Welcome to Interconnected Capital’s 2025 annual letter.

To new and old readers alike, a friendly reminder: I run a global technology long-only fund focused on investing in both the hardware and software “picks and shovels” of the interconnected global digital AI economy. I draw on my technology business operator's experience and geopolitical antennas to bring an edge to how I assess a tech company’s rhythm and prospects in a constantly changing world.

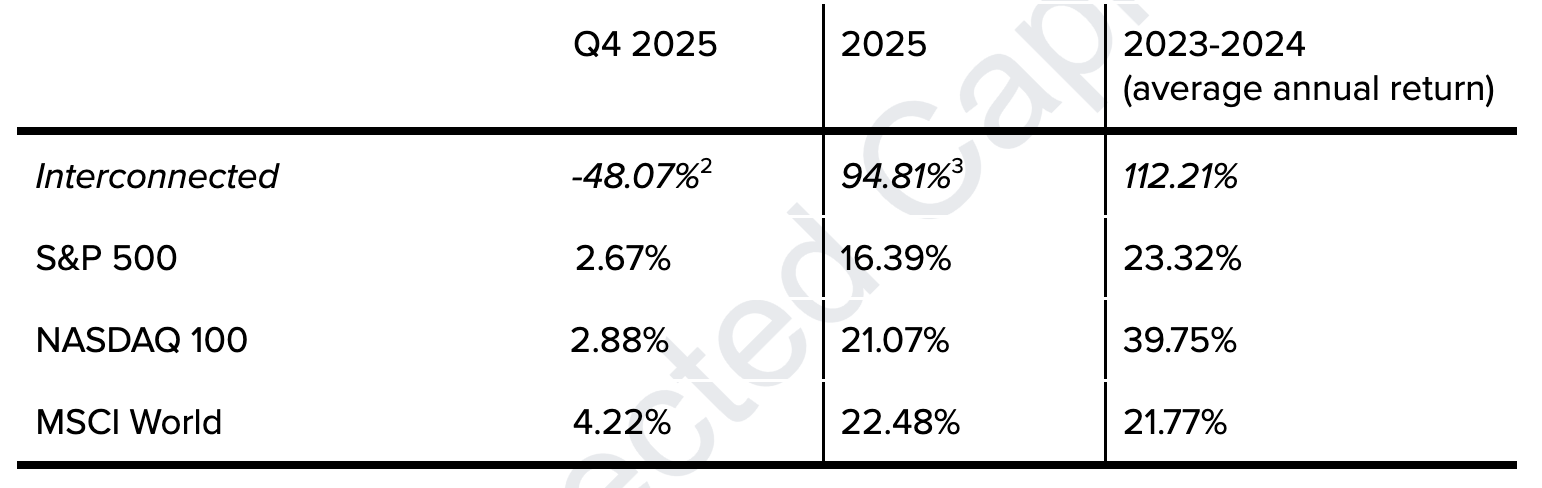

As always, first the numbers, then the reflection.

[1] My past experiences include: senior leadership position at GitHub (the world’s largest developer and open source technology platform, now owned by Microsoft), a unicorn database startup, early stage VC, and the White House and Department of Commerce during the Obama administration. I studied law and computer science at Stanford; international relations at Brown.

[2] Includes October 1 - December 31, 2025. Gross returns. Unaudited.

[3] Includes January 1 - December 31, 2025. Gross returns. Unaudited.

Fund Business Update

I will open this annual letter by providing a business update of the fund. For me to deliver on my ambitious goal of achieving 30% per annum return for 30 years (30 for 30), running a healthy sustainable business is perhaps more important than seeing the right technology trend or picking the right company to invest in at any given moment. It is all about “time in the market”, not “timing the market”.

I will not be able to disclose a specific AUM number because that is proprietary information for our LPs. What I can share is that we had a solid year of organic fundraising, where we added 18 outside investors to the Interconnected family. Furthermore, only a little more than half of our AUM at the end of 2025 is from funds raised, so a good chunk is from unrealized, untaxed performance gains! That is exactly how I like it, as my aim is to compound for the long-term, not to gather assets to live on fees.

I have also decided to close the fund to more outside investors, with two exceptions: 1) strong referrals from our current investors; 2) additional funds from current investors. I made the decision because I’m quite happy with how fundraising has worked out from individual investors, and I don’t want to add too much overhead by managing more investor relations than I can handle. I will be forever grateful for the “founding 18”, who took a chance on me!

This year, I will spend a little more time building relationships with larger institutional investors. It is a long game, similar to selling software to large enterprises, which I have had some experience with in my past startup life, so I’m not expecting immediate outcomes. But as the fund levels up, I think the timing is right for me to spend some time with that subset of the capital allocation community.

I made some small progress recently by applying to the Yale Prospect Fellowship program, and making it to the final round of in-person interview stage out of hundreds of applicants. Last month, I ventured up to New Haven and spent a solid two hours with six members of the Yale team to talk about my strategy and vision for Interconnected Capital. Sadly, I did not get a spot in the program this time, but the experience was enjoyable and validating.

Portfolio positions in random order as of December 31, 2025:

- CIENA CORP

- INTEL CORP

- UiPATH INC

- WERIDE INC ADR

- NEBIUS GROUP NV

Q4 Review

Transition to performance, Q4 was yet another volatile quarter, unfortunately to the downside, and deserves a review and debrief.

Looking back, it was by no means a perfectly executed quarter. No one likes big drawdowns, even though for a highly concentrated portfolio like ours, it is to be expected. Thinking back through how my thinking evolved last quarter, a few threads jumped out:

1. We had an abnormally large Q3, where the fund effectively doubled during that time, because two of our largest holdings, Nebius and Intel, both experienced an inflection and re-rating moment. That timing is coincidental. I called out this abnormality explicitly in my Q3 letter. Despite the re-rating, neither position reached my long-term price target. Thus, my mindset going into Q4 was do nothing, hold, and endure the ever-shifting market sentiment.

2. All our positions, including the two largest ones, were less than one year old. This is an idiosyncratic fact entirely attributed to the youth of our fund being barely one year old at the start of Q4. I did not want to sell prematurely and incur sizable short-term gains and large tax bills for my investors, so I resisted every urge to “sell at the top”. It also goes against my strategy as a long-only fund focused on producing long-term gains, regardless of short-term pains. Instead, we did the usual tax harvesting of closing some losing positions and not much else. As the largest shareholder of this fund, my own performance fees also got cut in half after Q4 was said and done. I’m not complaining about it. I’m actually very happy about it. This shows that my interest is always aligned with my investors in the same direction, no matter which direction.

3. Looking back, some hedging would have been smart. It is a tactic that I plan to apply opportunistically, though not aggressively, to protect the long-term potential of our best ideas while moderating the short-term gyration of the whims and tickles of the public market. I have already begun implementing it modestly. It will be an on-going experiment to get the sizing and timeline right.

The inspiration for this tactic came from none other than the Yale Investment Office itself. Decades ago, it struck a winner with Snapple from one of its private equity managers. As that manager took Snapple public, the price declined significantly during the fourteen months after it went public. To protect the gains, Yale used a combination of short sales and put options to hedge and risk manage the position. In a nutshell, that is how I plan to execute this tactic. If it’s good enough for Yale, it is good enough for me.

This tactic, along with others I may incorporate for better risk management in the future, will never be perfect. But it is an element of the craft I aim to perfect in due course.

Sharpened Strategy and Process

On a strategic level, I’m more clear and confident in my approach and process than ever before.

You may have read about my investment process at some point as a combination of technology, businesses, value-oriented price, and geopolitics. But combination does not clarify sequence and prioritization. Over the course of 2025, I have sharpened this process further.

Technology fundamentals come first. Identifying the technology in the stack that has a right to win is always step #1. Geopolitical evaluation, whether it is a tailwind or headwind assessment, is step #2. While I have held this view for some time, the world is finally coming to grasp with the rupture we are experiencing globally and the emergence of a new world order (if there is one). The ramification of this rupture will last for years, if not decades. So only when the technology fundamentals and the geopolitical considerations check out favorably, do we look into specific companies for their business models and operational details to find the right bet. Then we wait for the right price to factor in the timeless, value-oriented wisdom of margin of safety.

Technology -> geopolitics -> company -> price, always in this order.

A working analogy I like to use: technology is the cake, geopolitics is the icing. Layers of cake are like layers in a tech stack. We all want to eat the cake, but to get to the cake, we must get through the icing surrounding the cake first, whether we like icing or not. (I personally don't like icing that much, so I either scrape it away or eat through it with a grimace.) To get to the goodness of technology, everyone must get past the geopolitical icing first. It is no longer optional.

2026 Outlook (and Beyond)

Looking ahead into 2026 and beyond, I see two opportunity areas and two risk areas. As an optimist by nature, let’s start with the opportunities.

Deterministic Guardrails, Probabilistic Agents: many people proclaimed 2025 to be the year of the AI agents. This proclamation ended mostly in disappointment until perhaps the very end of 2025, when Claude Code, an autonomous AI coding agent built by Anthropic, took the developer community by storm. We are witnessing the ramifications of the potential of agents completing tasks by itself by taking actions in multiple steps. Exhibit A is the severe drop in the price of all companies categorized as software, aka SaaSpolcalypse.

Every AI lab is making a major push in 2026 to have more enterprises (think companies with at least 1,000 employees) adopt more agents (likely at the expense of those employees). Agents increasing productivity, profitability, and efficiency inside companies is the cleanest ROI story that the AI industrial complex can tell, and must tell, this year. But to go wall-to-wall with agents inside any company, you need guardrails around and against these agents, so we don’t have episodes of “agents gone wild”. These agents are built based on large language models or variants of models that are trained using deep learning, which is and always will be a probabilistic approach to modeling the world. A probabilistic model generates many creativity and productive possibilities. But you can never guarantee and verify an AI agent’s output 100% of the time. That is the nature of probability. So you need deterministic guardrails, rules, observable and auditable boundaries placed around these agents, as they do the things they do best. Rules and auditability of software solutions have been table stakes in any enterprise environment for many years. This need will be super charged, if agents are also to be super charged inside enterprises.

My small position in UiPath, a leader in RPA (robotic process automation) software, is a preliminary and tentative expression of this opportunity. To be clear, I don’t have high conviction in this name at this point. I’m actively researching this theme. So far, I have not seen any software vendor releasing a “guardrail” solution that satisfies the market. The space is muddy, noisy, and confusing. This solution may also come from other subsets of the software space that are not RPA, perhaps observability, or data governance, or DevOps, or cybersecurity, or somewhere else.

What is not muddy or confusing is its necessity. It is not a “nice to have”. Therein lies the opportunity, and one that falls straight within my circle of competence.

From GPUs to CPUs: connected to the potentially wide adoption of agents is the change in hardware demand from GPUs to CPUs. GPUs dominated the conversation for the last three years because we were wrestling with the demand for training and improving larger and larger models. The core math function that must be done repeatedly and efficiently in a large training run is matrix multiplication. That is what GPUs are good at – parallel processing of matrix multiplications. We are still training larger and more complex models this way, but the market has more or less grasped this dynamic and priced GPUs accordingly.

Agents are different. For agents to work, they need to do many different mathematical operations depending on the task and context. It would sometimes query proprietary data, or access a browser to search, or scan your laptop’s files, or coordinate with other agents. Whereas a training workload is computationally demanding but homogenous, an agentic workload needs less raw compute but is heterogeneous. That’s what CPUs are designed to do, both CISC-based (x86) and RISC-based (Arm, RISC-V), depending on workload complexity and power consumption.

We are already seeing signs of this. Intel’s earnings report revealed its inability to meet large customer demand for its server CPU products that just became evident in the last few months. Similarly, AMD’s earnings showed sequentially increasing demand for its data center server CPU products, even though Q1 is seasonally weak for CPUs. Even NVIDIA, the king of GPUs, is entering the space, with its intention to release the Vera CPU as a standalone product via CoreWeave.

As the shine of GPUs wear off, good old fashioned CPUs are making a comeback.

Now onto the two risks.

From Quiet Quitting to Quiet Resisting: how would we know if AI agents are delivering on their promises within enterprises? Surveys! Who answers surveys? Humans!

Therein lies a tough challenge in accurately evaluating whether agents inside companies are actually working or not. If the agents are working really well, it does not take a genius human to see the writing on the wall of his or her employability. So when a survey inevitably comes from either the CIO or the HR office about those agents, the natural and rational reaction is to make the agents look bad and complain about them. If the agents are not working that well or improving too slowly, then nipping this AI thing in the bud with some “honest negative feedback” to the managerial class is also the correct, self-preserving response. In a human survey, the AI agents lose either way.

This Wall Street Journal article published a few weeks ago, describing the divide in attitudes between CEOs and their employees when it comes to AI, is the perfect display of this human condition. When I read this article, published comically in the Lifestyle section when it should probably be front and center in the Business or Technology section, I couldn't help but chuckle and take note as the era of quiet quitting post-Covid gives way to quiet resistance against the machine.

People losing their jobs is of course no funny business; the prospect of mass white collar unemployment due to AI diffusion is a major topic that I won’t be able to address sufficiently in this letter. What is funny is how much we in the technology industry still rely on good old surveys to make decisions, when telemetry and log data are plentiful. Having been in the tech industry for close to 10 years now, mostly as an operator, I have been part of countless memos written and decisions made off of Stackoverflow surveys, Gartner roundtables, and other authoritative sources, when the underlying justifications come from humans responding to multiple choice questions with their self interest in mind. Now that I’m a full time investor, the surveys my peers pay attention to come from Morgan Stanley or Barclays instead, dishing out the same multiple choice questions to busy CTOs or CIOs about their IT budget to make investment decisions.

As long as surveys are how we make decisions or measure ROI, instead of something more quantitative and telemetry driven, the AI agents will likely always get the short end of the human stick, no matter how useful they are.

AI becomes the Midterm Punching Bag: I am a recovering ex-professional political junkie. As the US barrels toward another midterm election, I am noticing unlikely bedfellows aligning against the growing construction AI data centers. When CNBC prints a headline like this on new year day, “Bernie Sanders and Ron DeSantis speak out against data center boom”, my political antennae perk up. There aren’t too many odd bedfellows odder than a socialist senator from Vermont and a conservative governor from Florida. Yet, here we are, so I’m paying attention.

There is a good chance that the AI boom becomes a populist punching bag that candidates from both sides of the aisle will gravitate towards for electoral gains. This will manifest not just in headlines here and there, but also on the local level in low profile congressional races or even state and municipal level campaigns. It only takes a few city councils placing a moratorium on building new data centers to further constrain an already supply constrained environment. While this is strictly a US domestic issue, it will reverberate globally as well.

Laying out these two risks does not mean they are the only two risks I see. Memory constraints, semicap equipment supply chain risks, lack of labor to build powered-up data centers, all software companies potentially becoming irrelevant, the list of hurdles goes on. I’m calling out these risks because they are two under the radar, less discussed risks I’m more uniquely attuned to dissect and digest.

As with all outlooks, it is a fool’s errand by nature to try to predict the future. In case you remember, when I laid out my 2025 outlook, I called out three areas of opportunity – API platforms, databases, and neoclouds. Looking back, I was only right about one of them. One out of three is a decent baseball batting average, but a failing grade on any exam. So outlooks should always be taken with a giant grain of salt. That’s how I hope you would contextualize my 2026 outlooks and all outlooks in future years.

As an investor, as long as the wrong outlooks don’t incur too much loss, while the right ones are taken advantage of fully, things will be alright, no matter how rough and challenging the journey is to get there. I expect 2026 to be a rough year, even rougher than 2025, which is saying something.

I’m ready for it.

Kevin S. Xu

February 9, 2026

(You can access the original letter in a view-only Google Doc link HERE.)

LEGAL INFORMATION AND DISCLOSURE

This letter expresses the views of the author as of the date indicated and such views are subject to change without notice. Interconnected Capital, LLC (“Interconnected”) has no duty or obligation to update the information contained herein.

Further, Interconnected makes no representation, and it should not be assumed that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

This letter is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources.

Interconnected believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

All figures are unaudited. Interconnected does not undertake to update any information contained herein as a result of audit adjustments or other corrections. Past performance is not indicative of future results.

This letter, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of Interconnected.