsoft and Cloudflare. Yet, it is not mentioned anywhere in white papers and thought leadership outputs by people who think about European sovereign AI all day long, like the EuroStack report.

One reason for this oversight may simply be that Nebius is, indeed, still new to the scene and it takes time for a new company to be noticed and understood. Even among the investment community, it is a new name with only six sell-side price targets to date. (ASML has 38, SAP has 26, OVH Cloud has 11.)

Another reason that is more unique to the European project is the constant tug-o-war between establishing a coherent European identity, while still needing to take care of the national pride of each member nation. If a EuroStack were to ever emerge, it appears that every country, or at least the major ones, must get a piece of the pie. Thus, a company's country of incorporation matters as much, if not more, as its technical acumen or innovative abilities.

Nebius, a Dutch-registered corporation born out of a divestiture from Yandex with growing presence in Silicon Valley, certainly does not have the cleanest “country of incorporation” story. But when it comes to delivering on building the sovereign AI infrastructure Europe needs, it is already doing the work, whether the EU leadership realizes it or not.